Question: i know its a few questions but if you can please help me out. it would be awesome and i alwys give likes to the

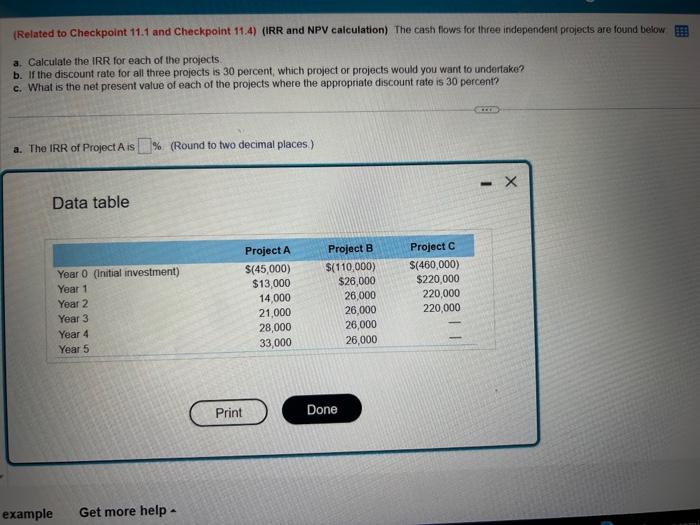

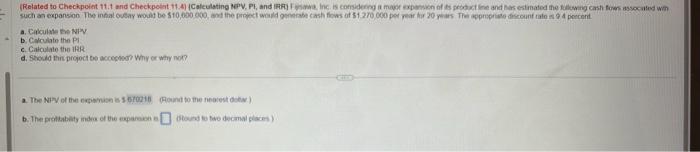

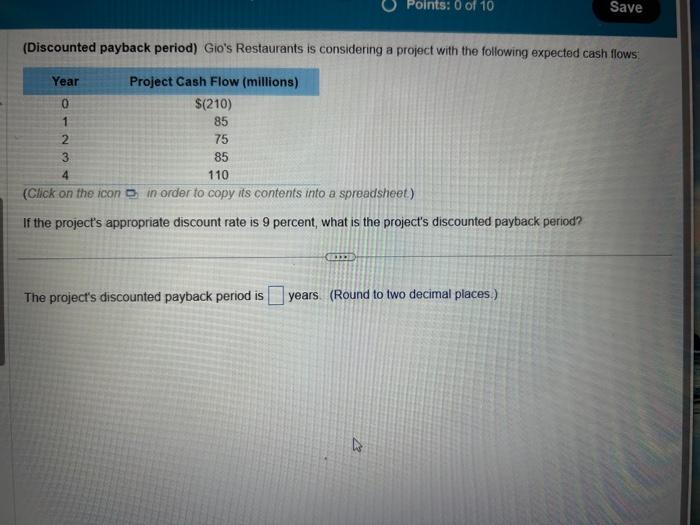

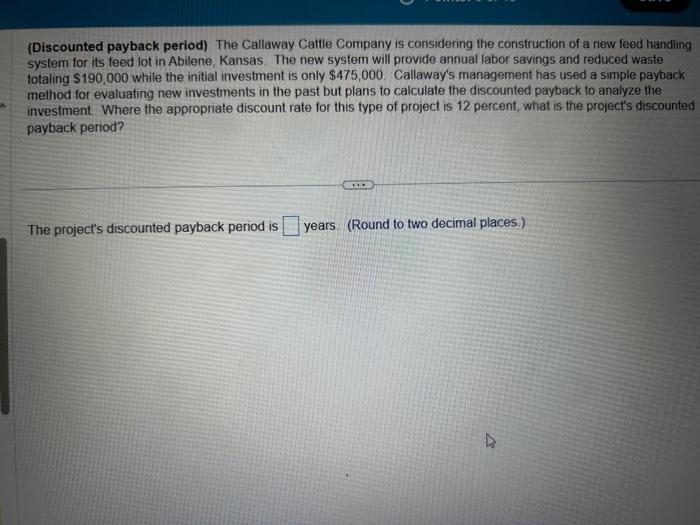

(Related to Checkpoint 11.1 and Checkpolnt 11.4) (IRR and NPV calculation) The cash fows for three independerit projects are found below a. Calculate the IRR for each of the projects b. If the discount rate for all three projects is 30 percent, which project or projects would you want to undertake? c. What is the net present value of each of the projects where the appropriate discount rate is 30 percent? a. The IRR of Project A is \%. (Round to two decimal places.) Data table a. Cidcuiate ne Nive b. Carculate the PI c. Catculate thi ifer. d. Stodid this projoct be accecoust Why or why nol? b. The prentablety nidac of tie ceparion e thound te twe decamal piacen ) (Discounted payback period) Gio's Restaurants is considering a project with the following expected cash flows (Click on the icon D in order to copy its contents into a spreadsheet) If the project's appropriate discount rate is 9 percent, what is the project's discounted payback period? The project's discounted payback period is years. (Round to two decimal places.) (Discounted payback period) The Callaway Cattle Company is considering the construction of a new feed handling system for its feed lot in Abilene, Kansas. The new system will provide annual labor savings and reduced waste totaling $190,000 while the initial investment is only $475,000. Callaway's management has used a simple payback method for evaluating new investments in the past but plans to calculate the discounted payback to analyze the investment. Where the appropriate discount rate for this type of project is 12 percent, what is the project's discounted payback period? The project's discounted payback period is years. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts