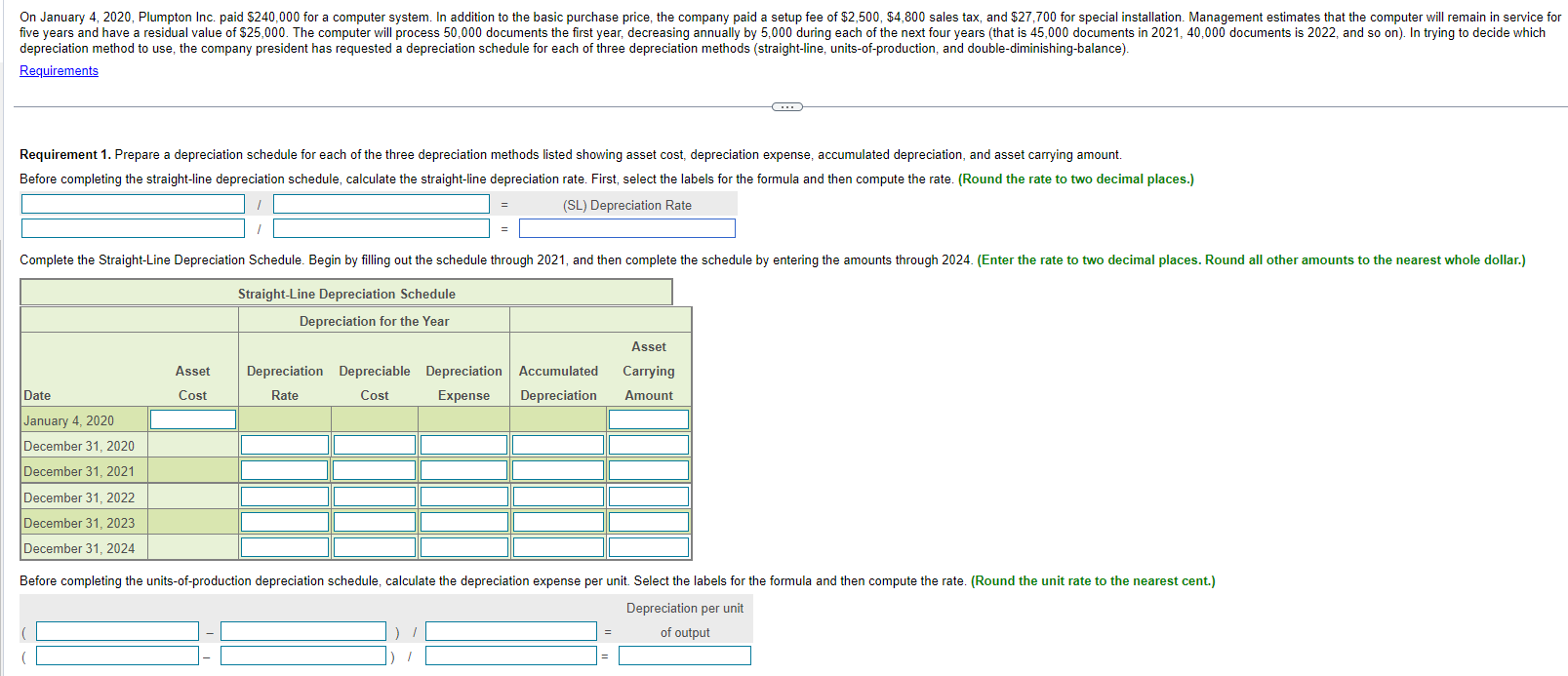

Question: I know it is a lot but I really cannot figure this out someone please help me! Requirements whole dollar.) begin{tabular}{|c|c|c|c|c|c|c|} hline multicolumn{7}{|c|}{ Units-of-Production Depreciation

I know it is a lot but I really cannot figure this out someone please help me!

I know it is a lot but I really cannot figure this out someone please help me!

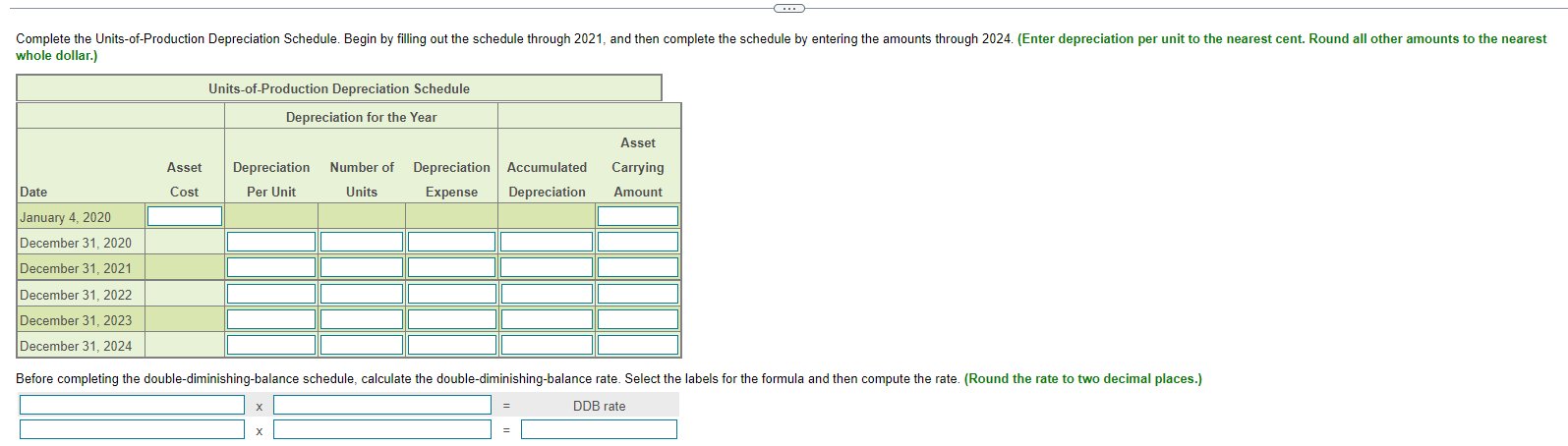

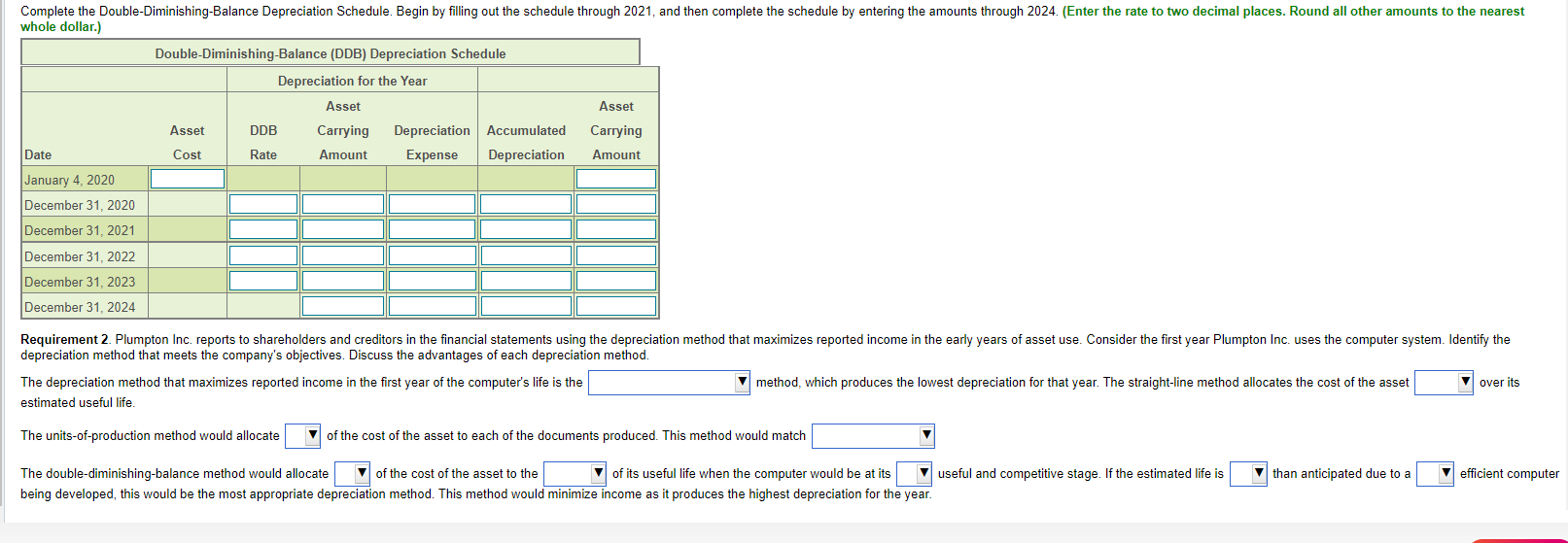

Requirements whole dollar.) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Units-of-Production Depreciation Schedule } \\ \hline & & \multicolumn{3}{|c|}{ Depreciation for the Year } & \multicolumn{2}{|r|}{ Asset } \\ \hline Date & \begin{tabular}{c} Asset \\ Cost \end{tabular} & \begin{tabular}{c} Depreciation \\ Per Unit \end{tabular} & \begin{tabular}{c} Number of \\ Units \end{tabular} & \begin{tabular}{c} Depreciation \\ Expense \end{tabular} & \begin{tabular}{l} Accumulated \\ Depreciation \end{tabular} & \begin{tabular}{l} Carrying \\ Amount \end{tabular} \\ \hline January 4, 2020 & & & & & & \\ \hline December 31,2020 & & & & & & \\ \hline December 31, 2021 & & & & & & \\ \hline December 31, 2022 & & & & & & \\ \hline December 31, 2023 & & & & & & \\ \hline December 31, 2024 & & & & & & \\ \hline \end{tabular} \begin{tabular}{l} ==0 DDB rate \\ \hline= \end{tabular} depreciation method that meets the company's objectives. Discuss the advantages of each depreciation method. The depreciation method that maximizes reported income in the first year of the computer's life is the method, which produces the lowest depreciation for that year. The straight-line method allocates the cost of the asset over its estimated useful life. The units-of-production method would allocate of the cost of the asset to each of the documents produced. This method would match The double-diminishing-balance method would allocate of the cost of the asset to the of its useful life when the computer would be at its useful and competitive stage. If the estimated life is than anticipated due to a efficient computer being developed, this would be the most appropriate depreciation method. This method would minimize income as it produces the highest depreciation for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts