Question: I know how to do this on Excel but need to know the (by-hand) method on pencil and paper for test . Please help .

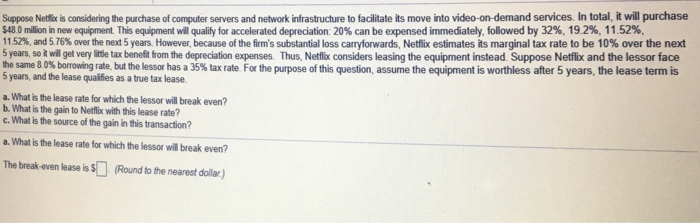

Suppose Netflik is considering the purchase of computer servers and network infrastructure to facilitate its move into video-on-demand services. In total, it will purchase S480mil in new eq ment This e pment wil qualify for accelerated depreciation: 20% can be expensed immediately, followed by 32%, 19.2% 11.52% 11 52% and 576% over the next 5 years. However, because of the firm's substantial loss car forwards, Netfix estimates its marginal tax rate to be 10% over the next 5 years, so t wil et very itle tax benefit from the depreciation expenses. Thus, Netflix considers leasing the equipment instead Suppose Netflix and the lessor face thes e 8 but the less r has a 35% tax rate For the purpose o his question, assume the equipment is worthless after 5 years, the lease term is 5 years, and the lease qualifies as a true tax lease. 0% borrowing rate. a. What is the lease rate for which the lessor will break even? b. What is the gain to Netfix with this lease rate? c. What is the source of the gain in this transaction? a. What is the lease rate for which the lessor ill break even? The break-even lease is s(Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts