Question: I KNOW ITS A LITTLE HARD TO READ,PLEASE HELP I WILL UPVOTE On December 31, 2016, you purchased a house, financing $370,000 with a standard

I KNOW ITS A LITTLE HARD TO READ,PLEASE HELP I WILL UPVOTE

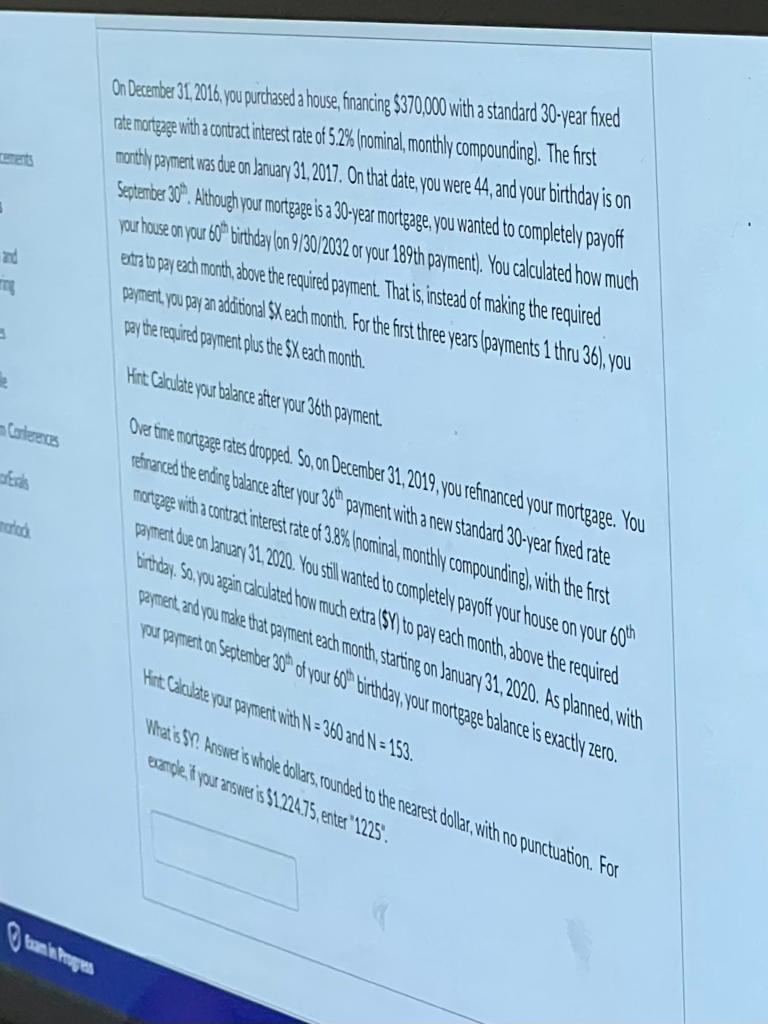

On December 31, 2016, you purchased a house, financing $370,000 with a standard 30-year fixed rate mortgage with a contract interest rate of 5.2% (nominal , monthly compounding) . The first monthly payment was due on January 31, 2017. On that date , you were 44, and your birthday is on September 30". Although your mortgage is a 30-year mortgage, you wanted to completely payoff your house on your 60" birthday (on 9/30/2032 or your 189th payment). You calculated how much extra to pay each month, above the required payment. That is, instead of making the required payment, you pay an additional SX each month. For the first three years (payments 1 thru 36), you pay the required payment plus the SX each month. and - Carles Hint Calculate your balance after your 36th payment Over time mortgage rates dropped. So, on December 31, 2019, you refinanced your mortgage. You retranced the ending balance after your 3611 payment with a new standard 30-year fixed rate mortgage with a contract interest rate of 3.8% (nominal, monthly compounding), with the first payment due on January 31, 2020. You still wanted to completely payoff your house on your 60th birthday. So, you again calculated how much extra (SY) to pay each month, above the required payment, and you make that payment each month, starting on January 31, 2020. As planned, with your payment on September 30h of your 60h birthday, your mortgage balance is exactly zero. rood Hit Coladate your payment with N = 360 and N = 153. What's 5. Answer is whole dollars, rounded to the nearest dollar, with no punctuation. For wende iyout answer is $12475, enter 1225

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts