Question: i know its a long question. but please help me with this one. please The post-closing trial balance at 30 June 2020 of Payneham Professional

i know its a long question. but please help me with this one. please

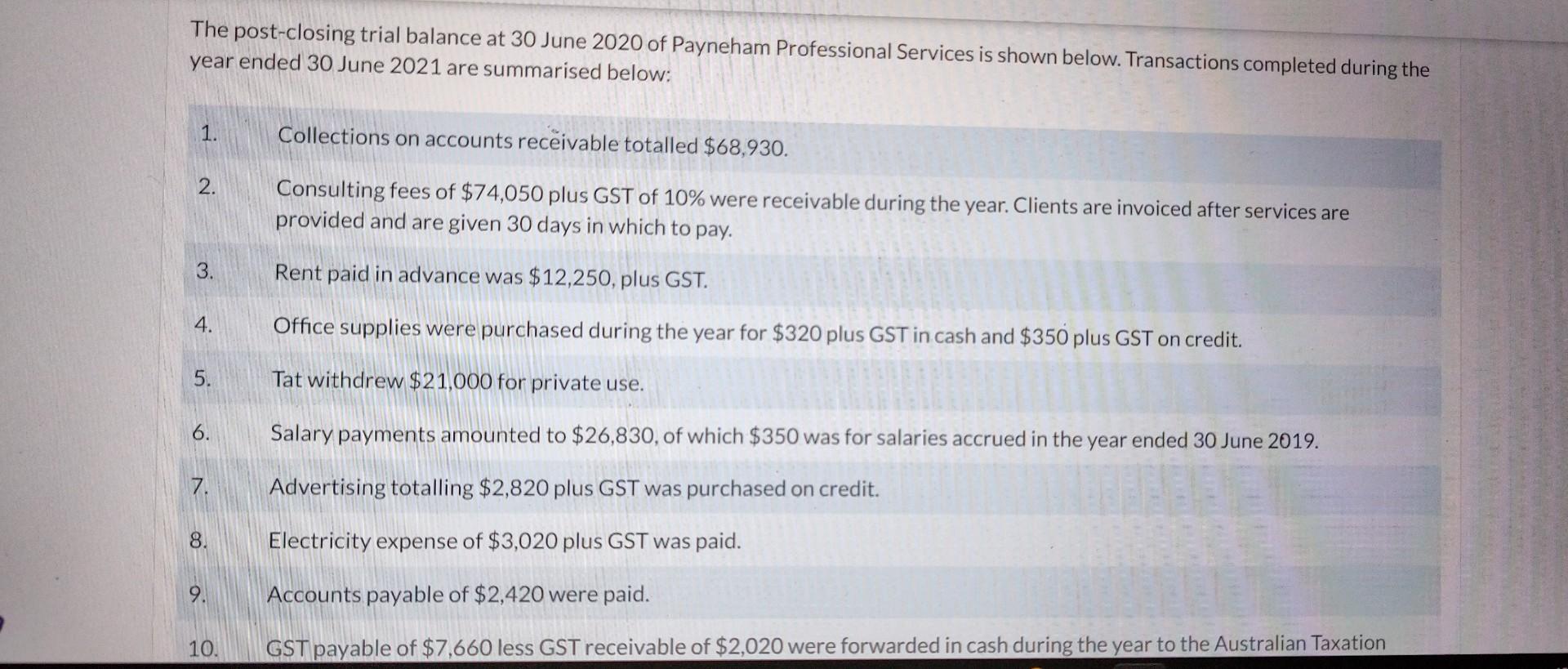

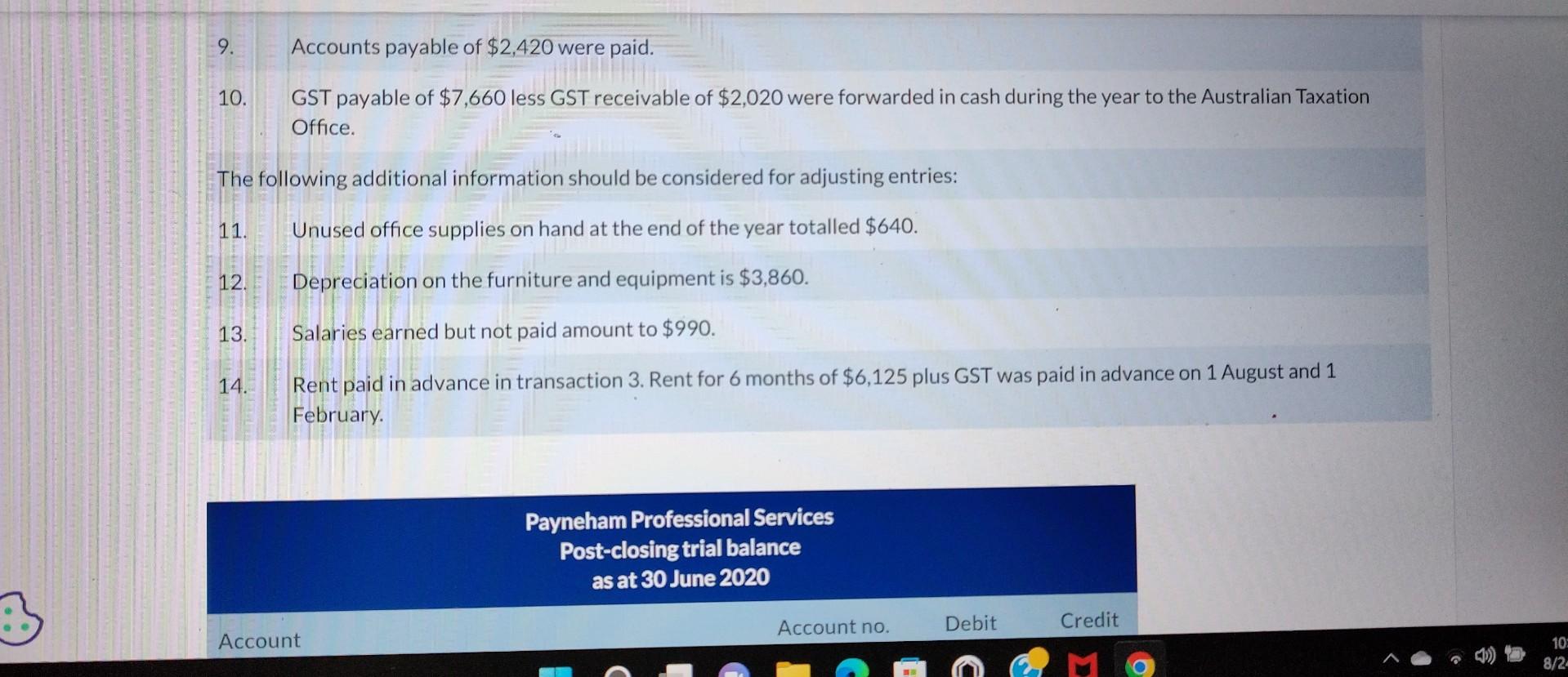

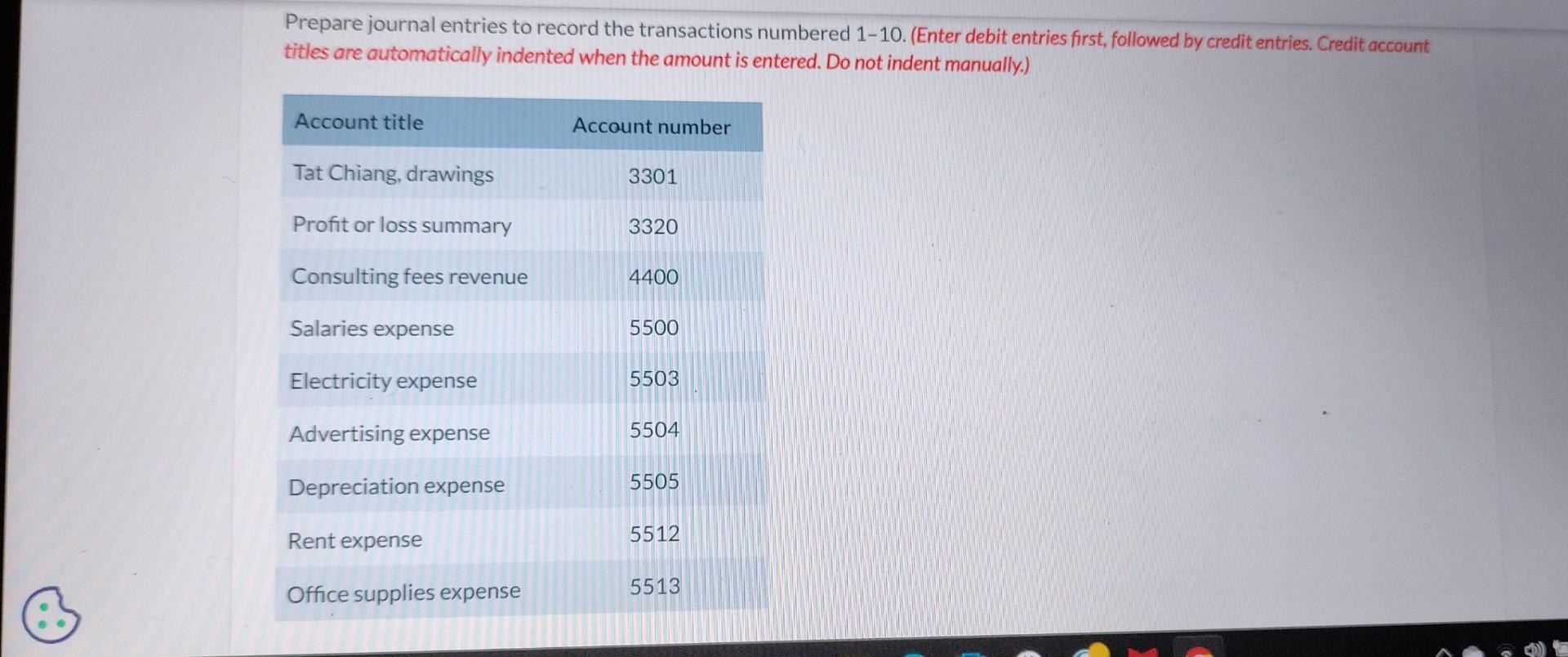

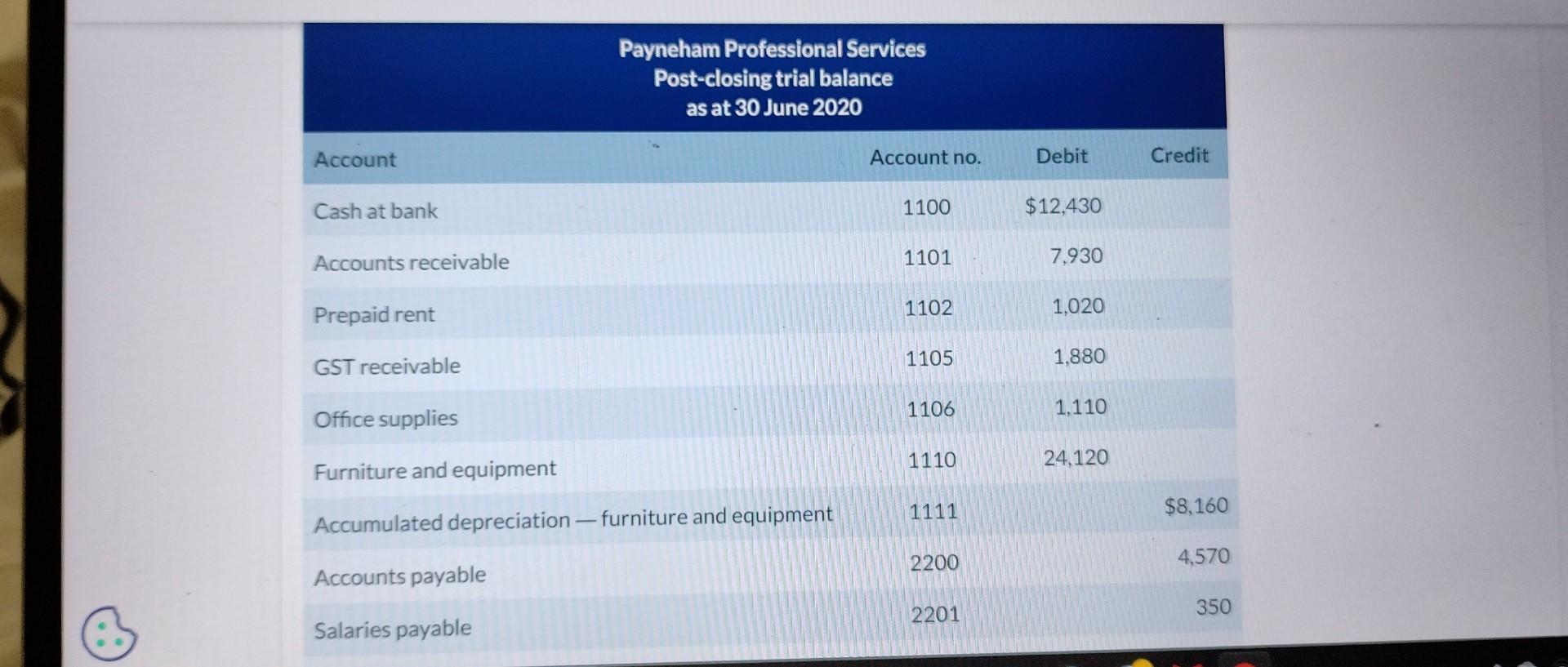

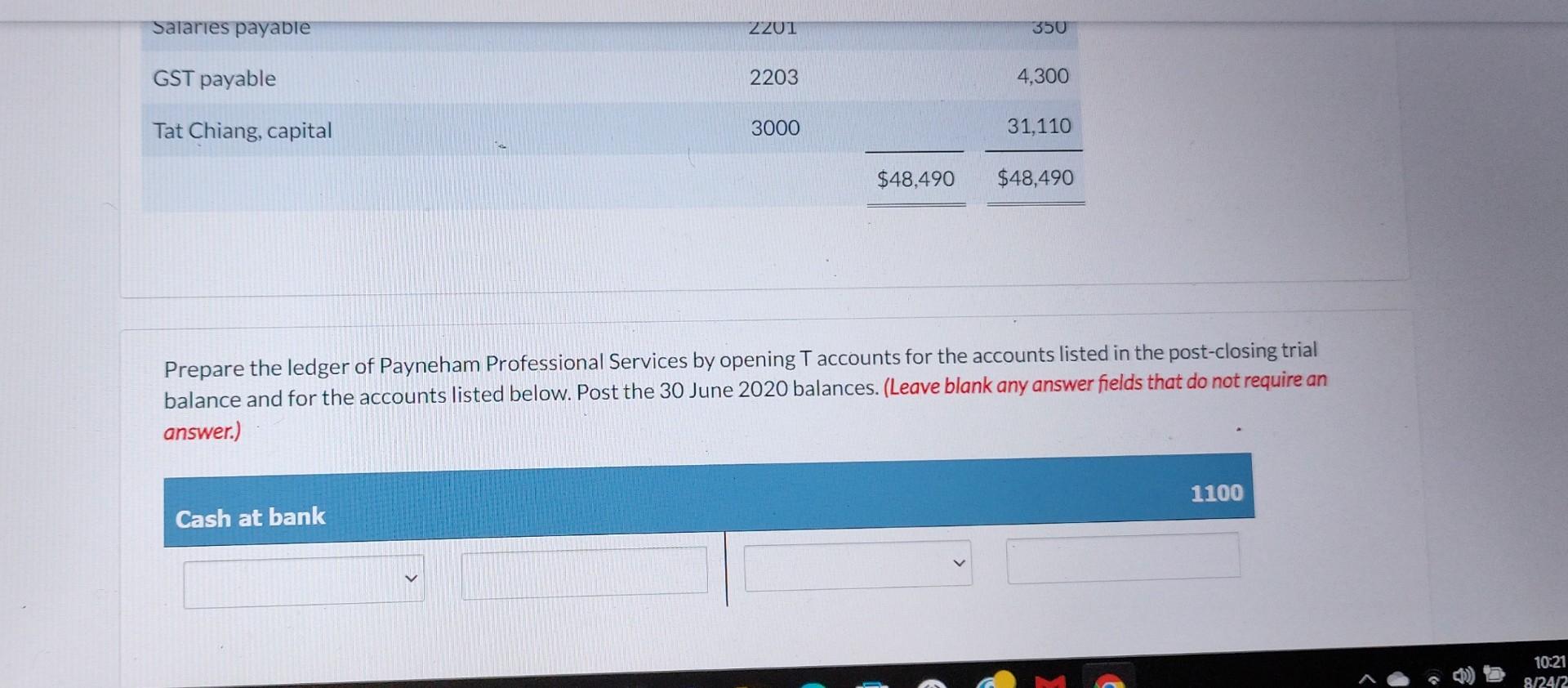

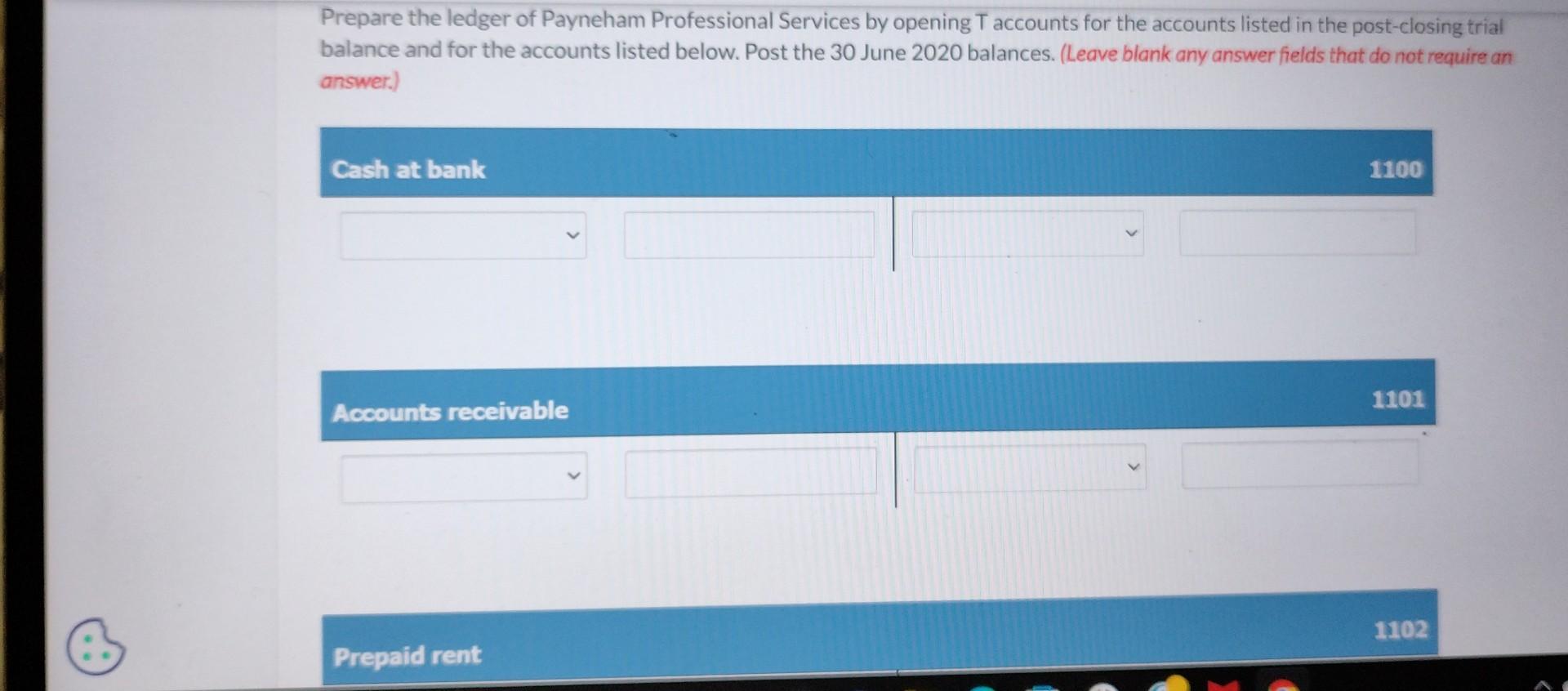

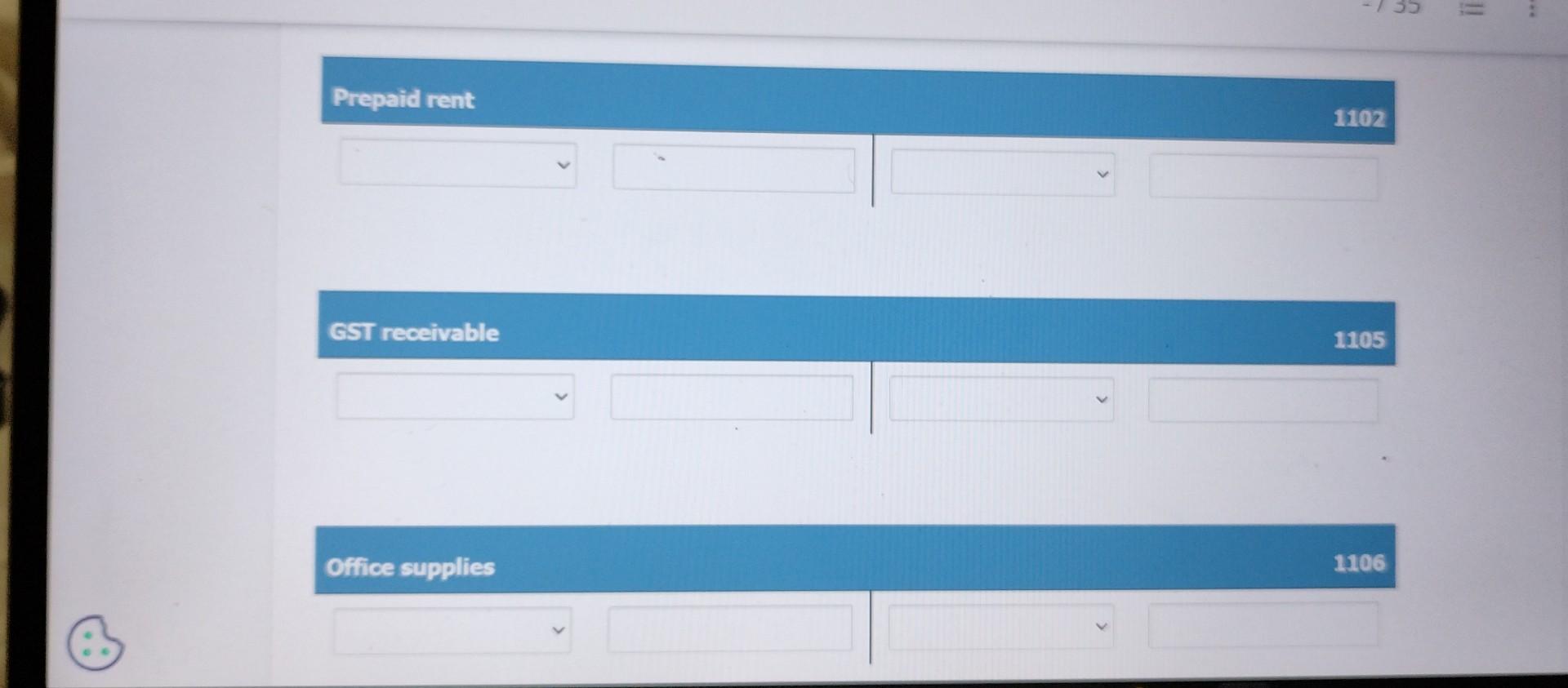

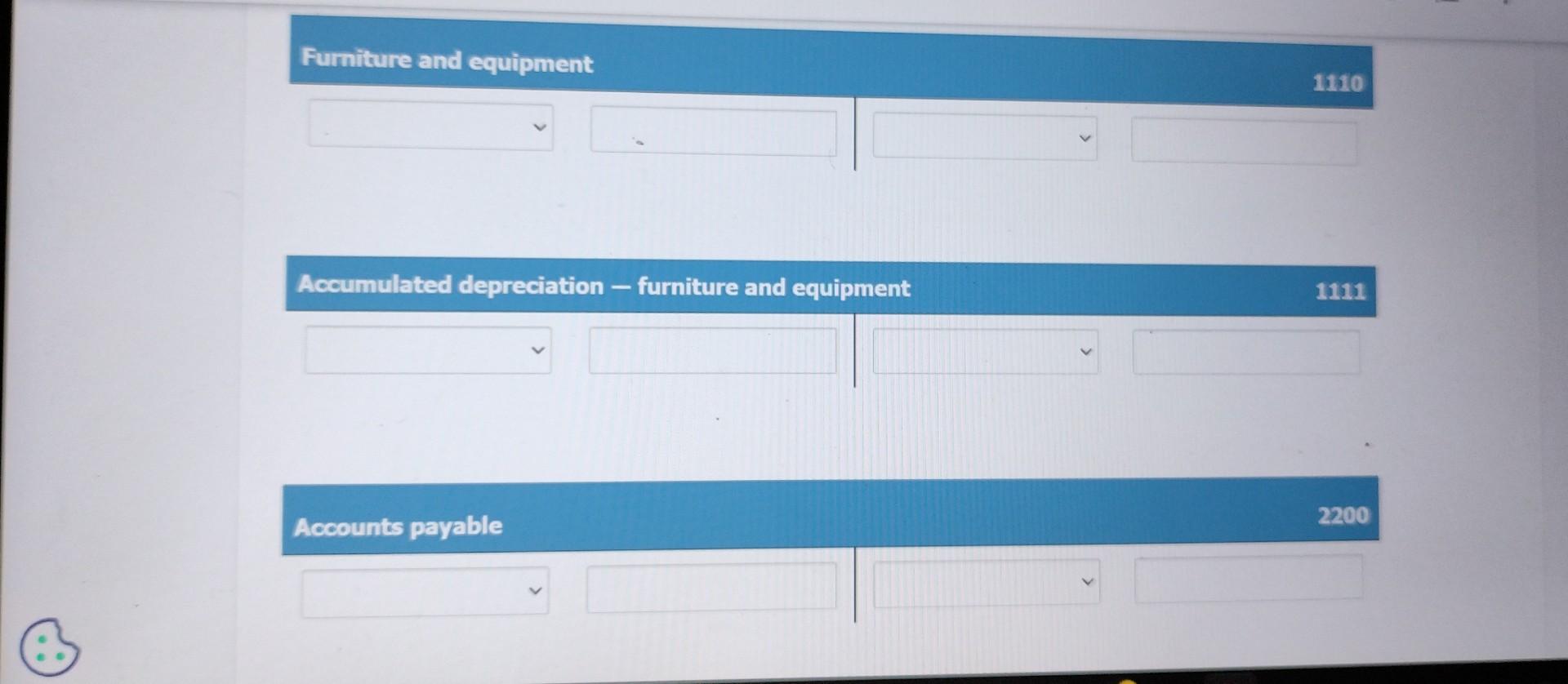

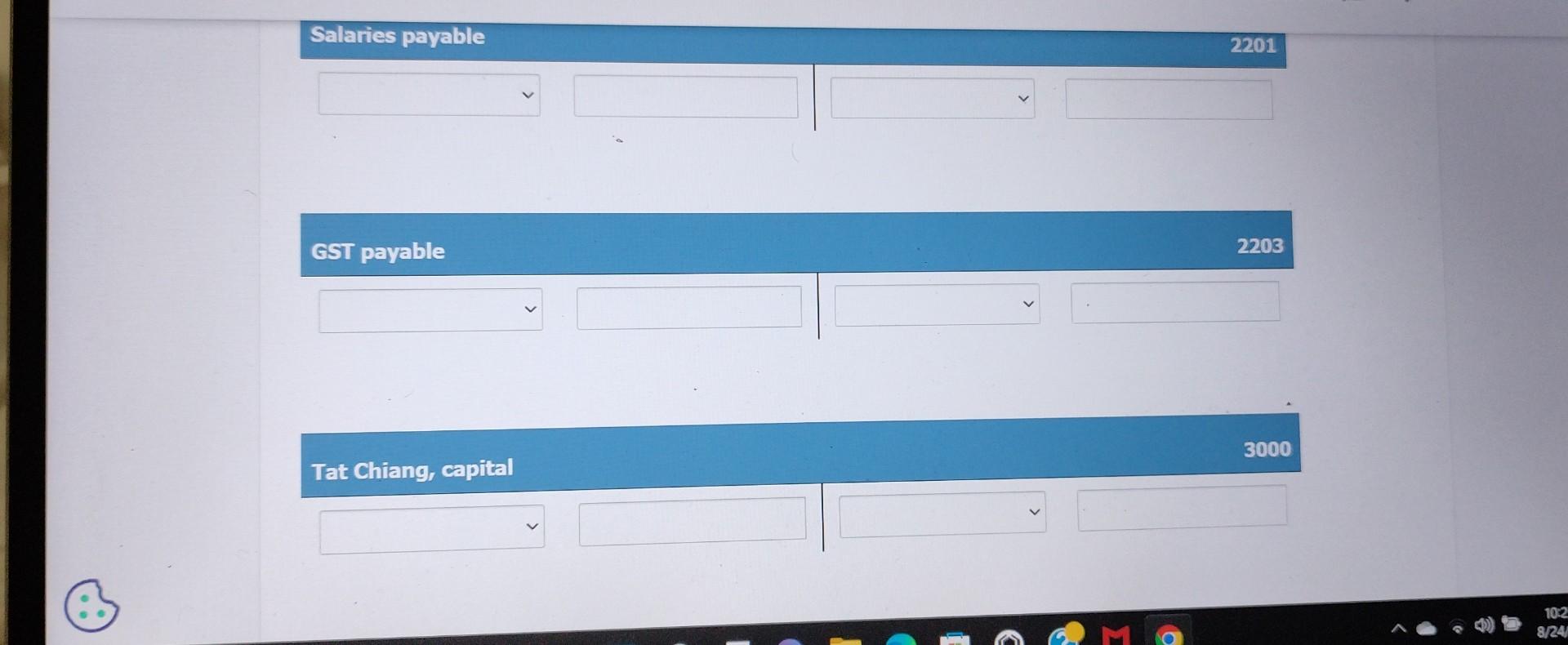

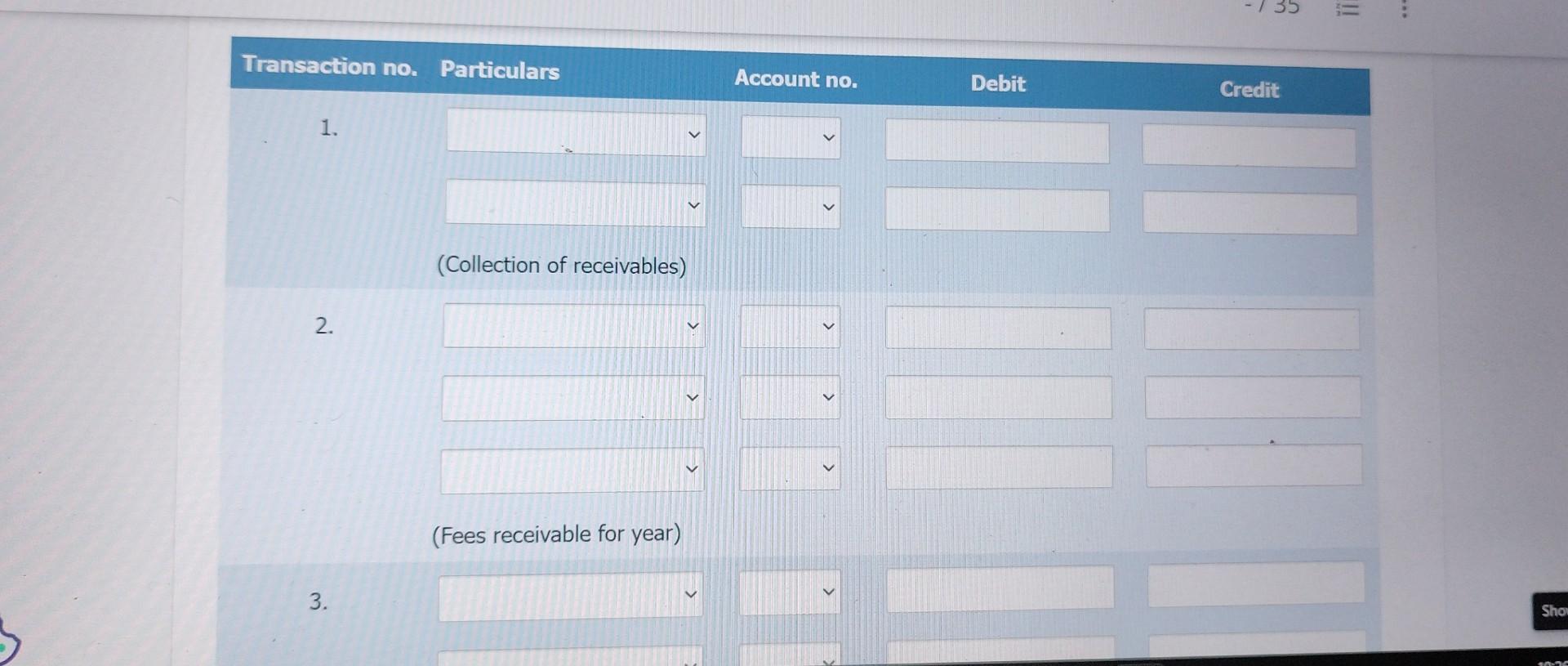

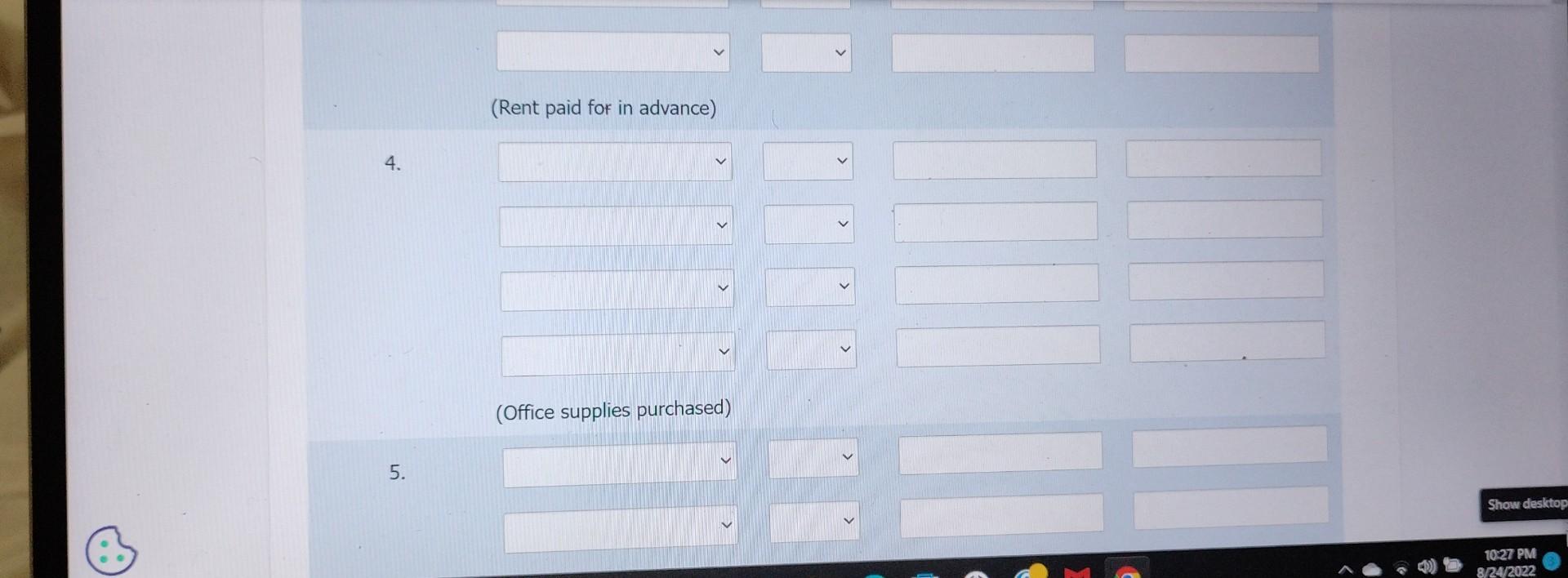

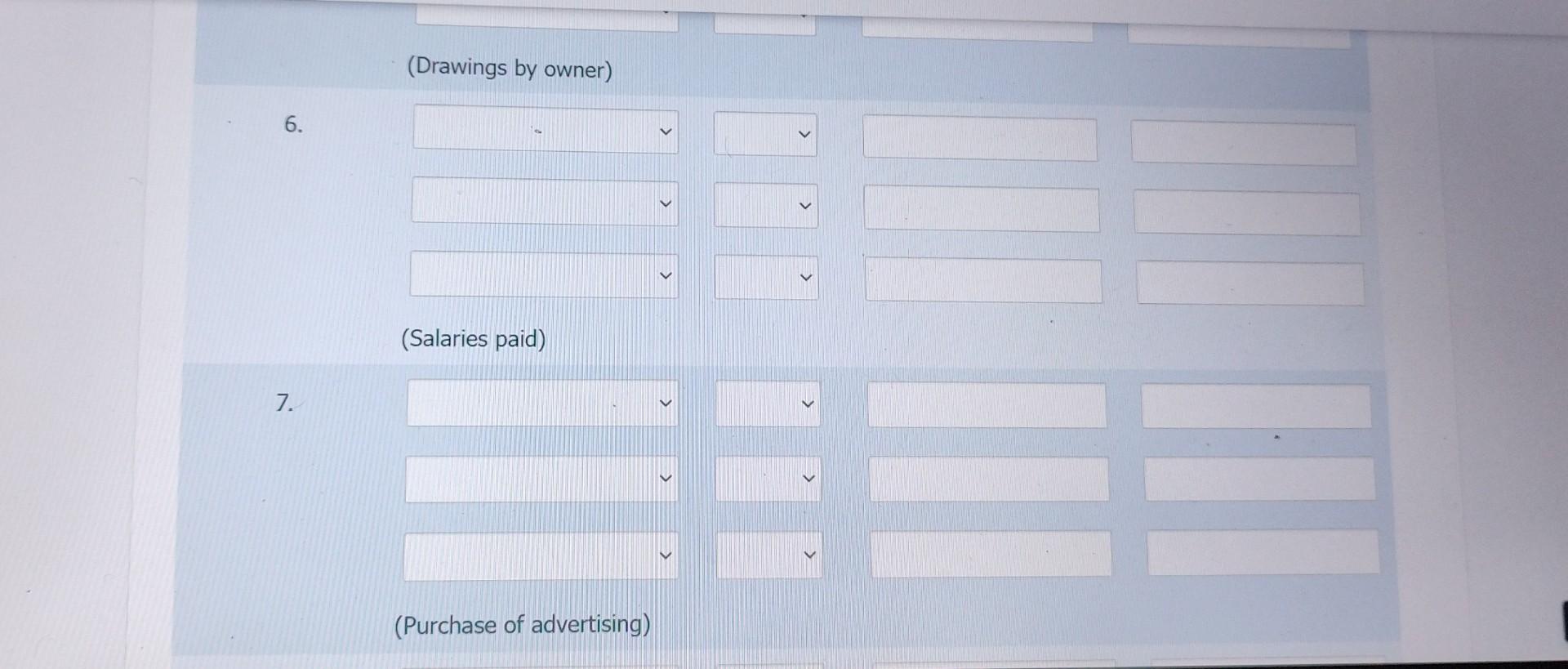

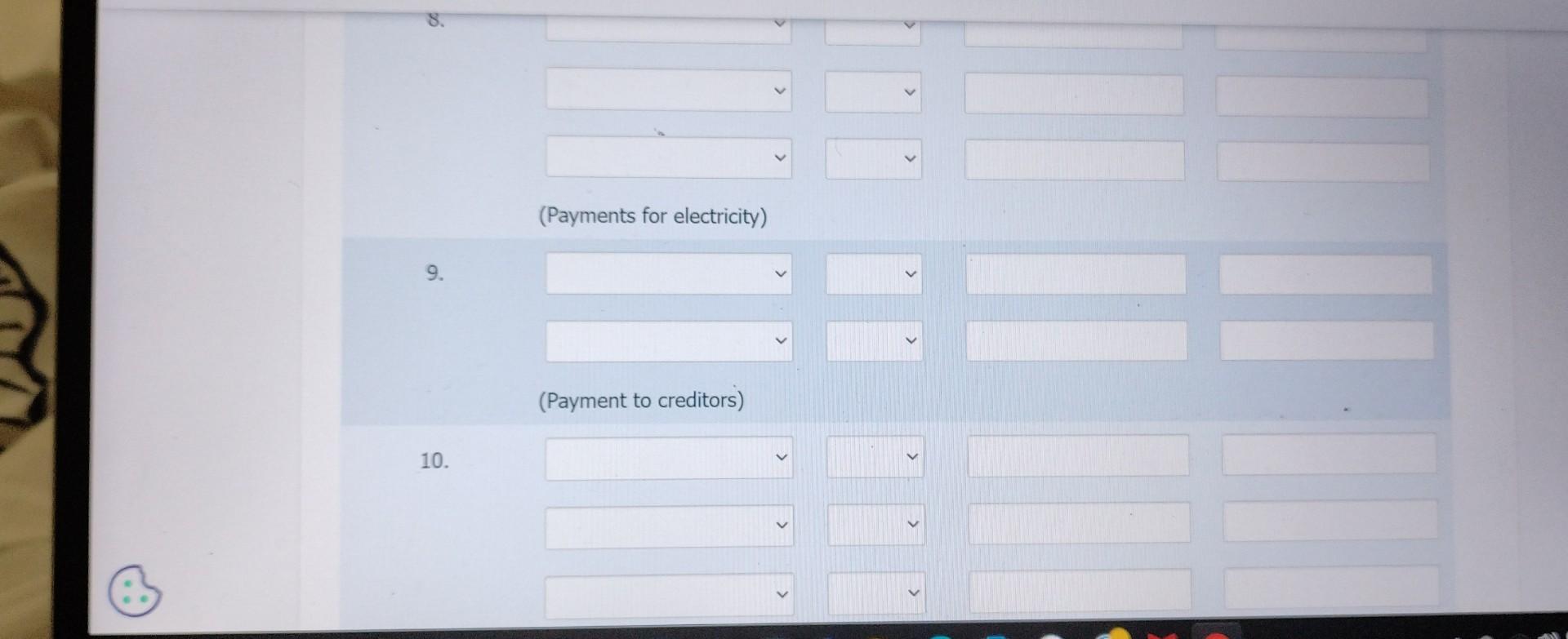

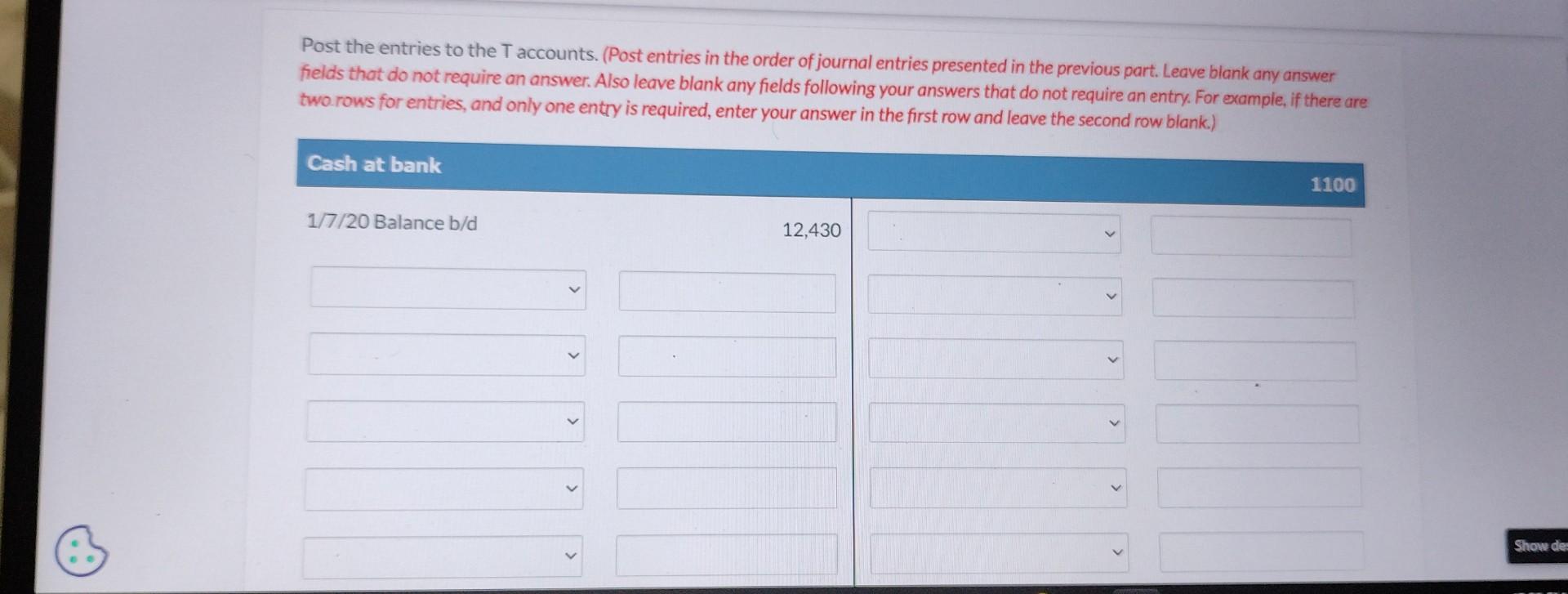

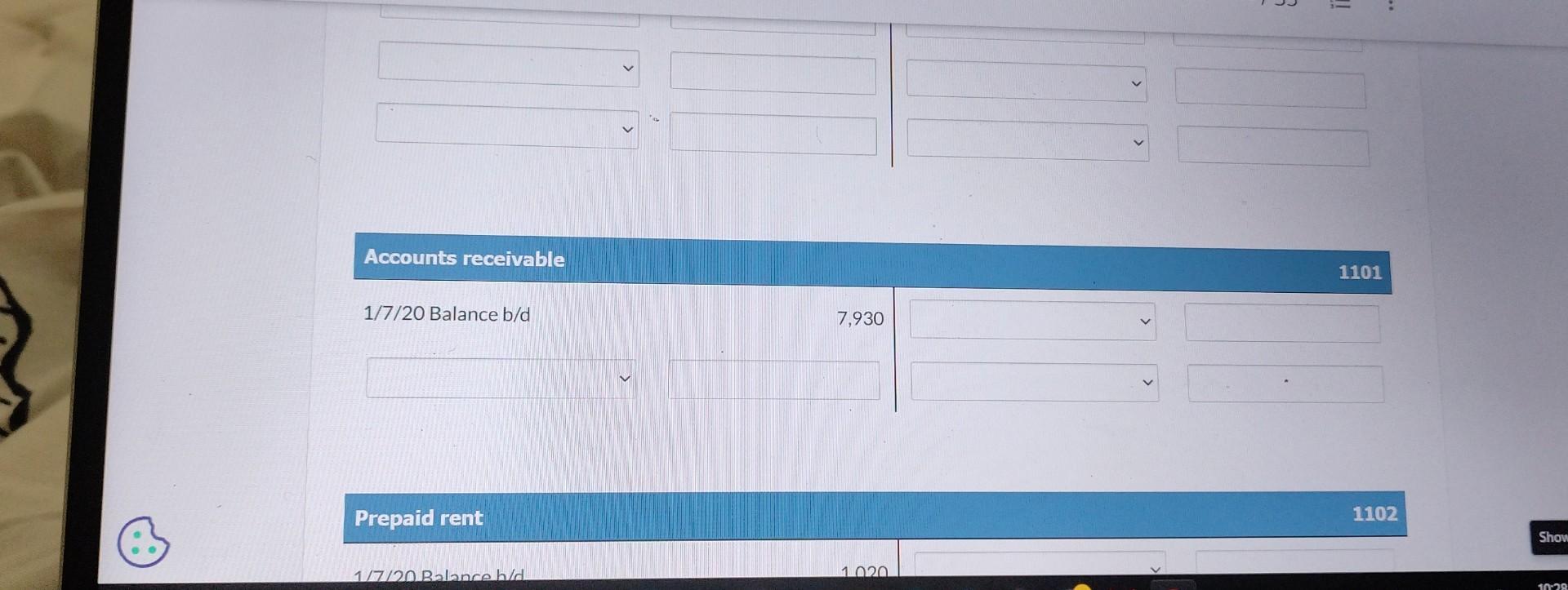

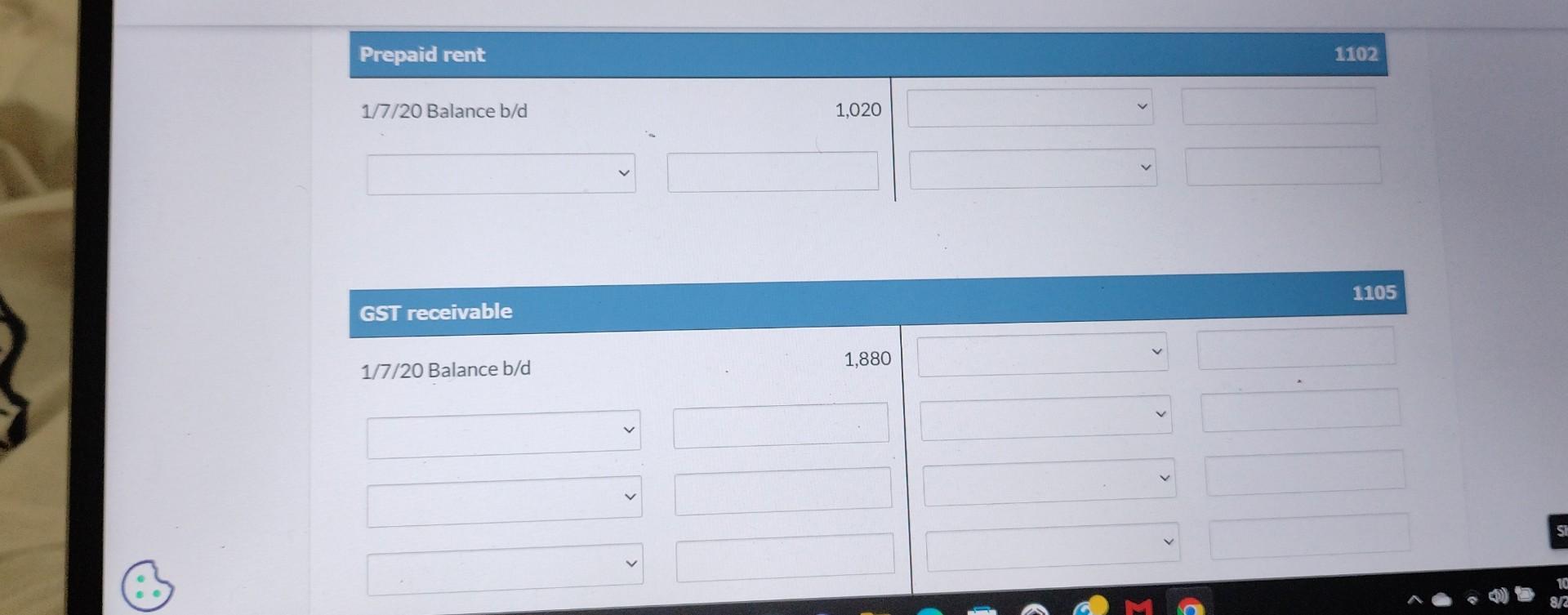

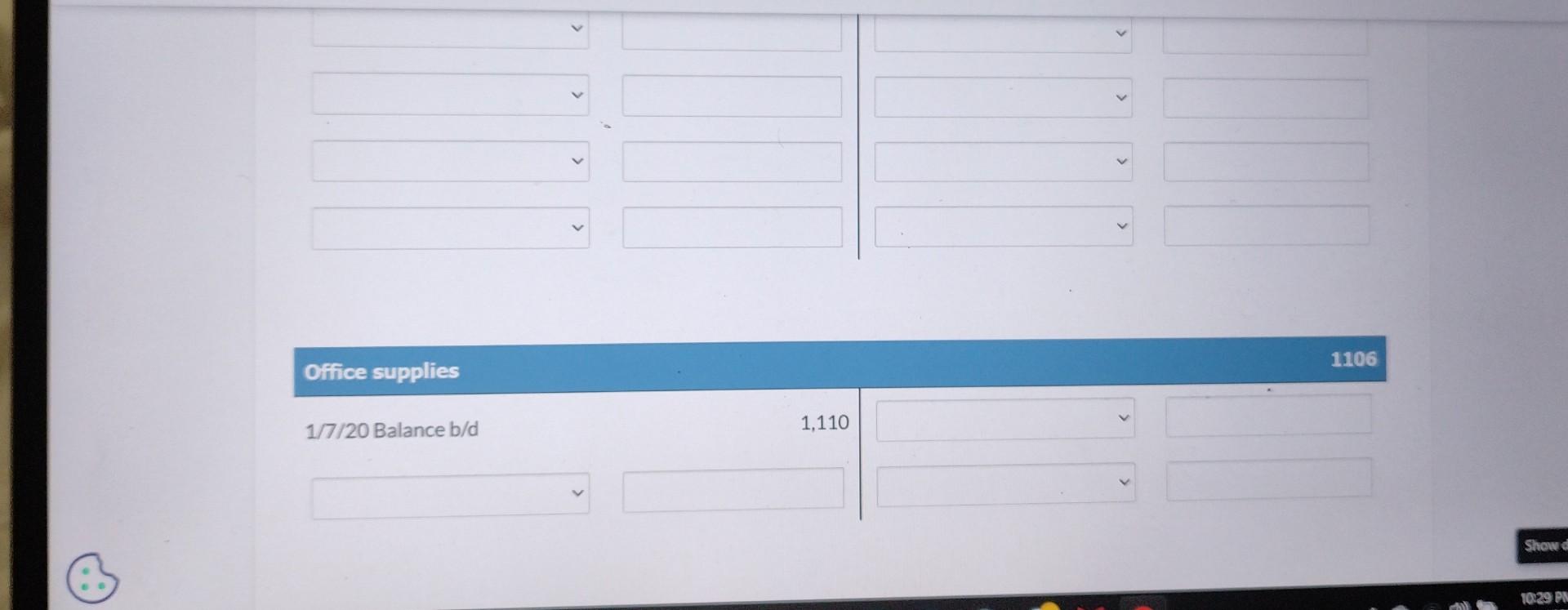

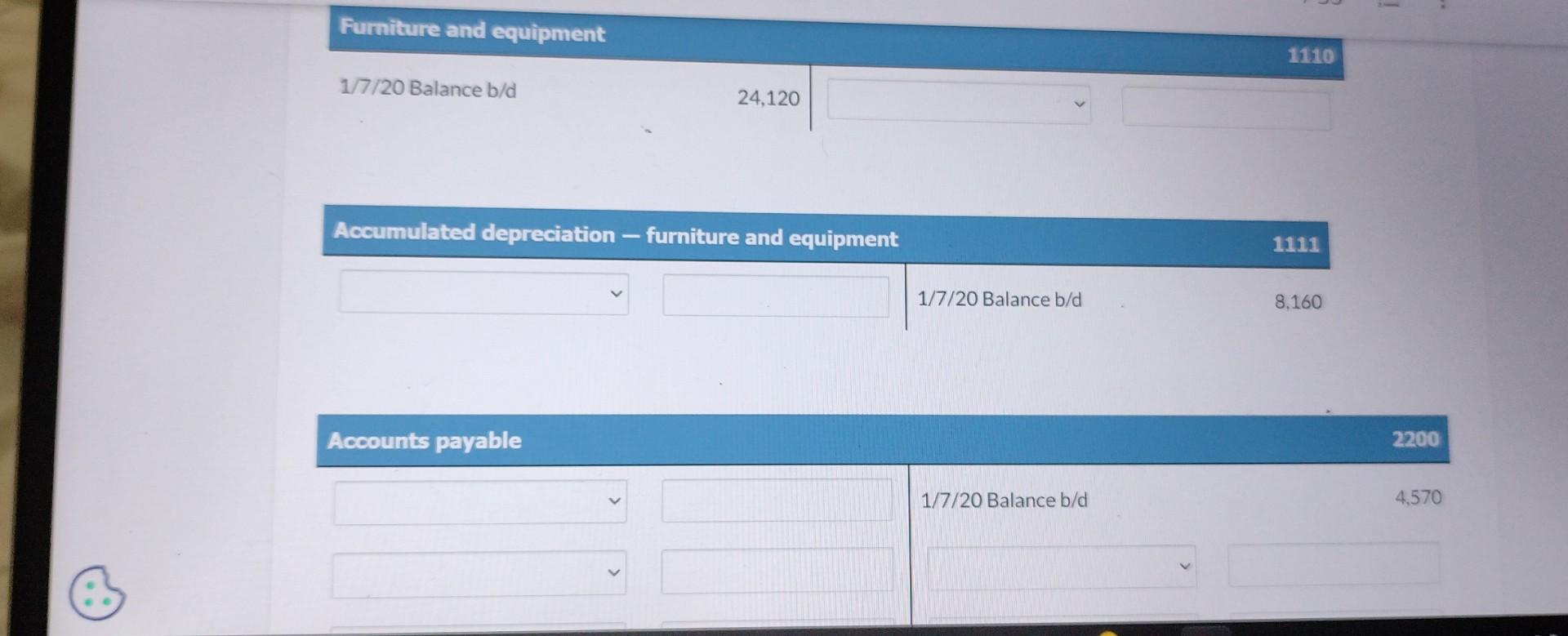

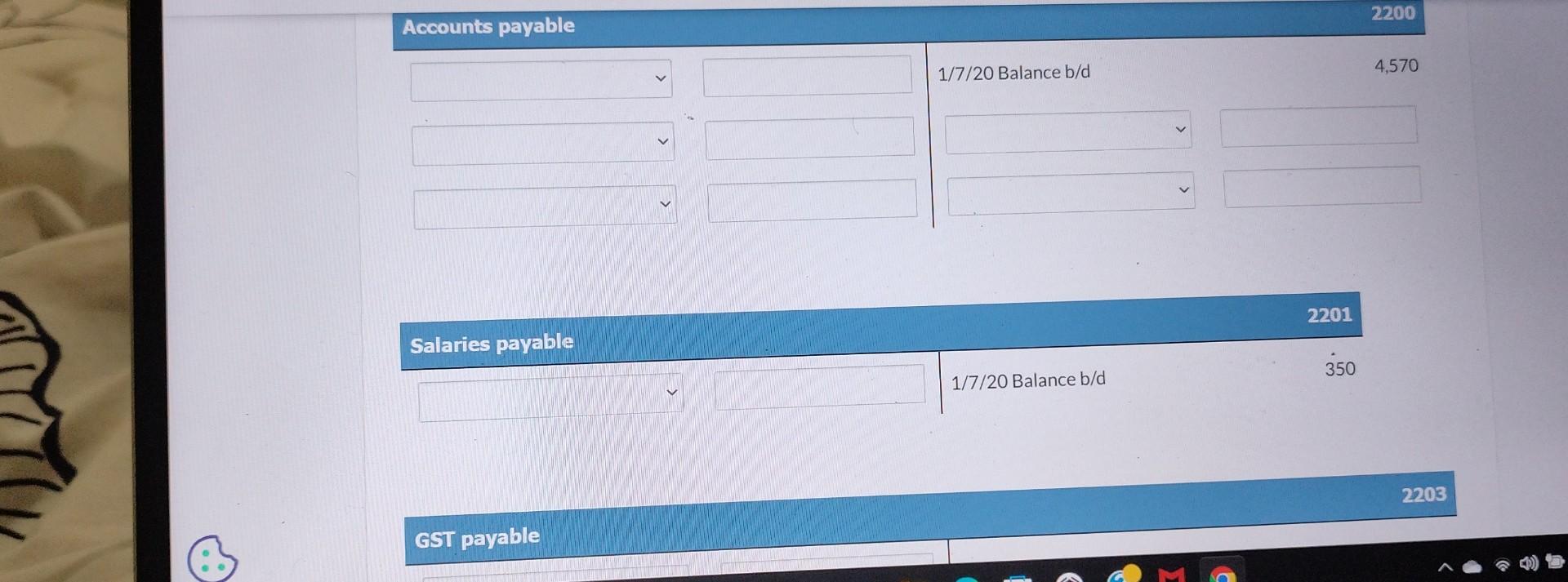

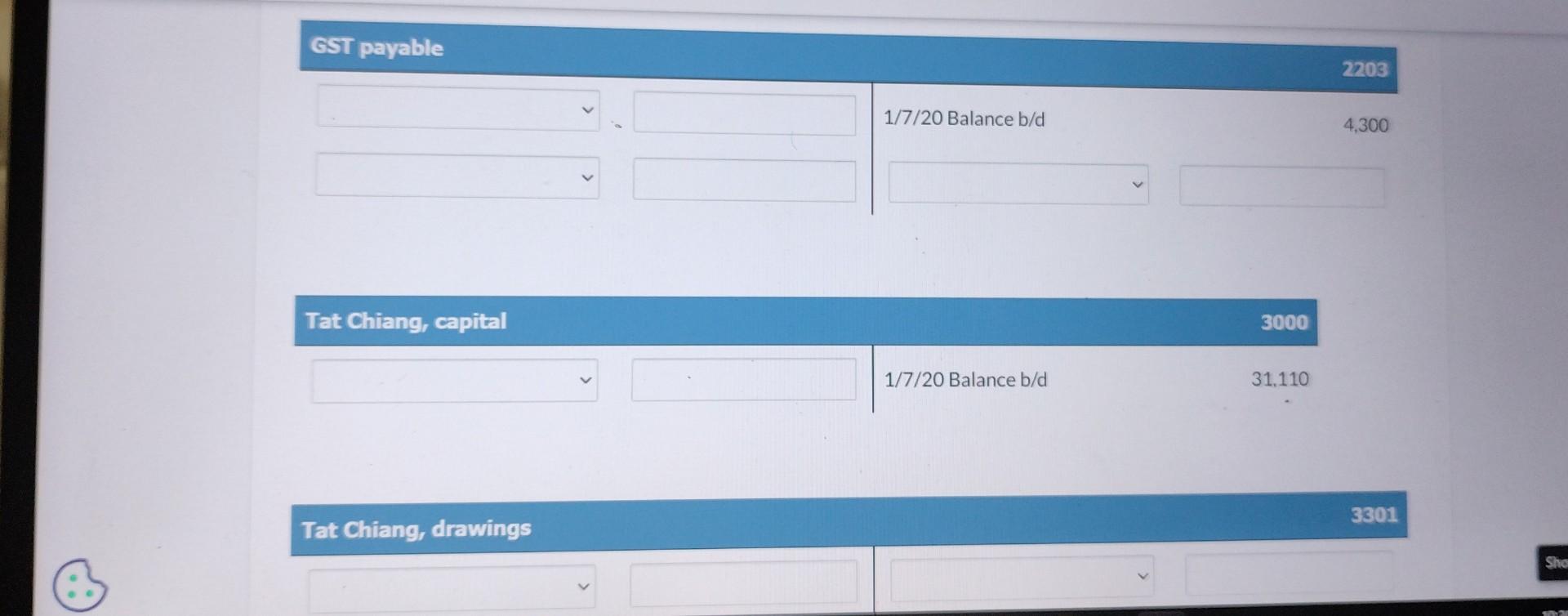

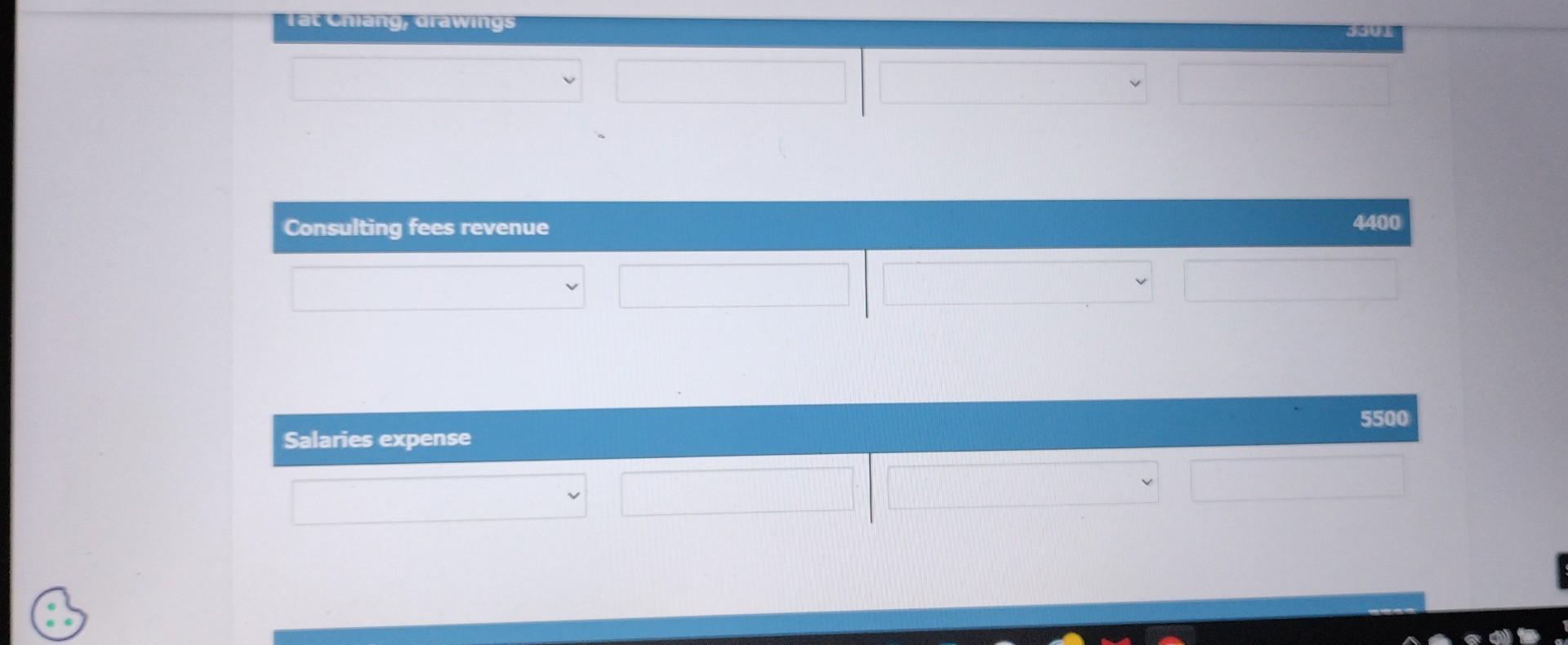

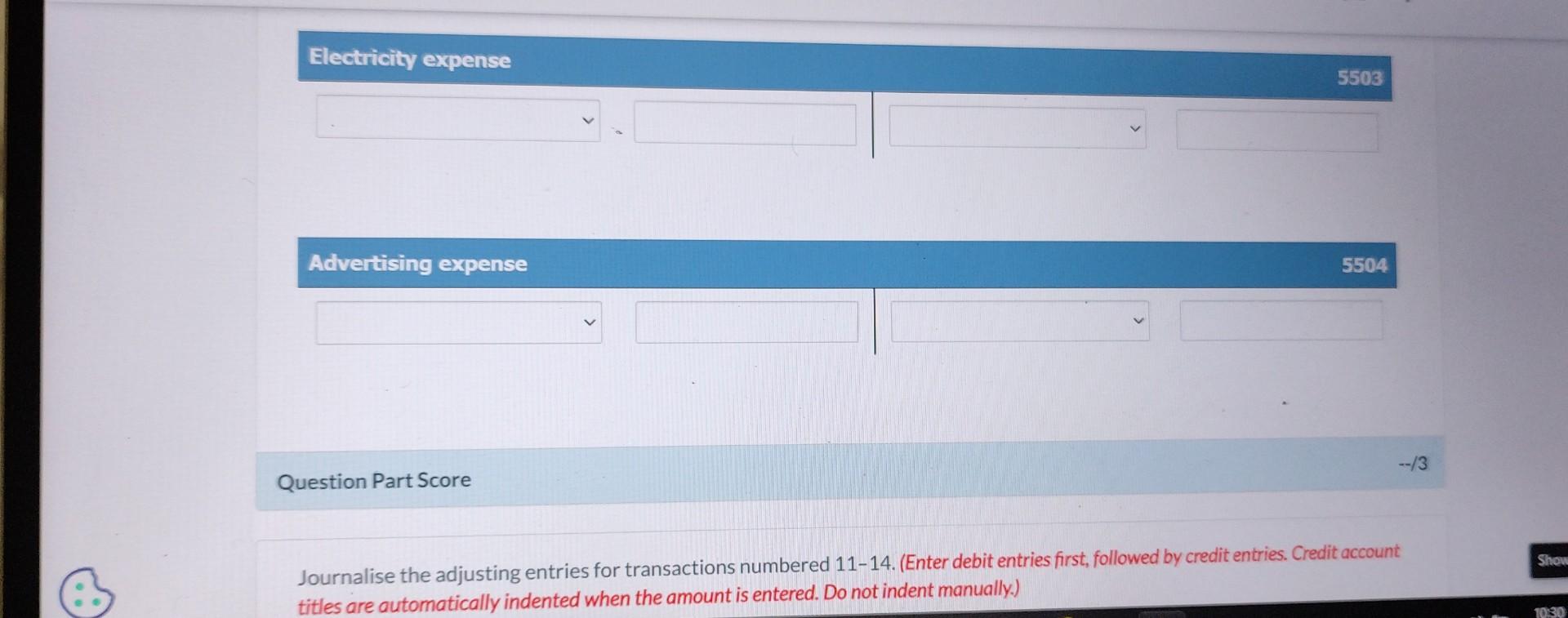

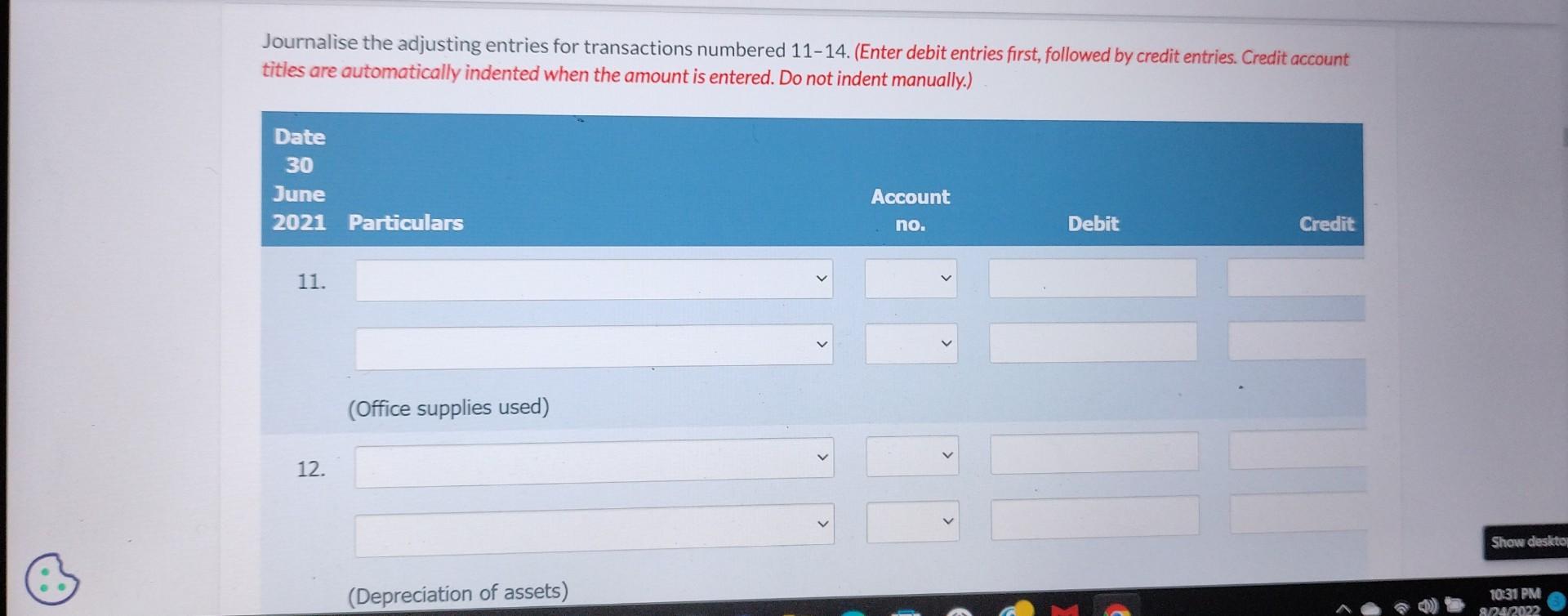

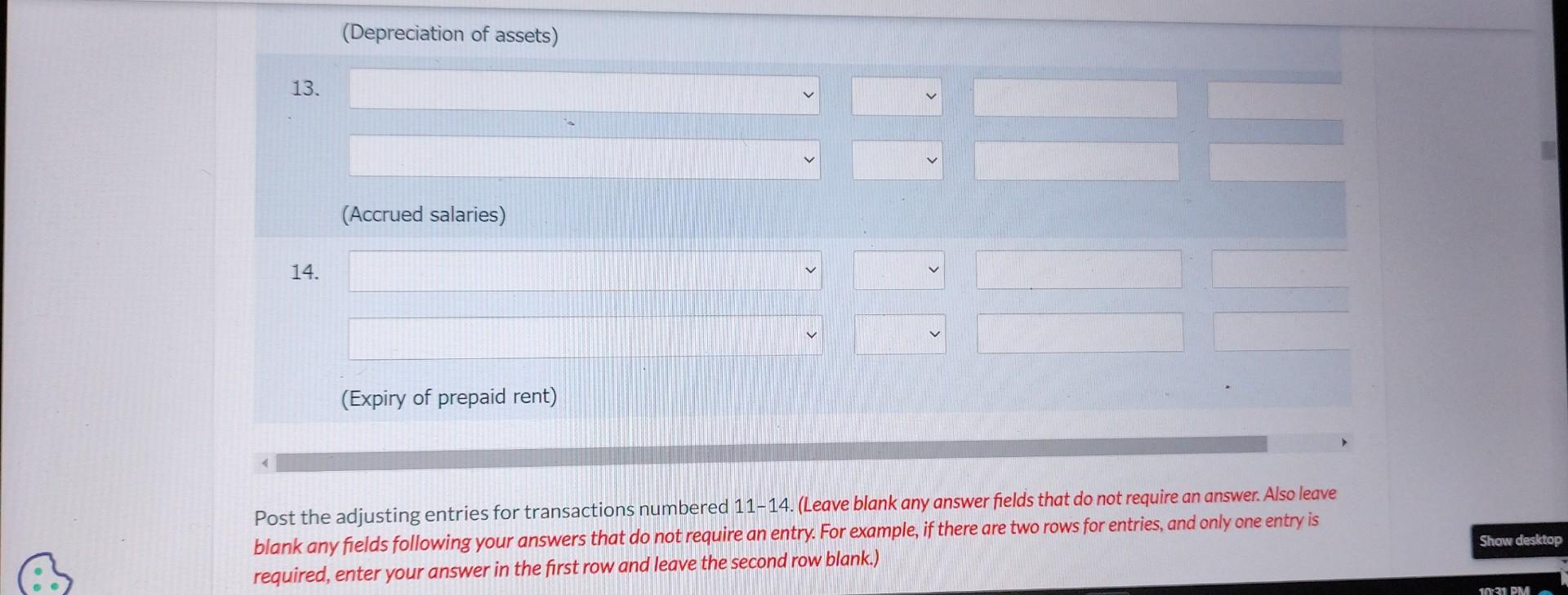

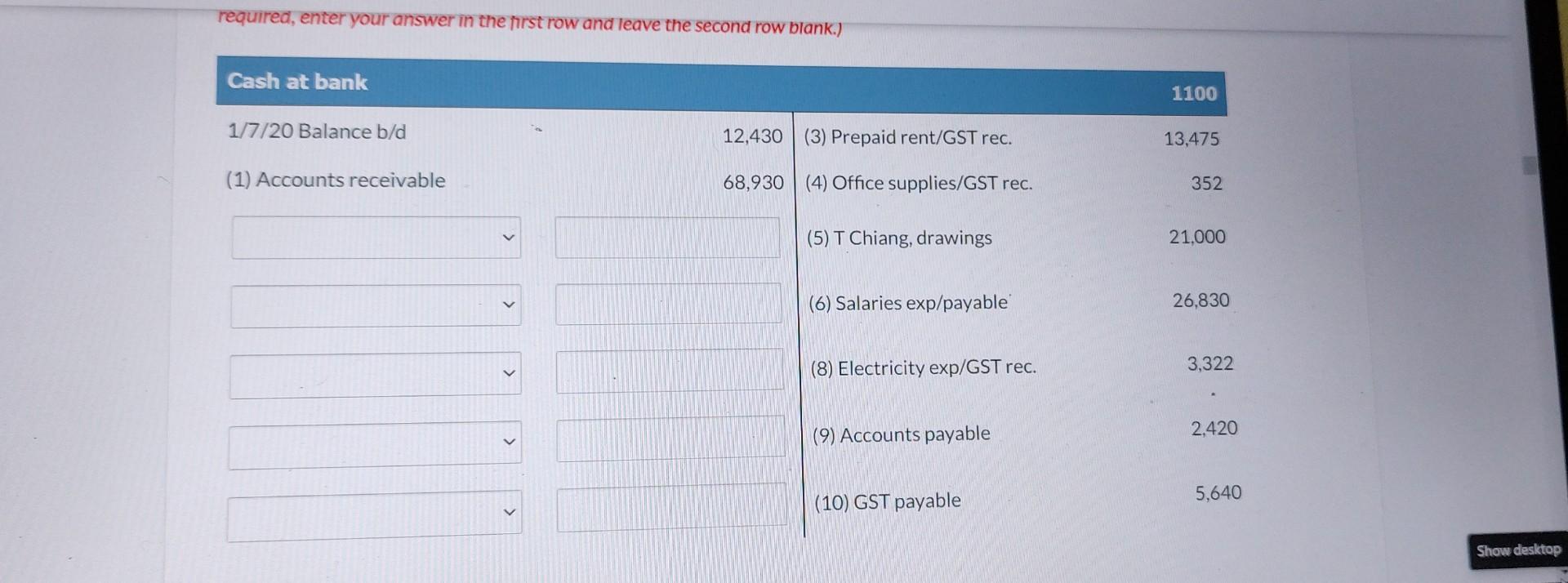

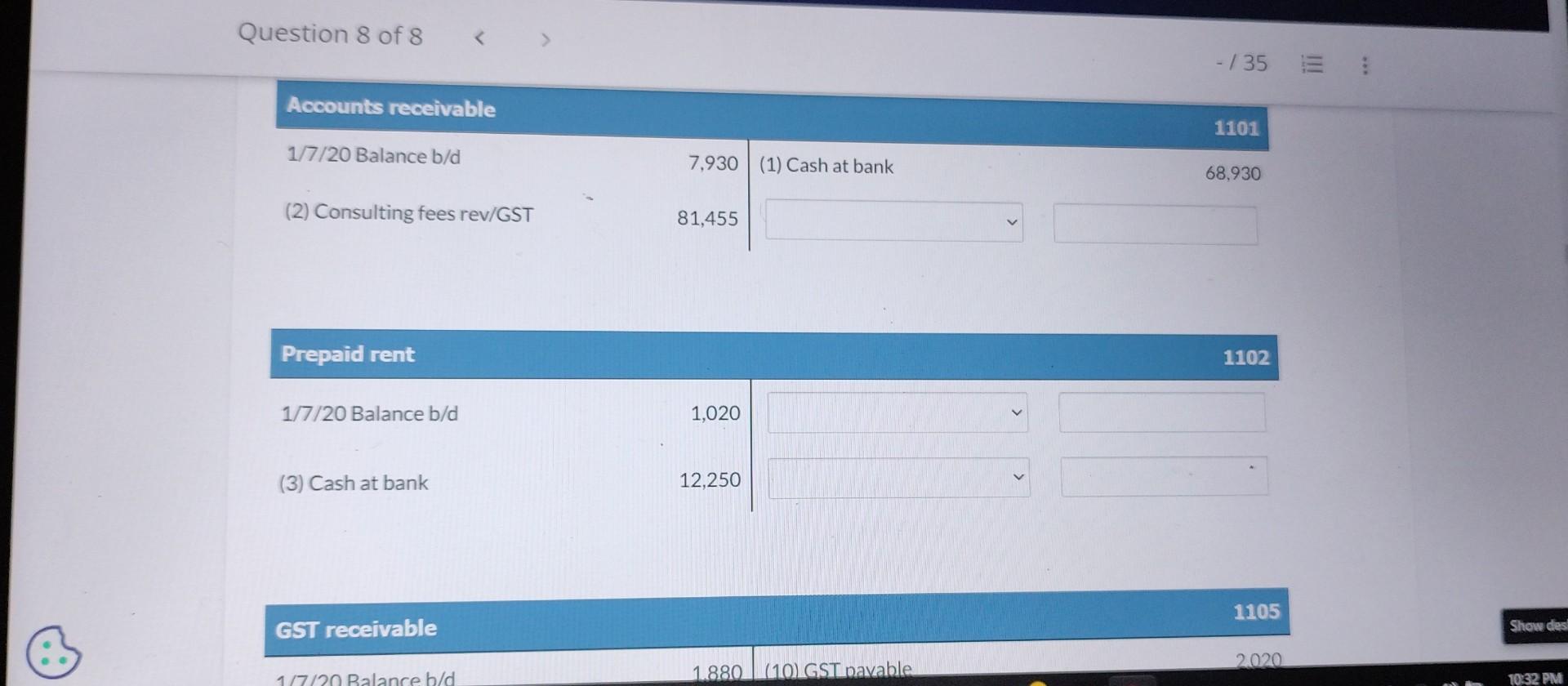

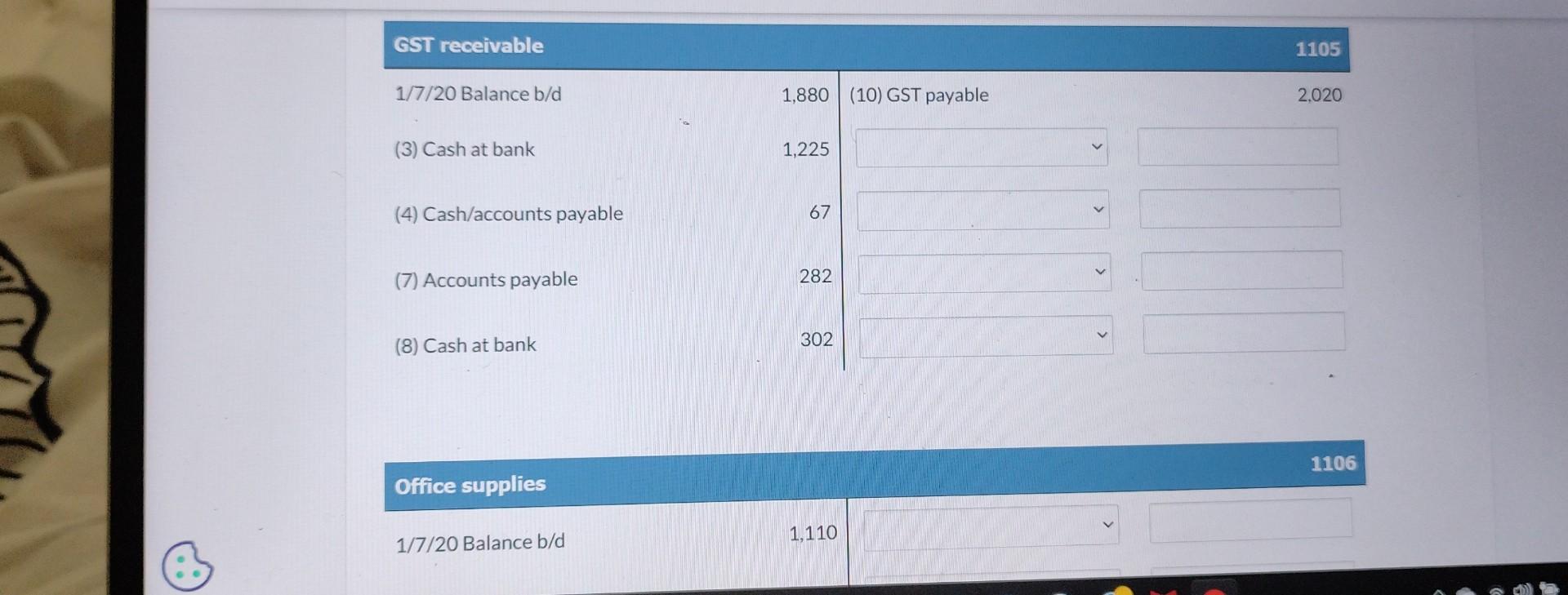

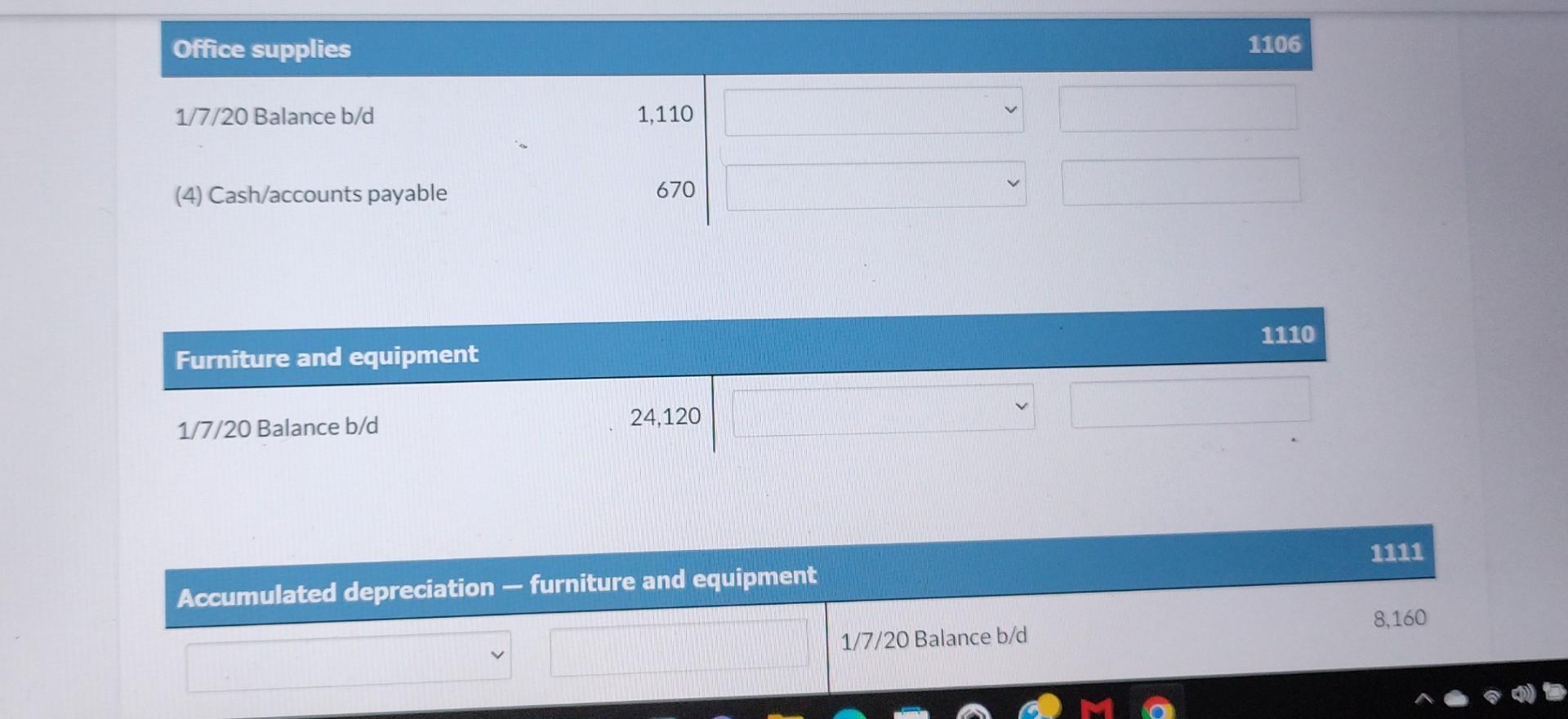

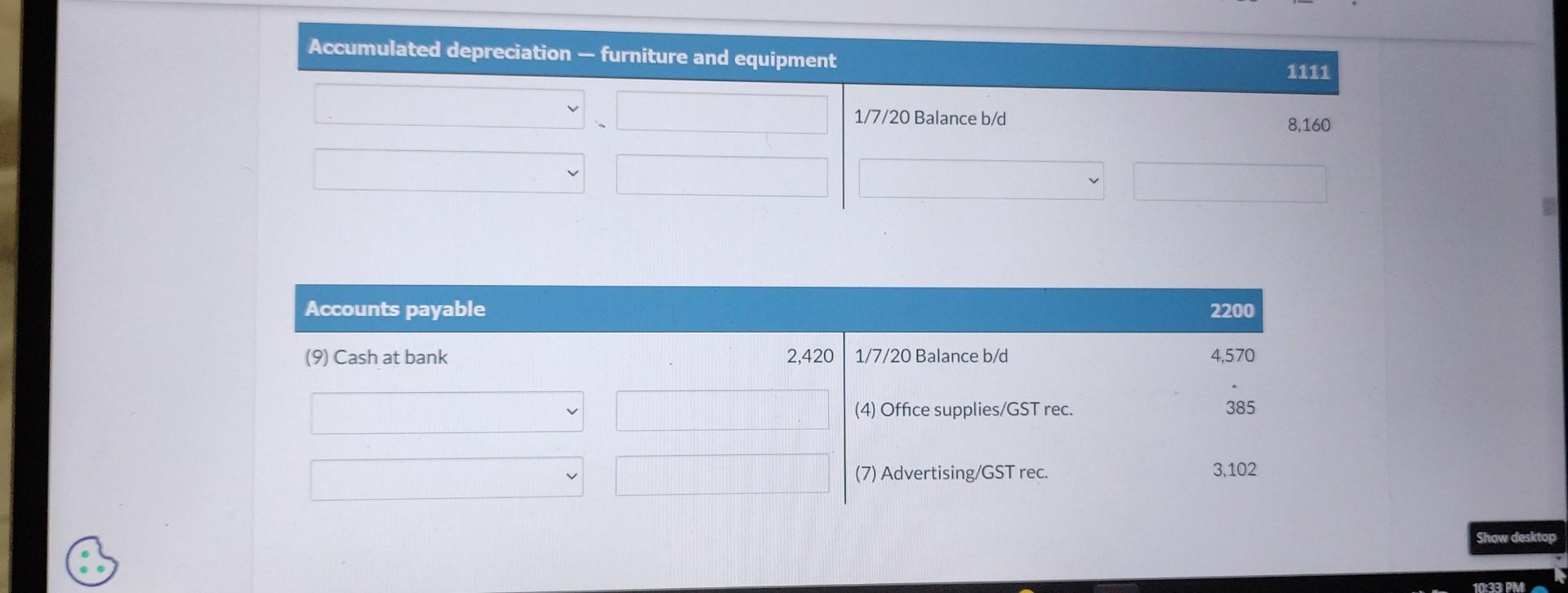

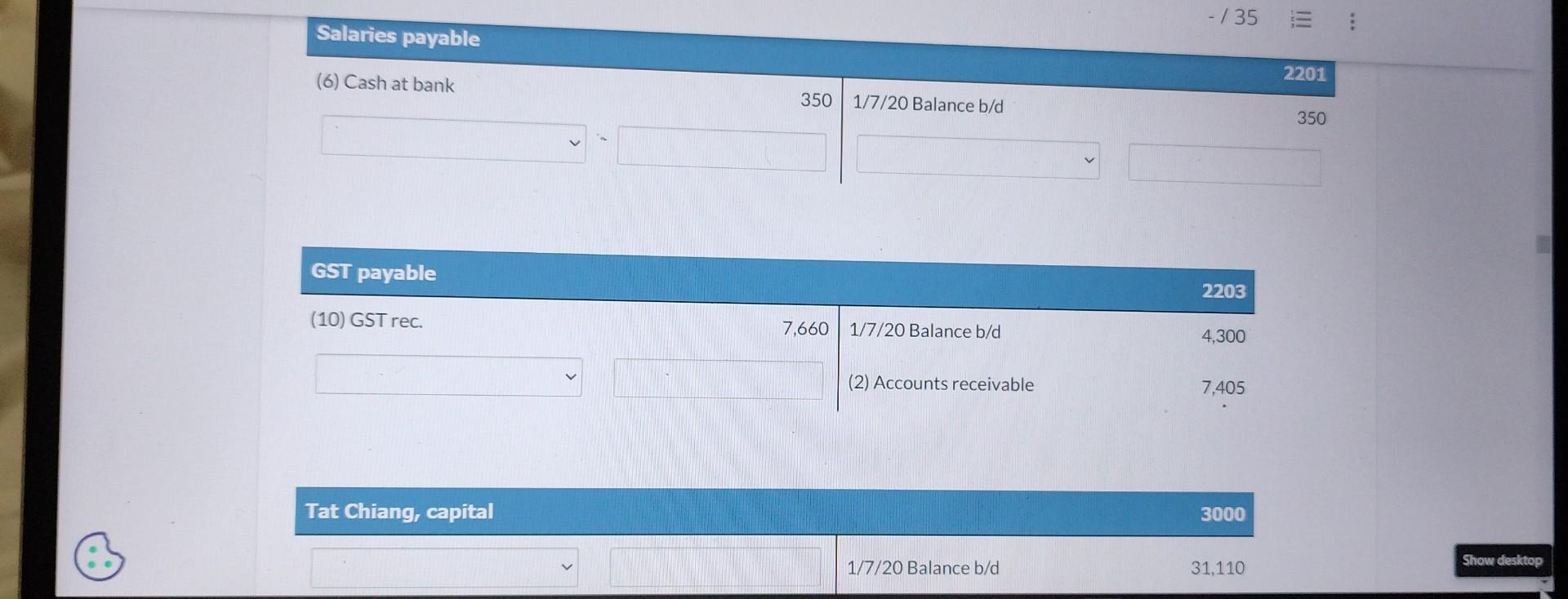

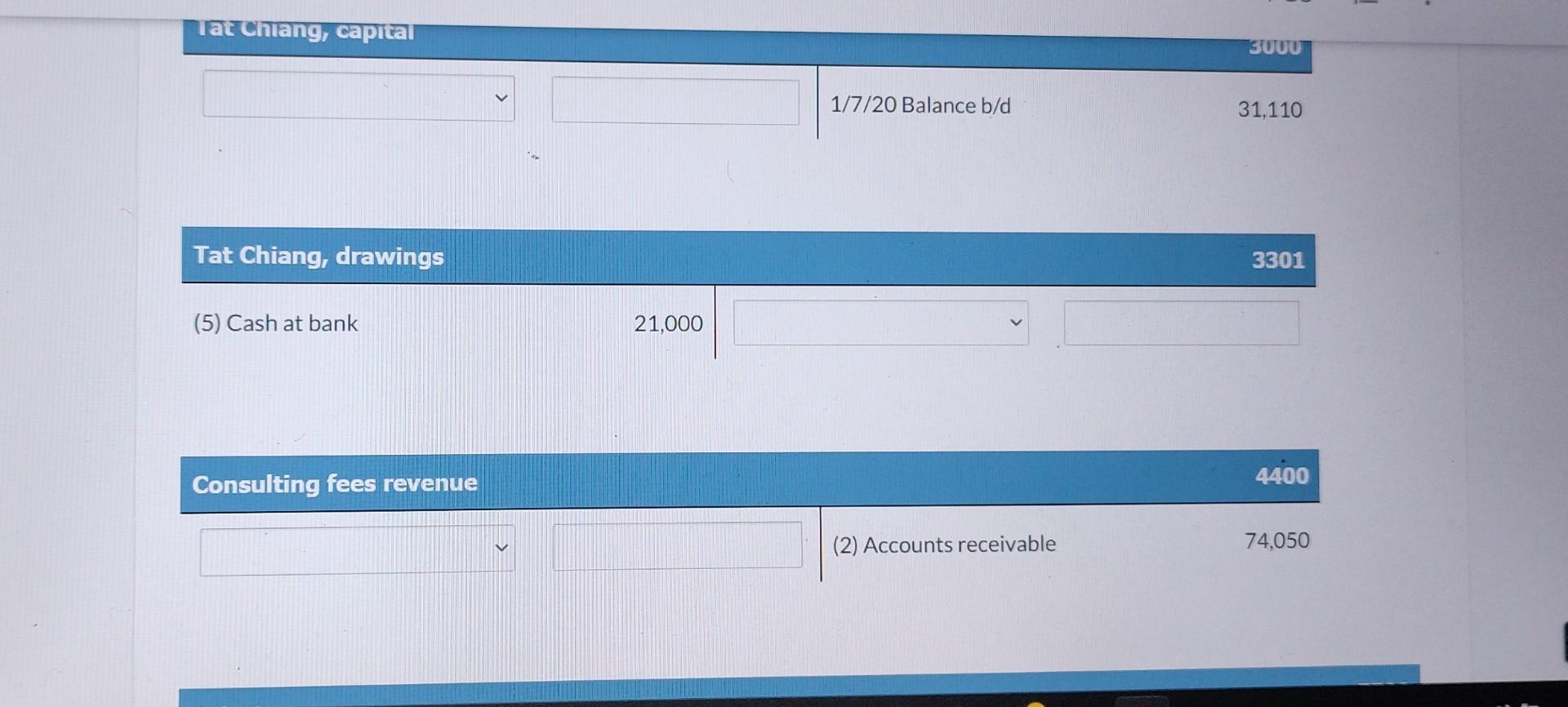

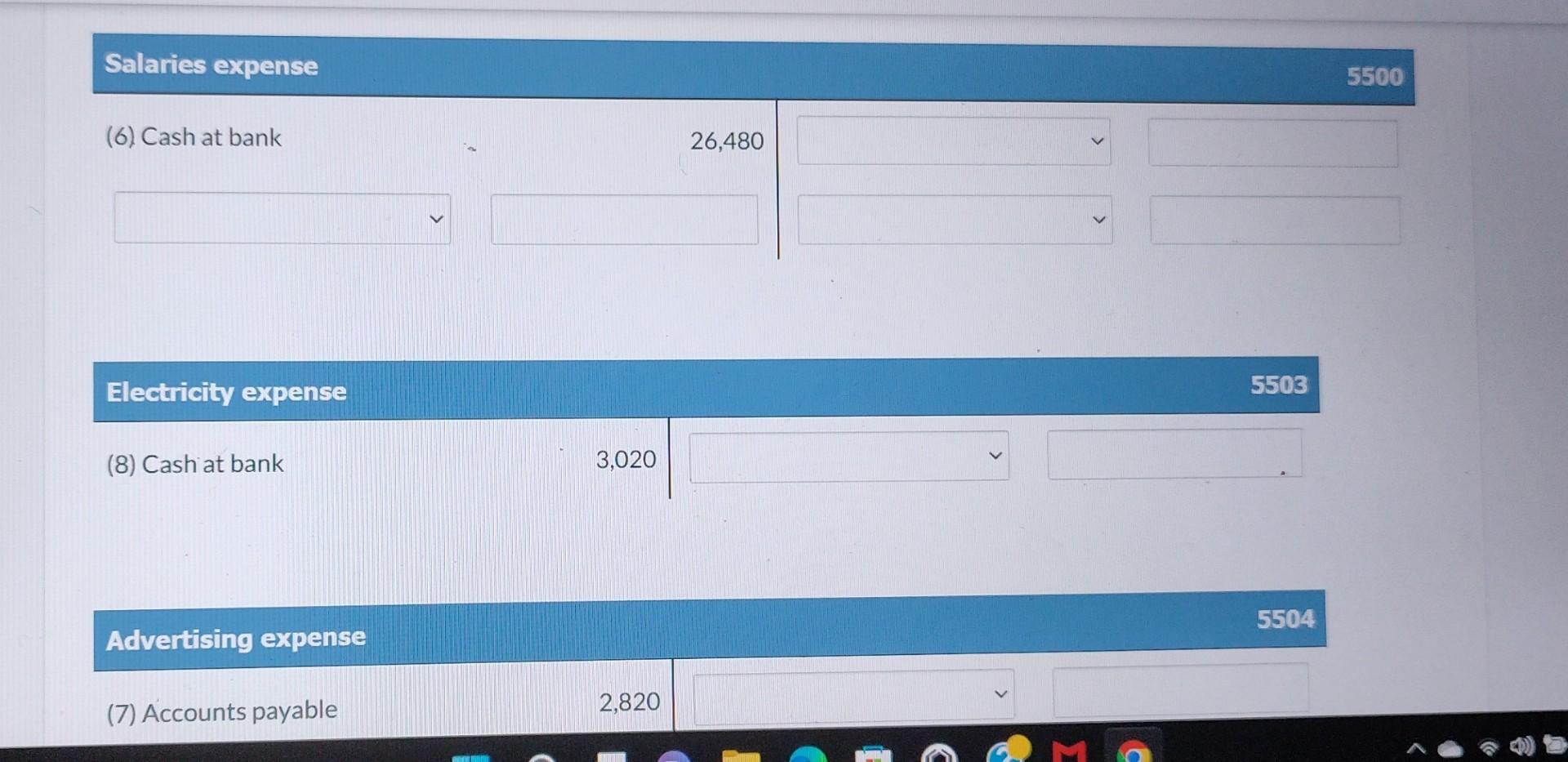

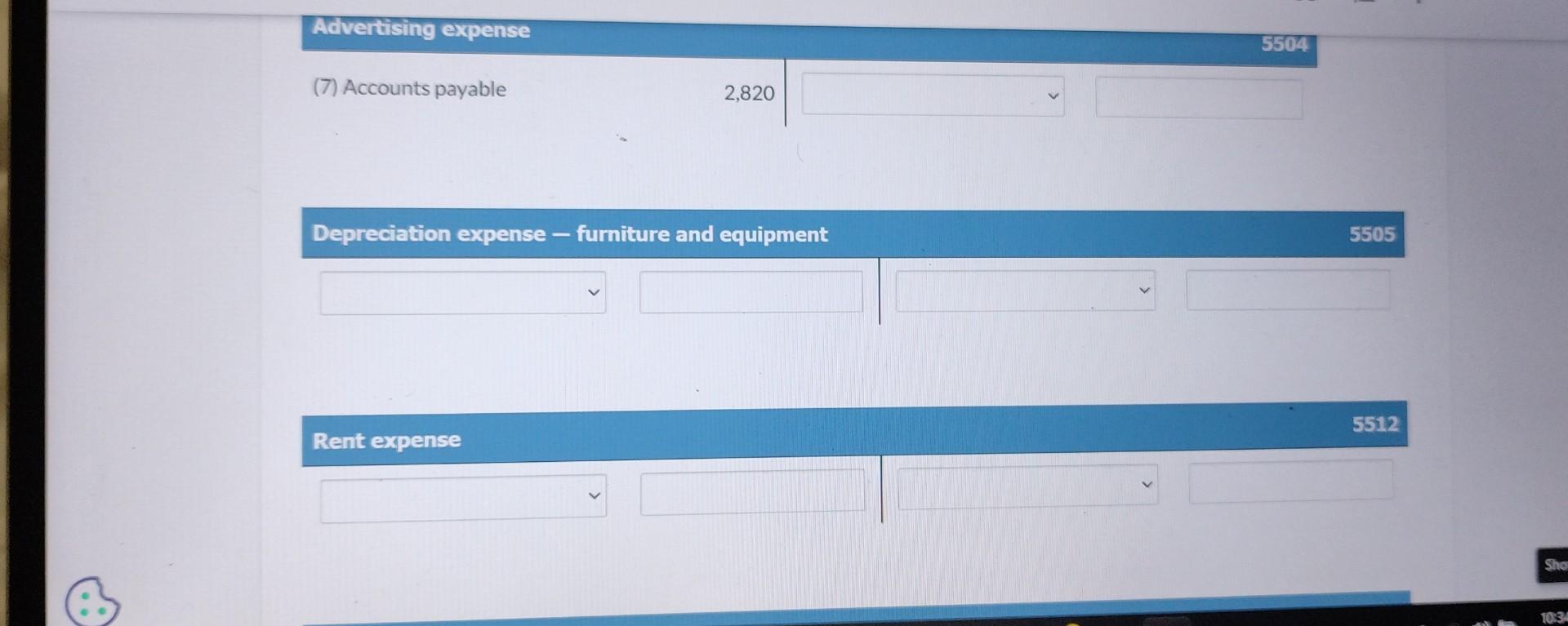

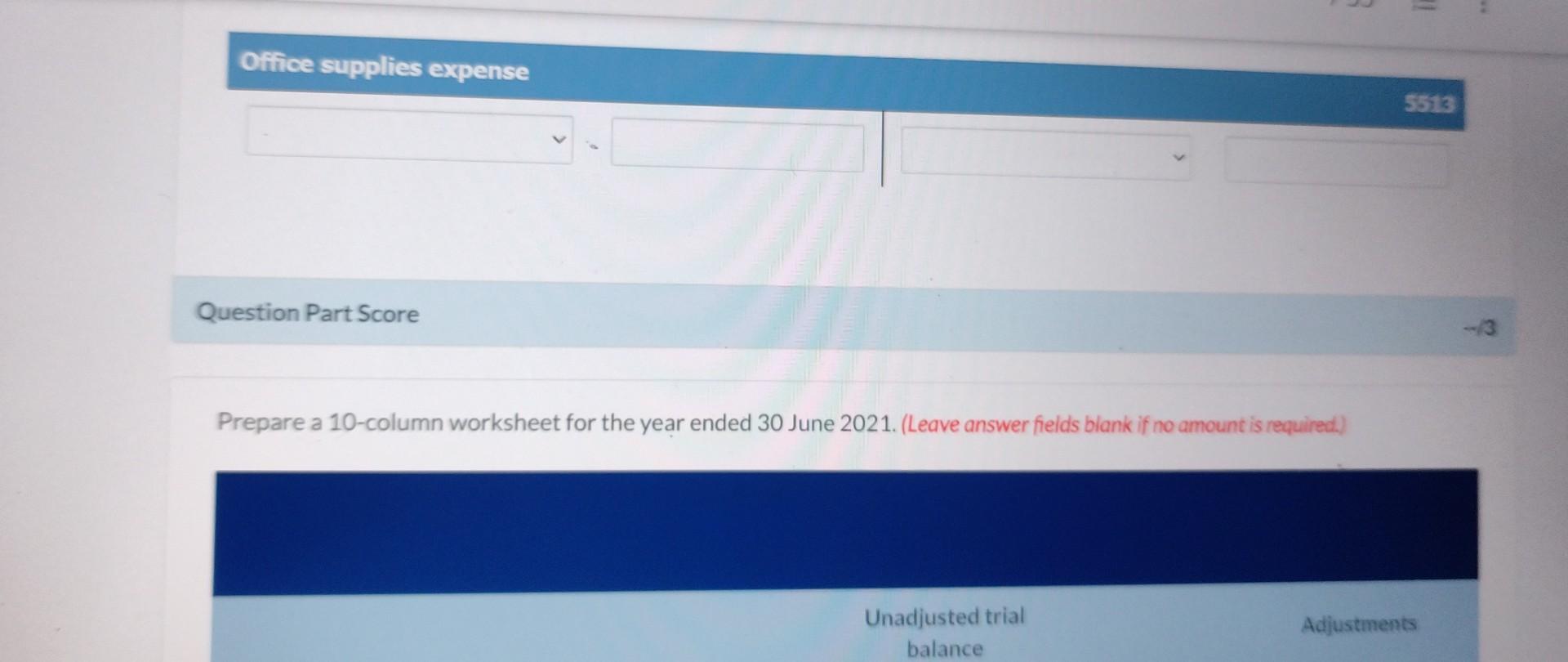

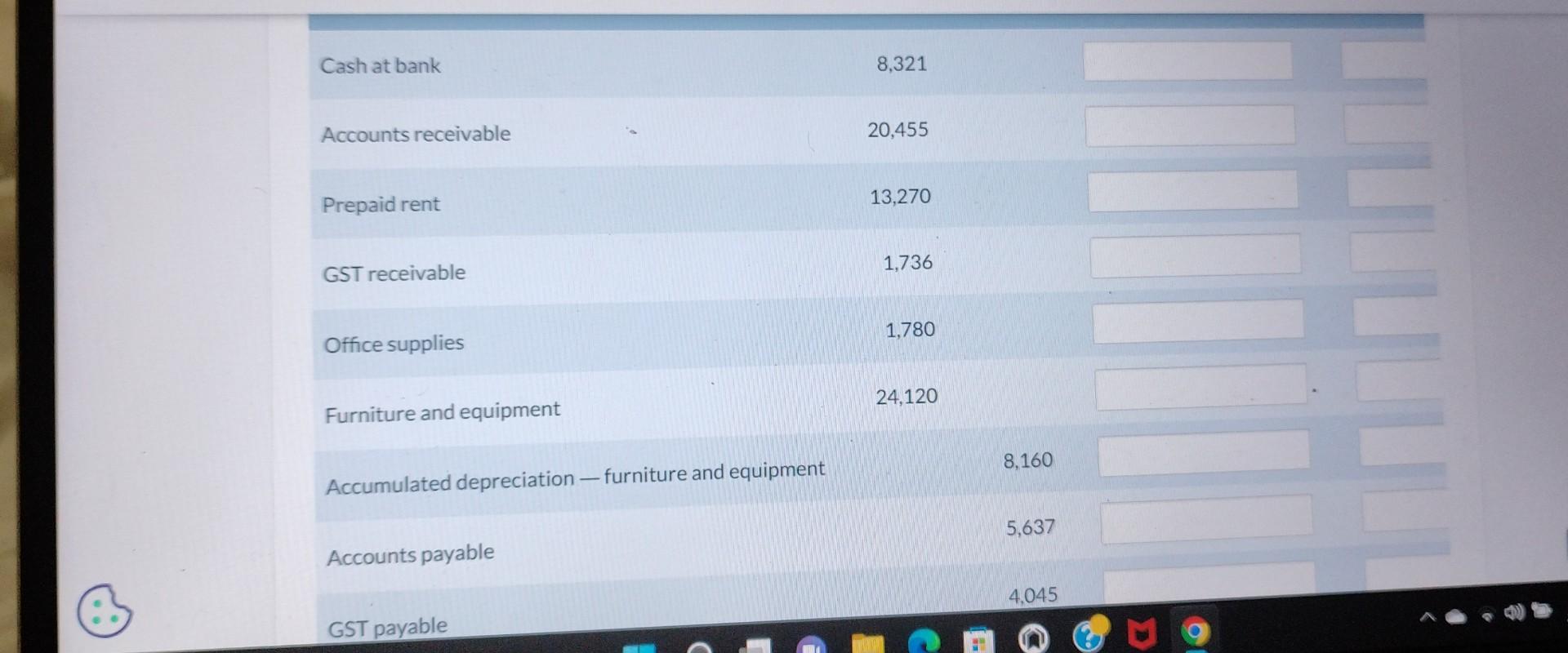

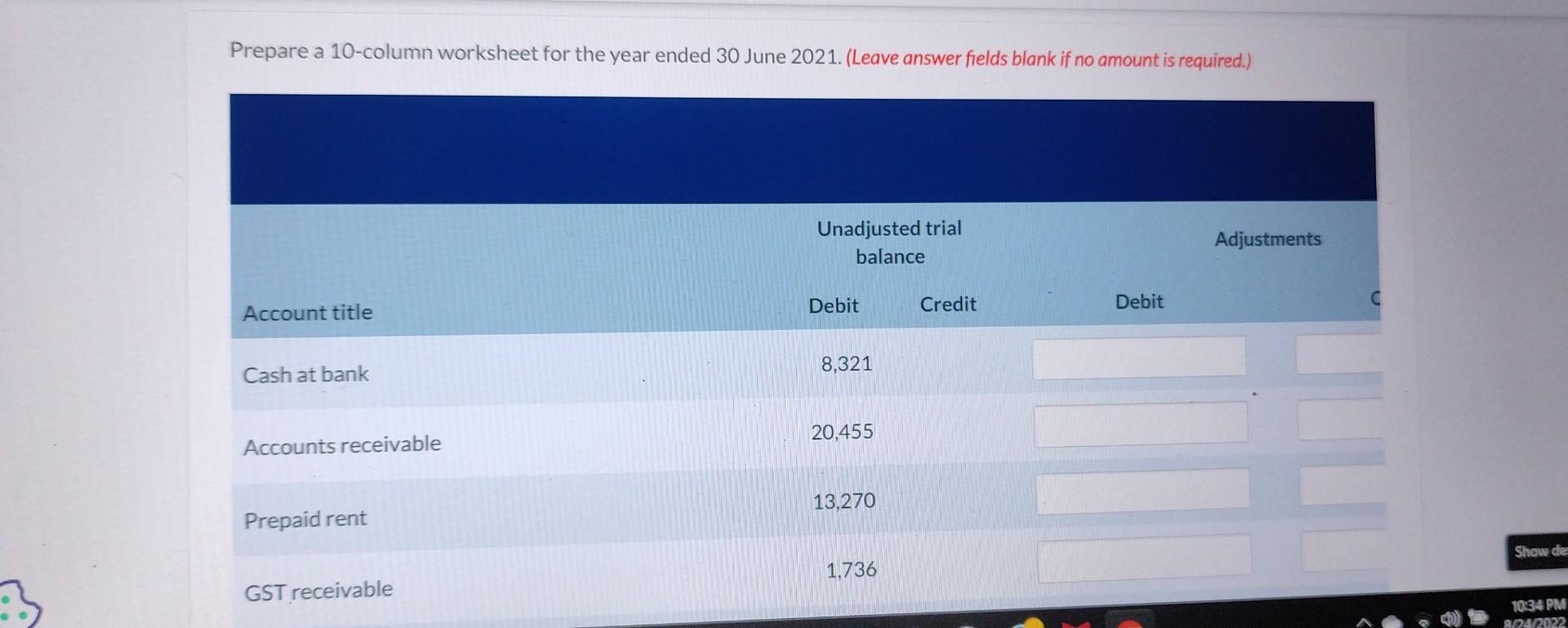

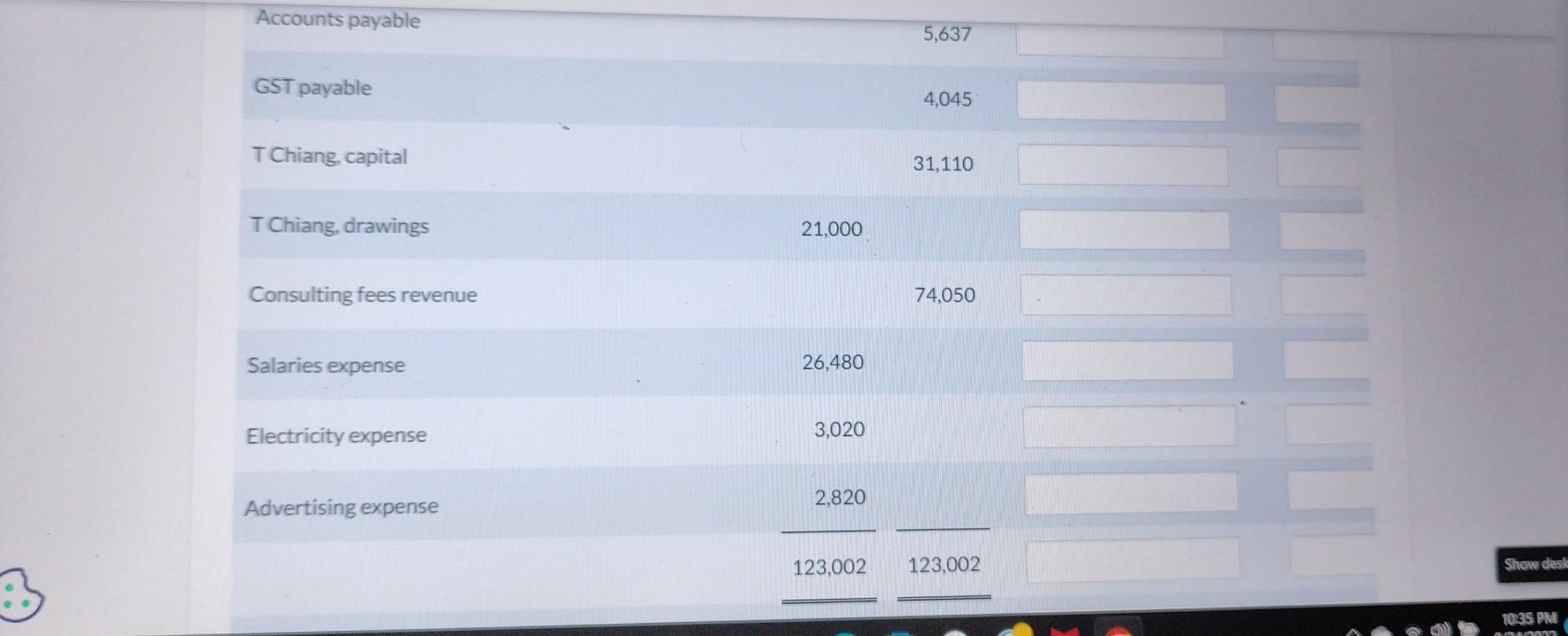

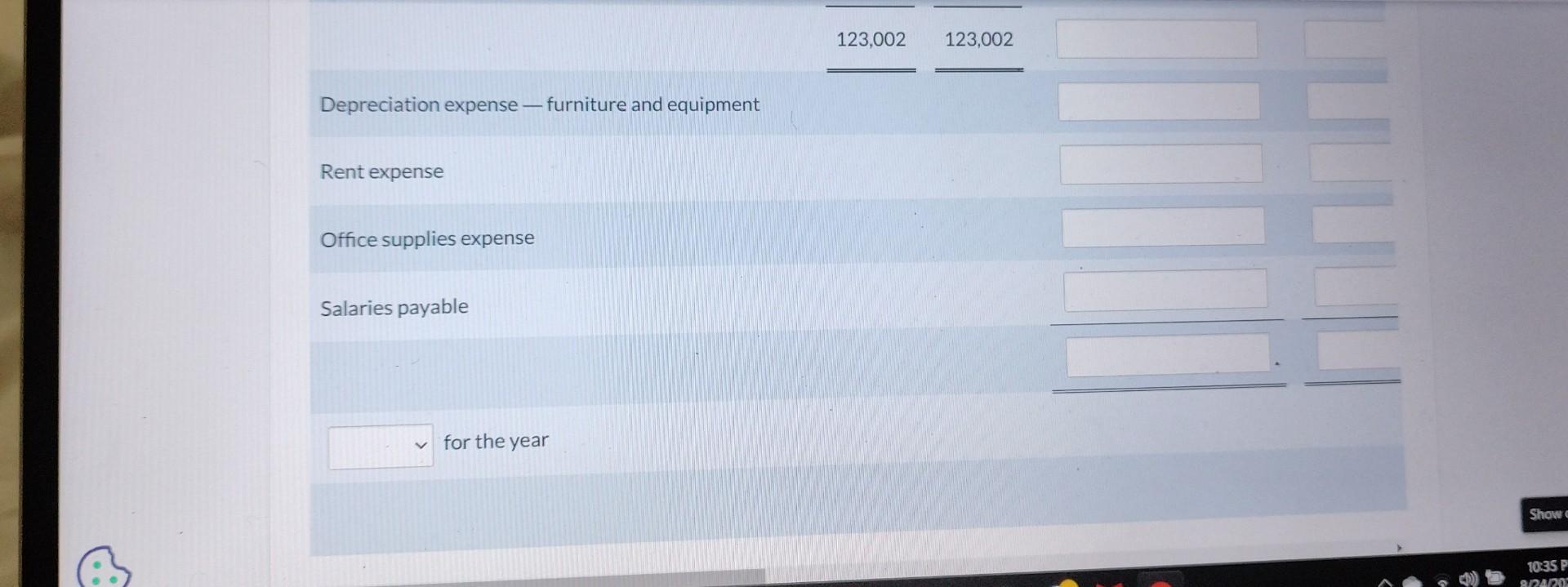

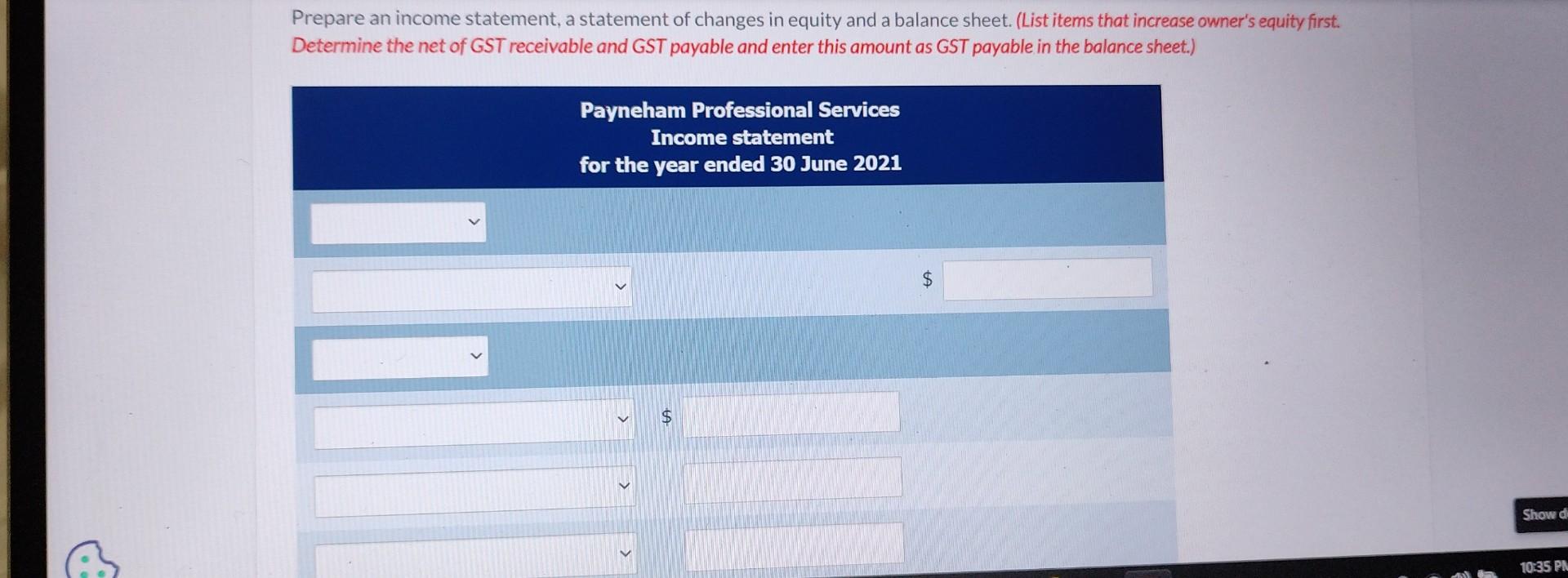

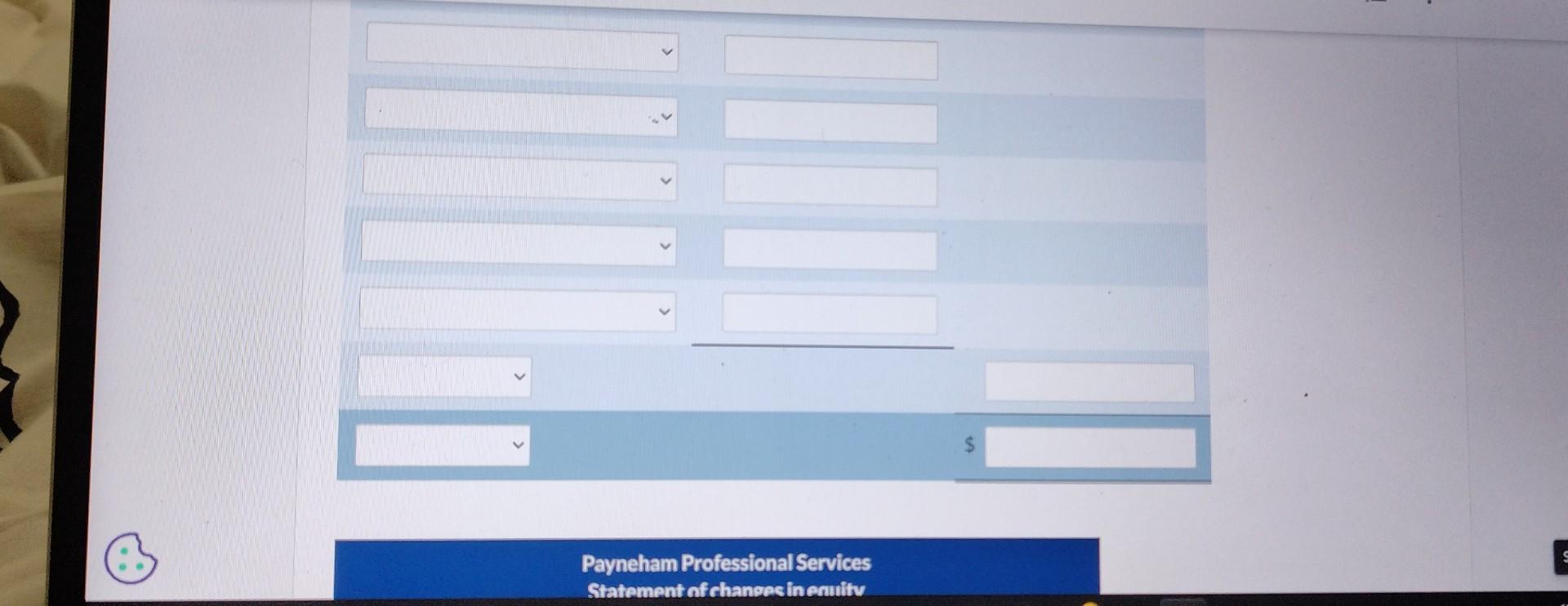

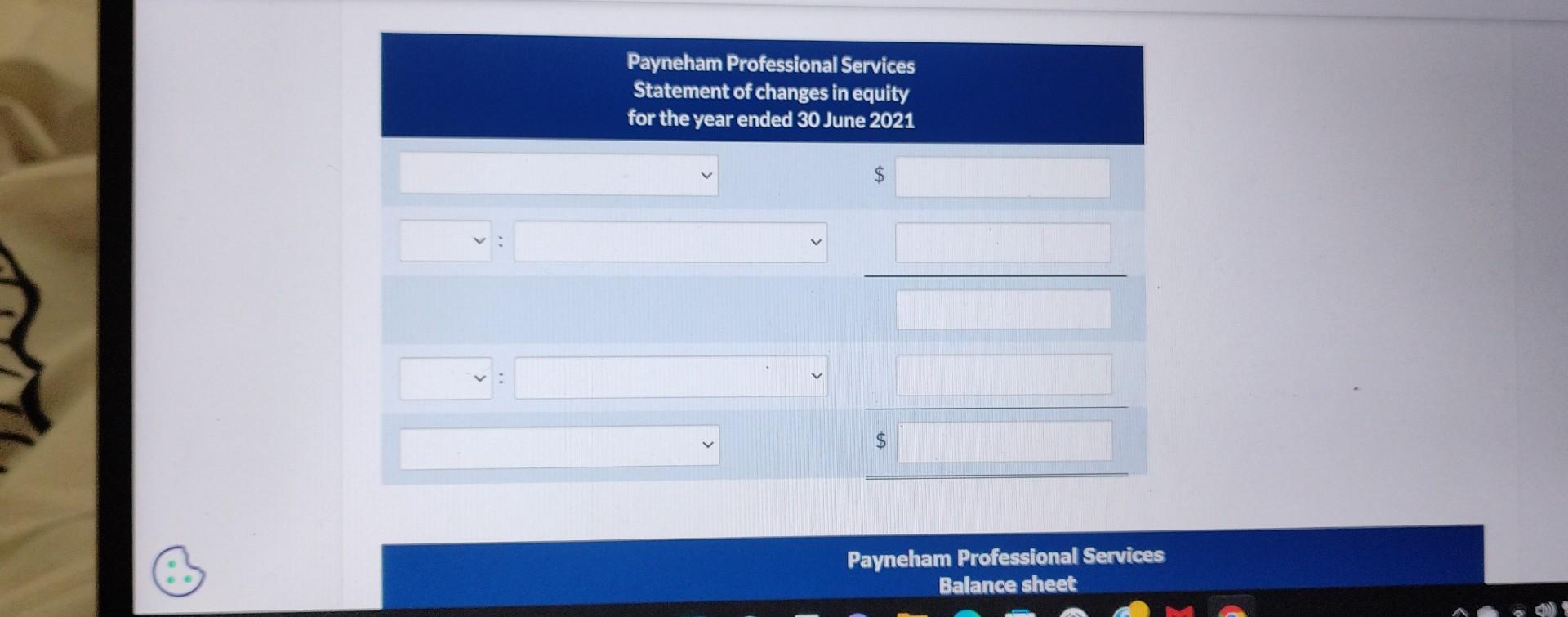

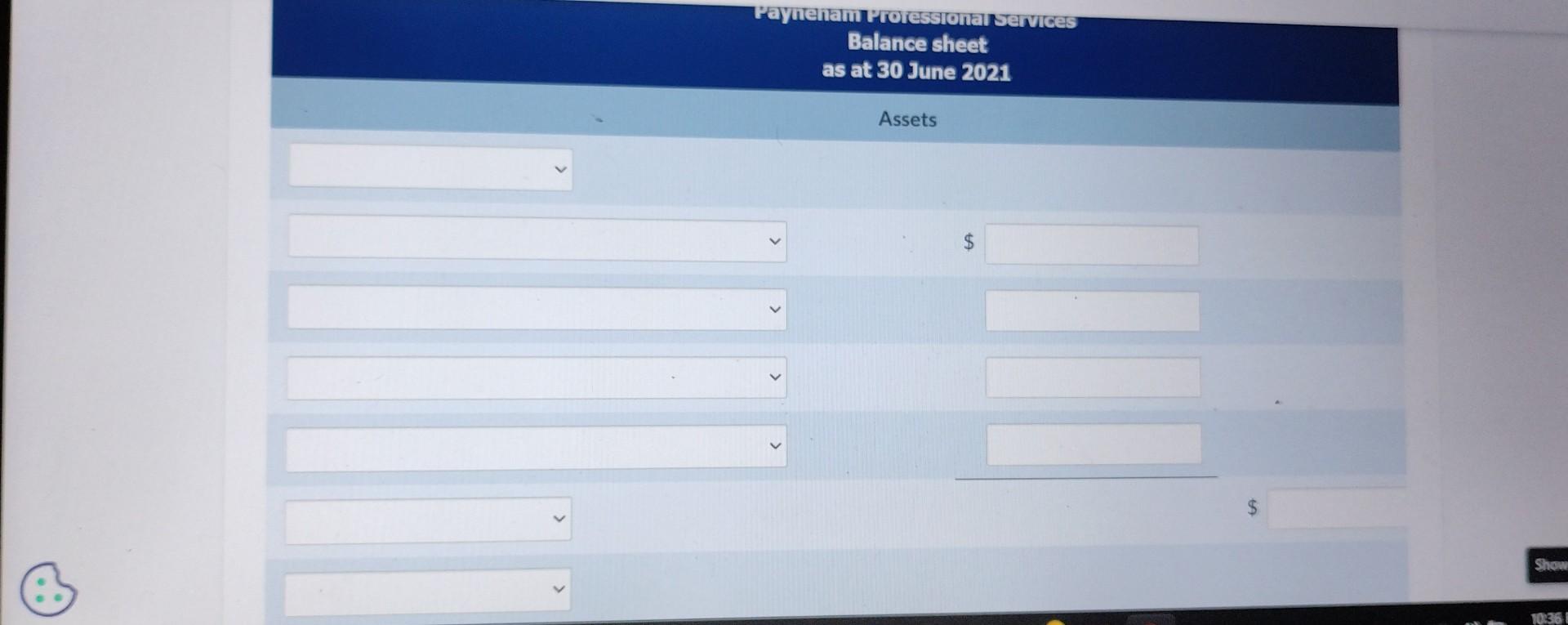

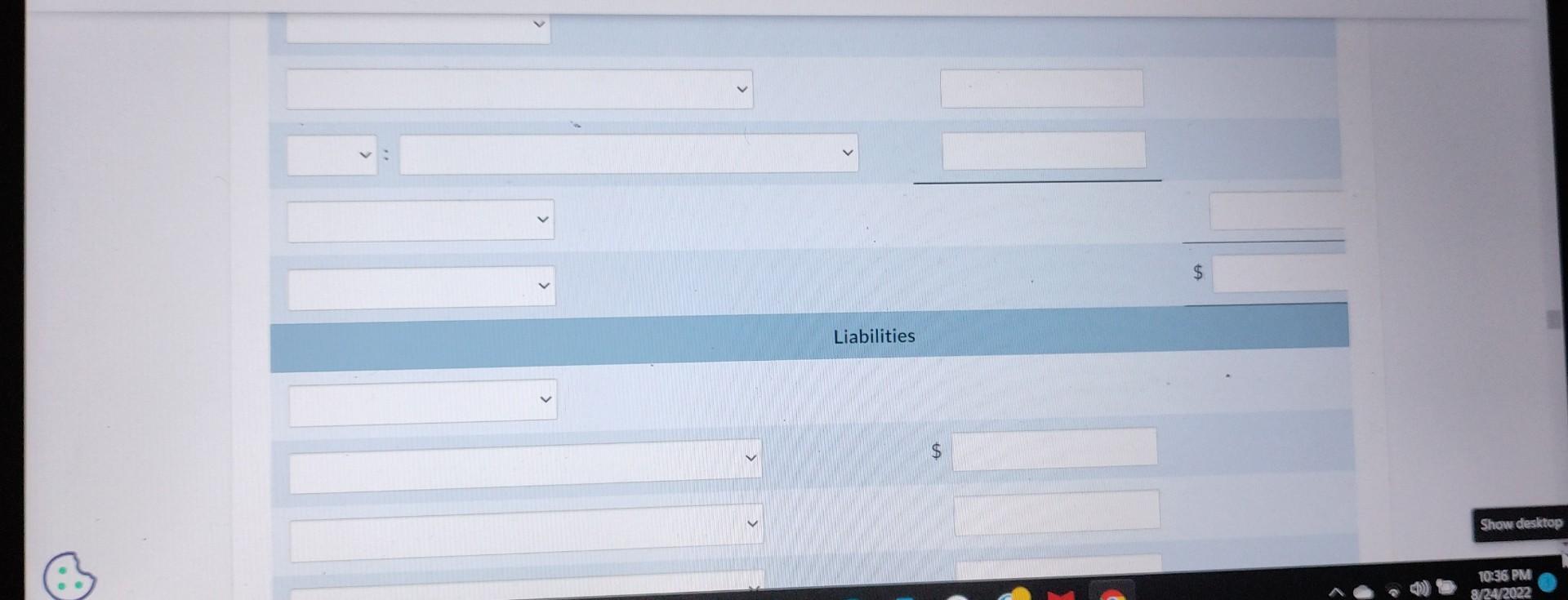

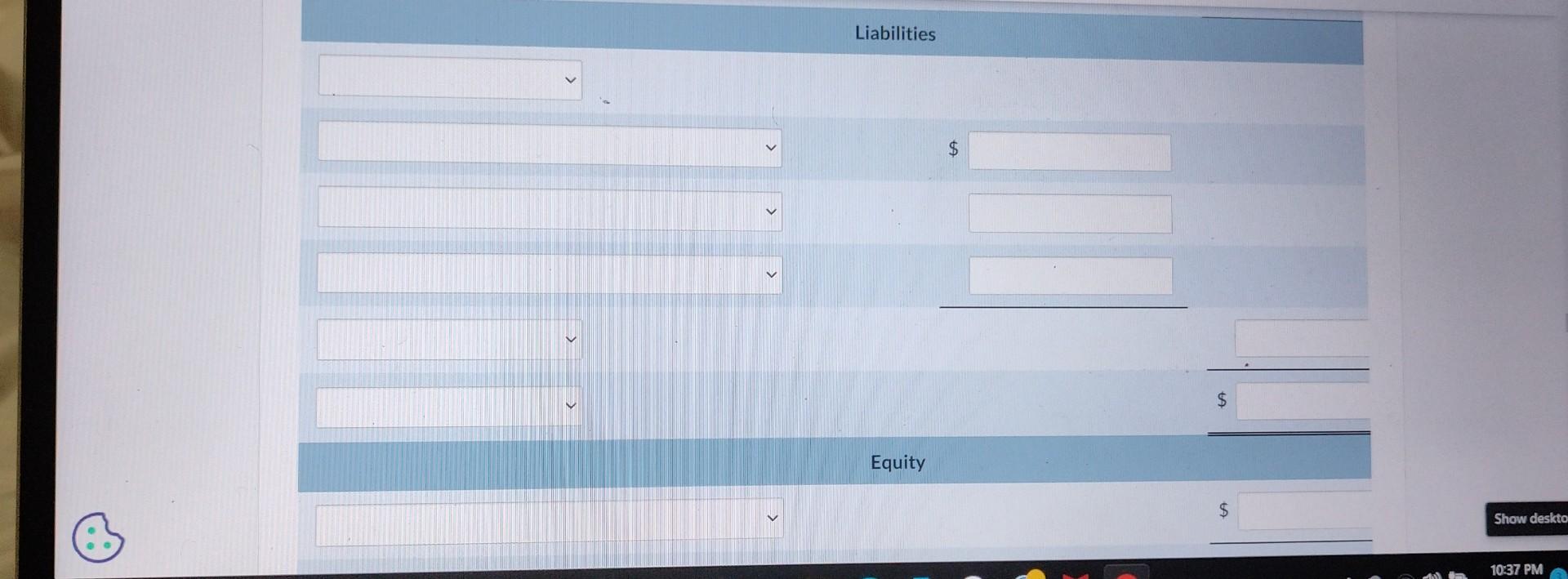

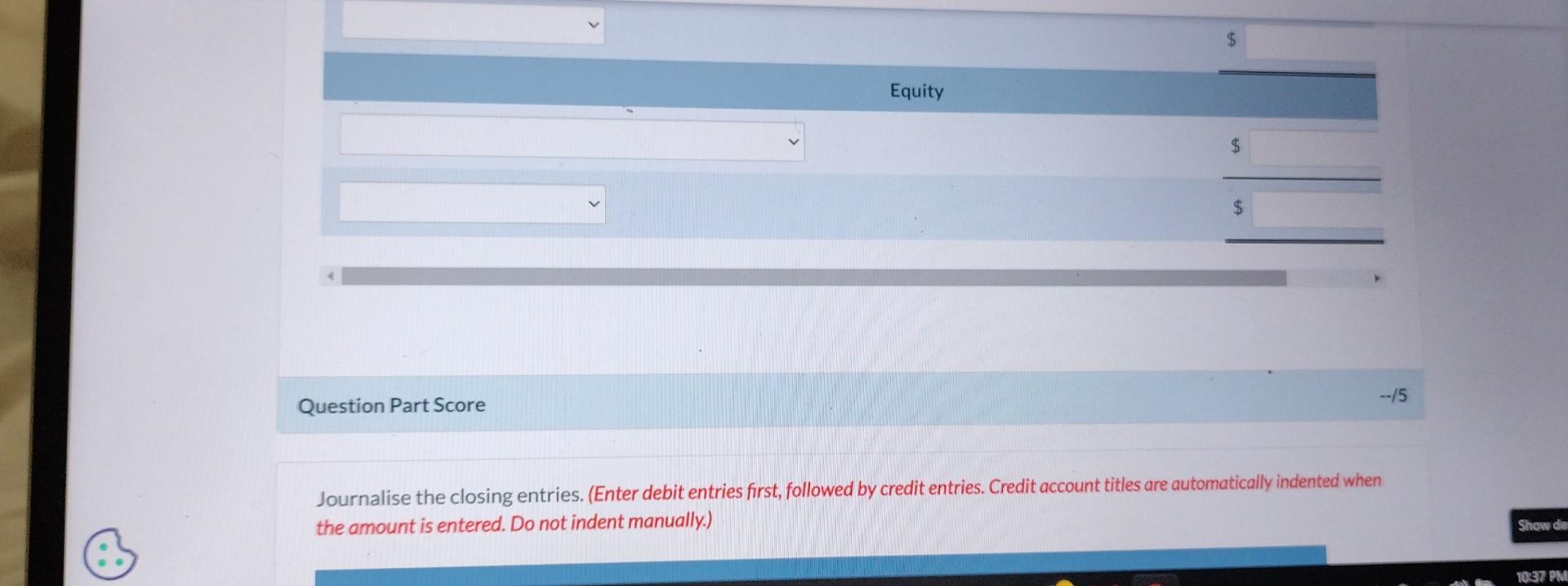

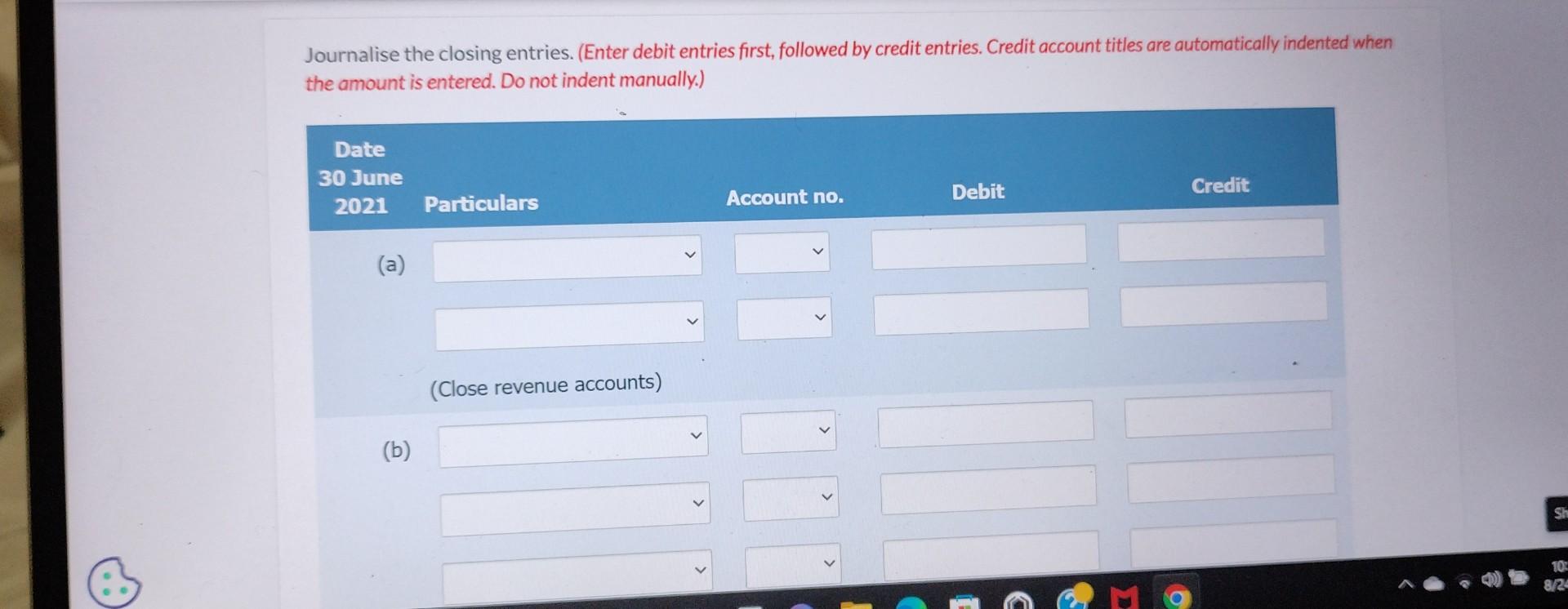

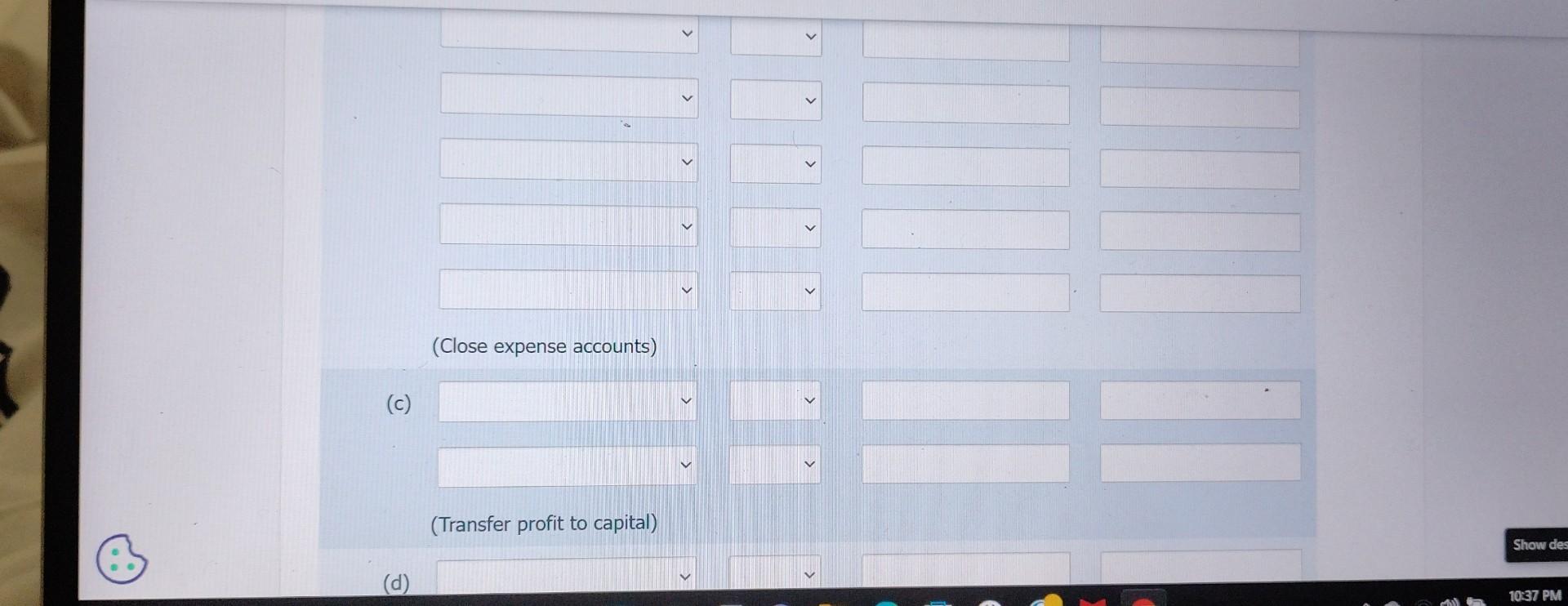

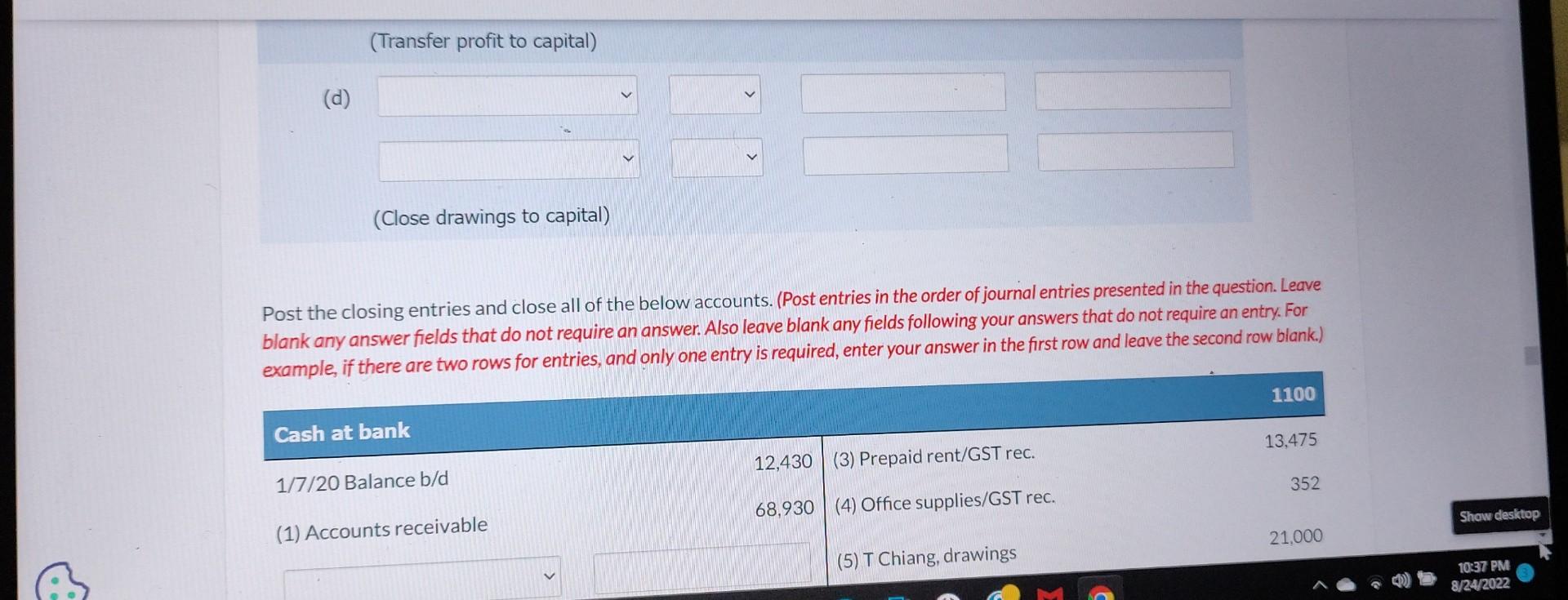

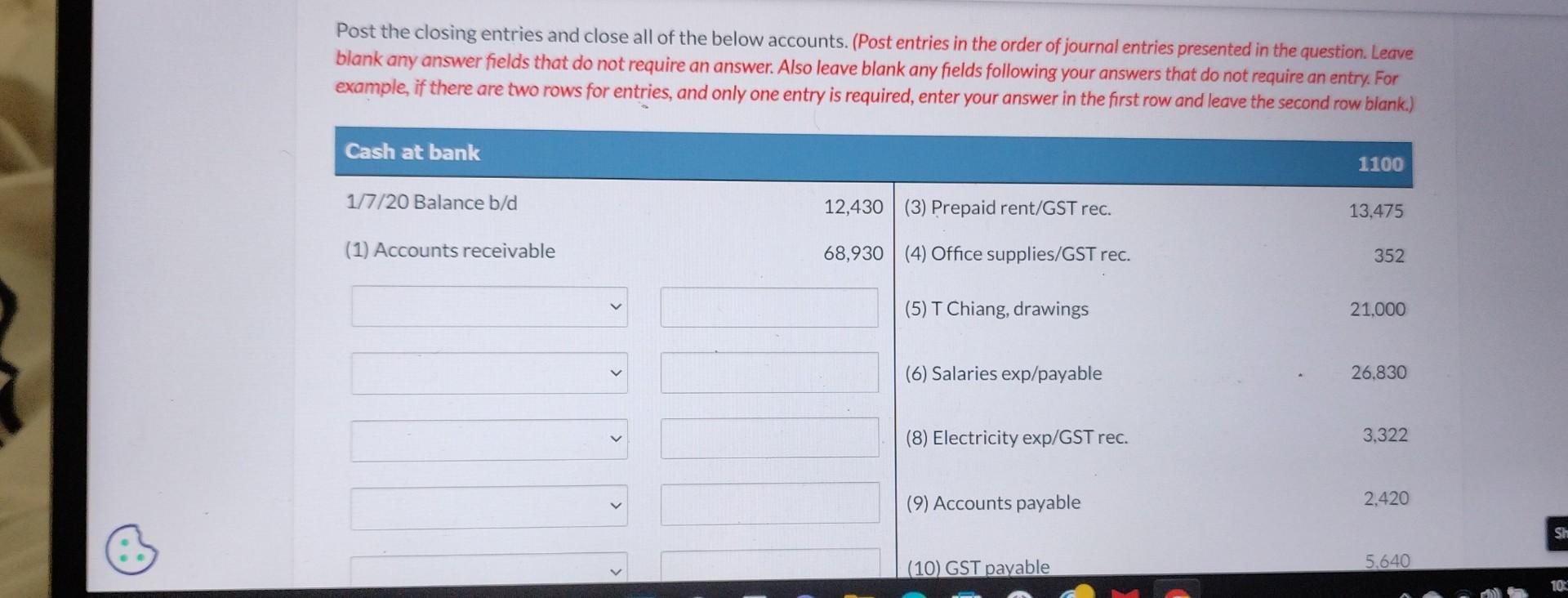

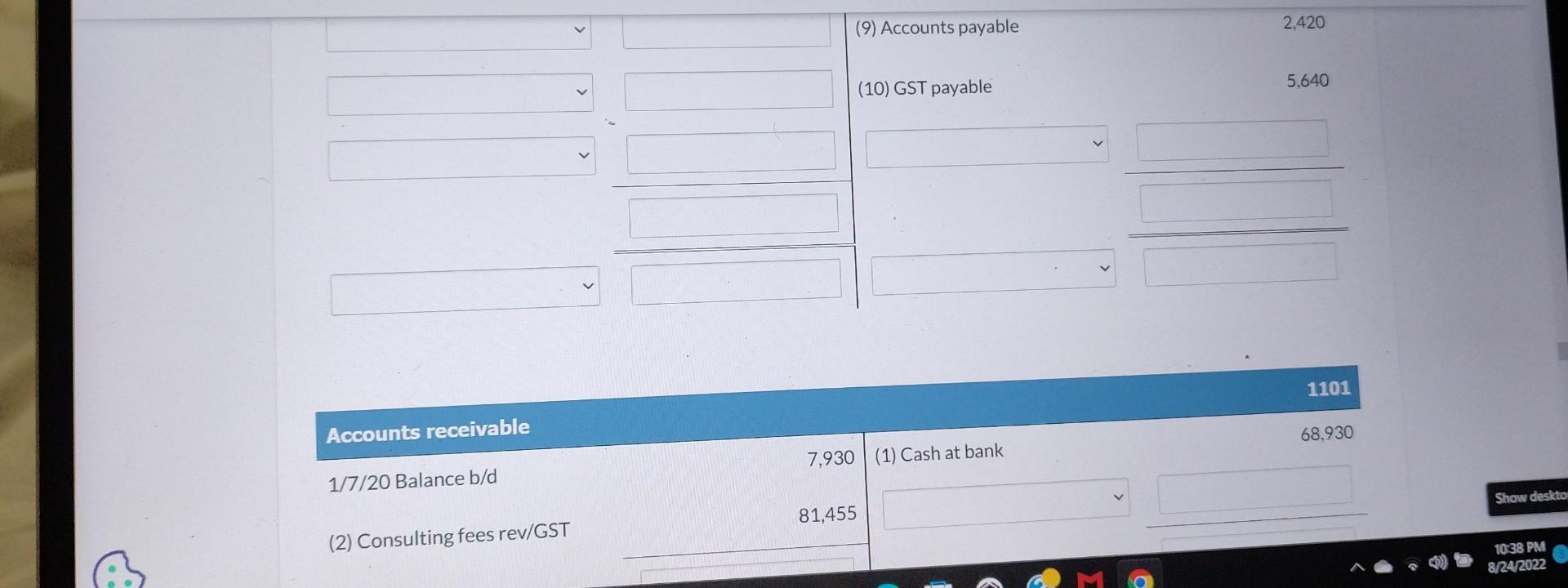

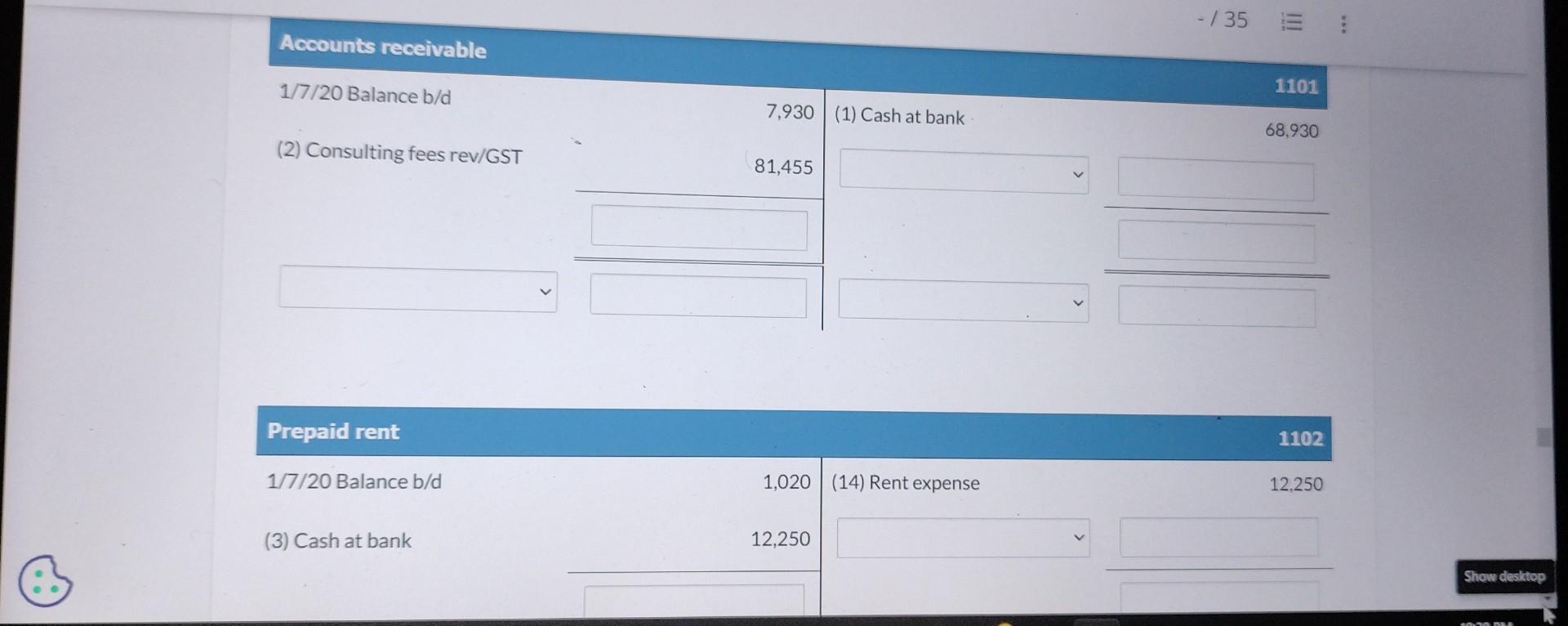

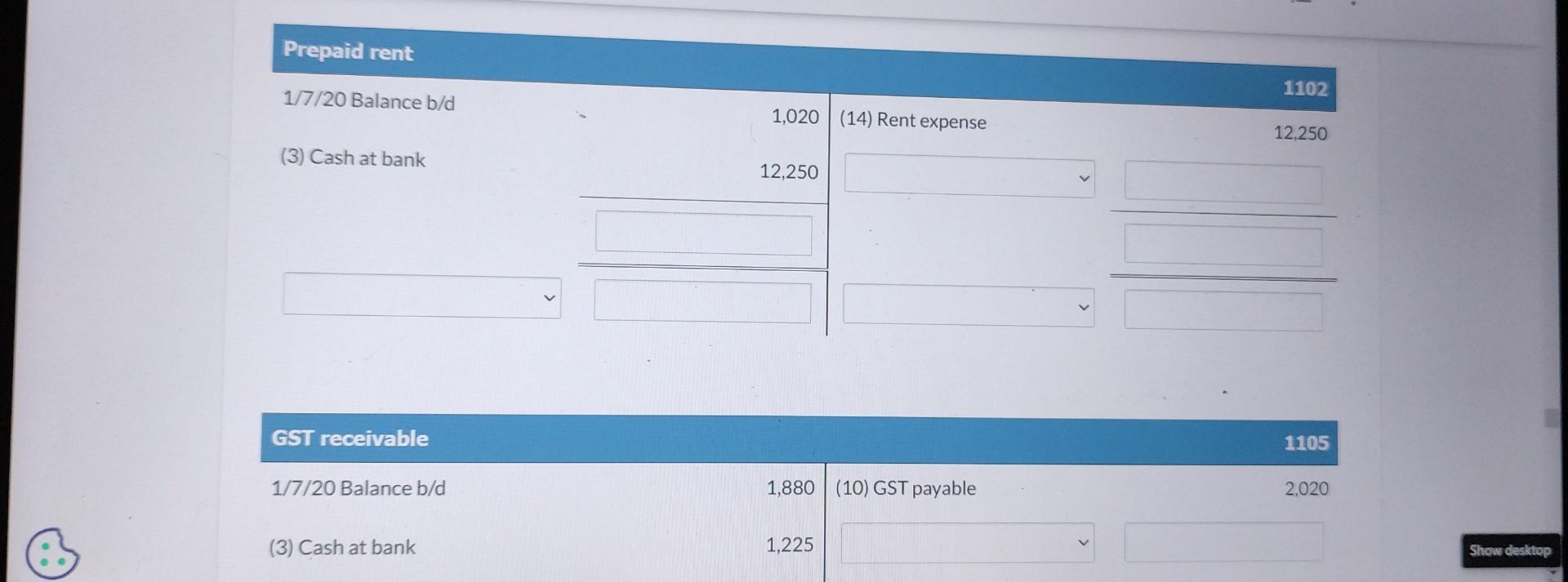

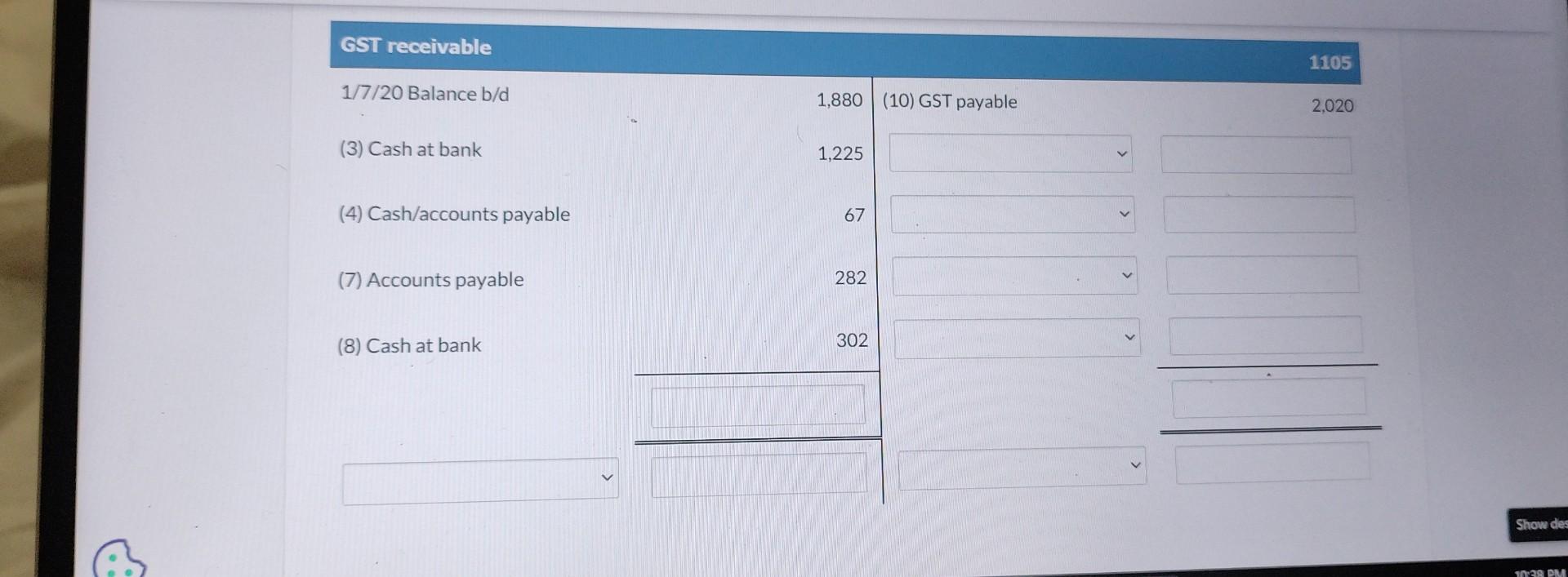

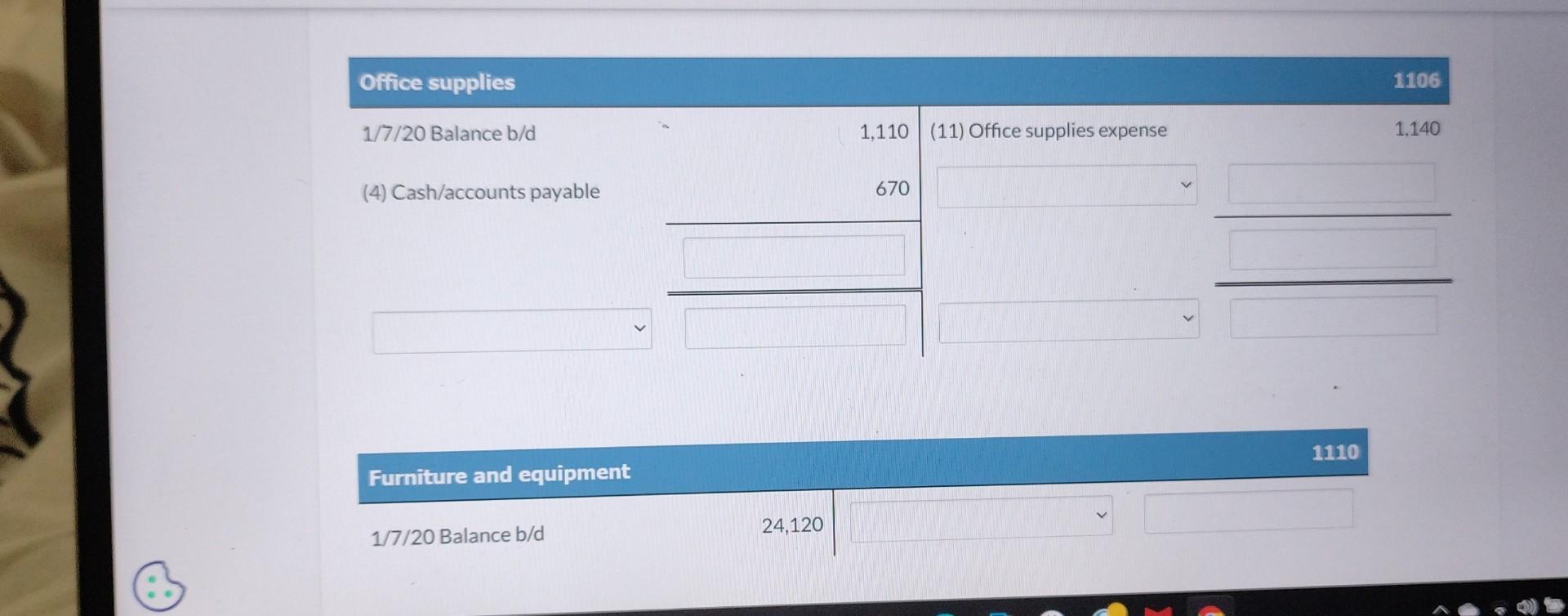

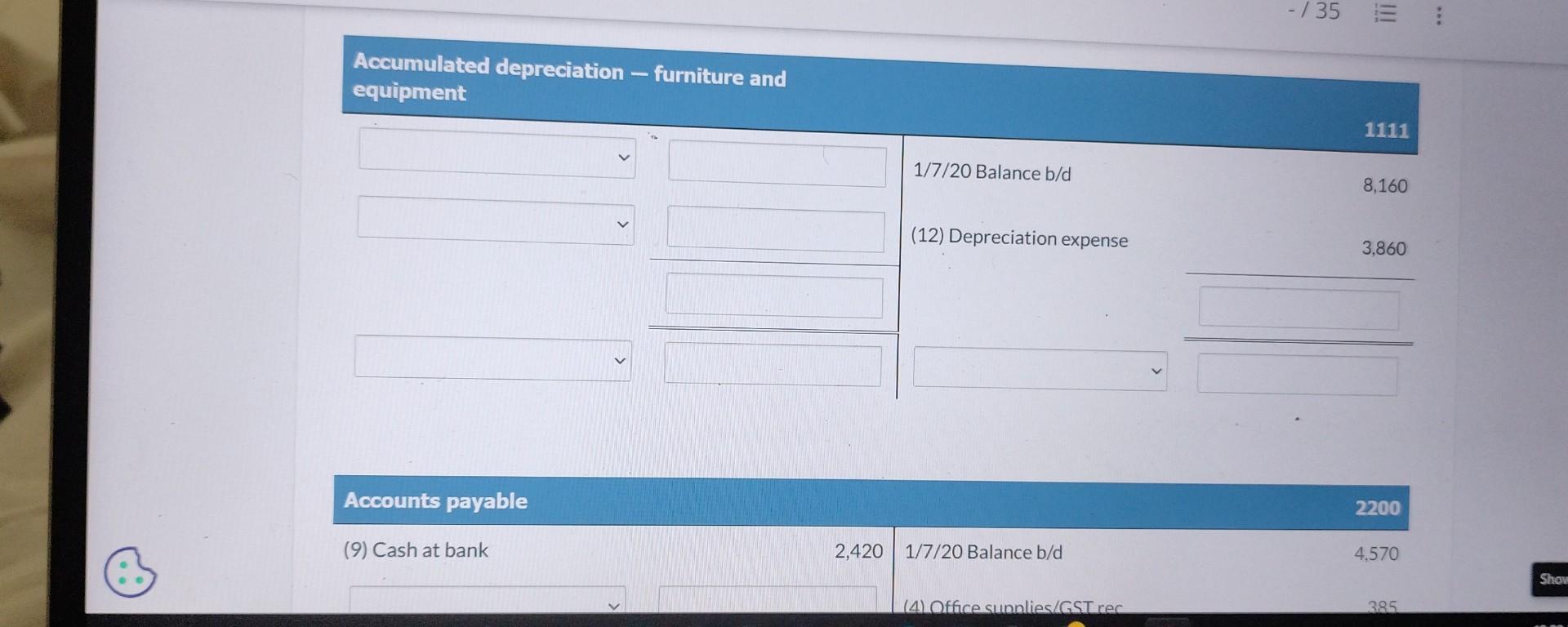

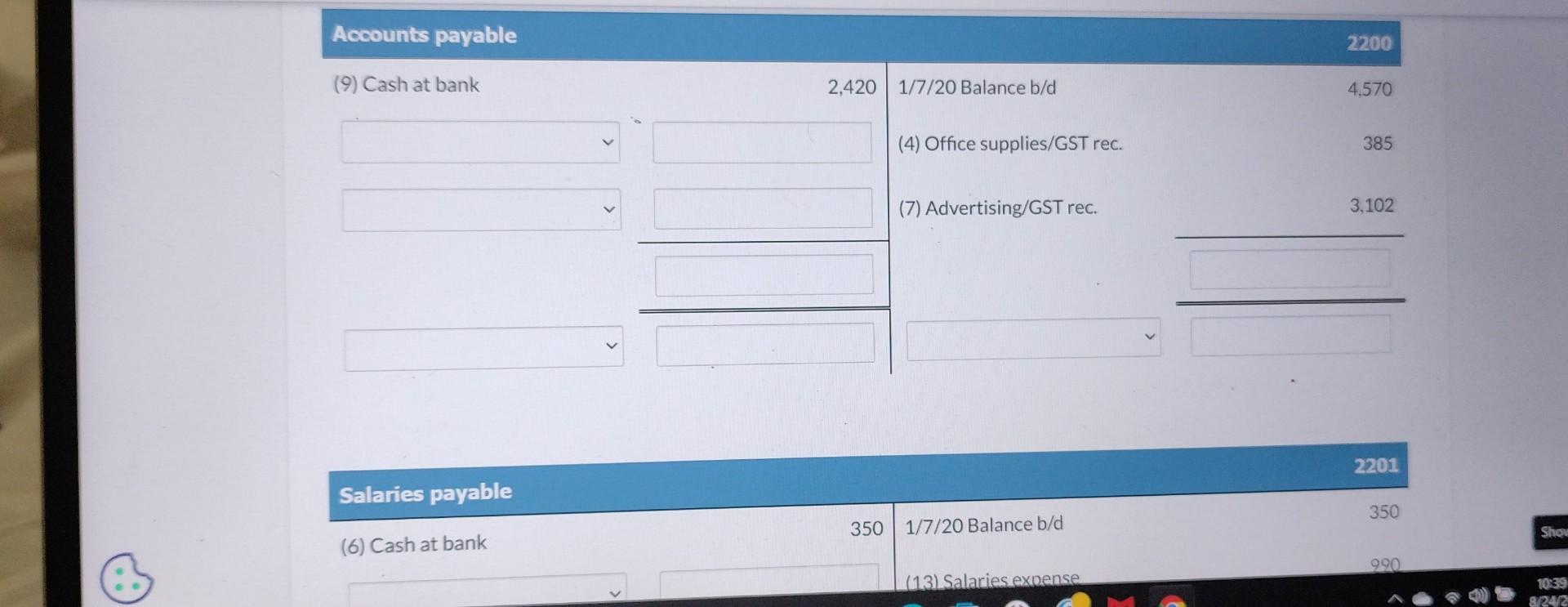

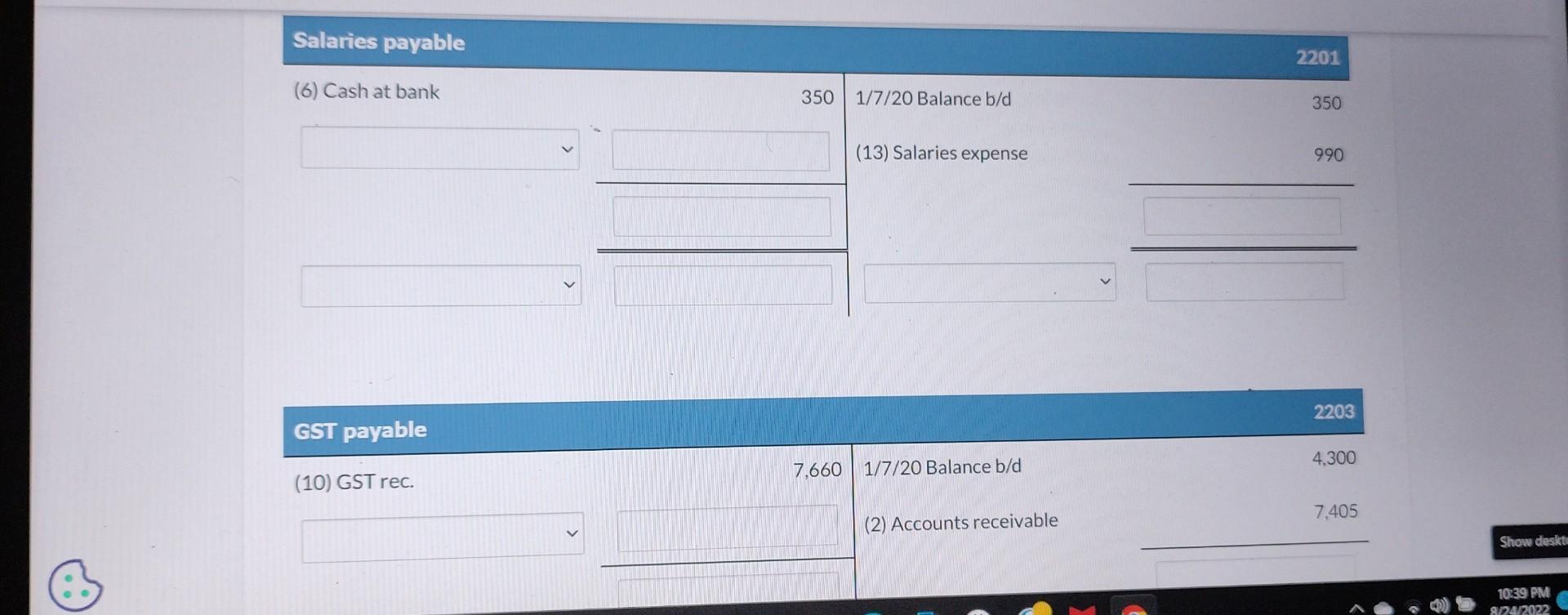

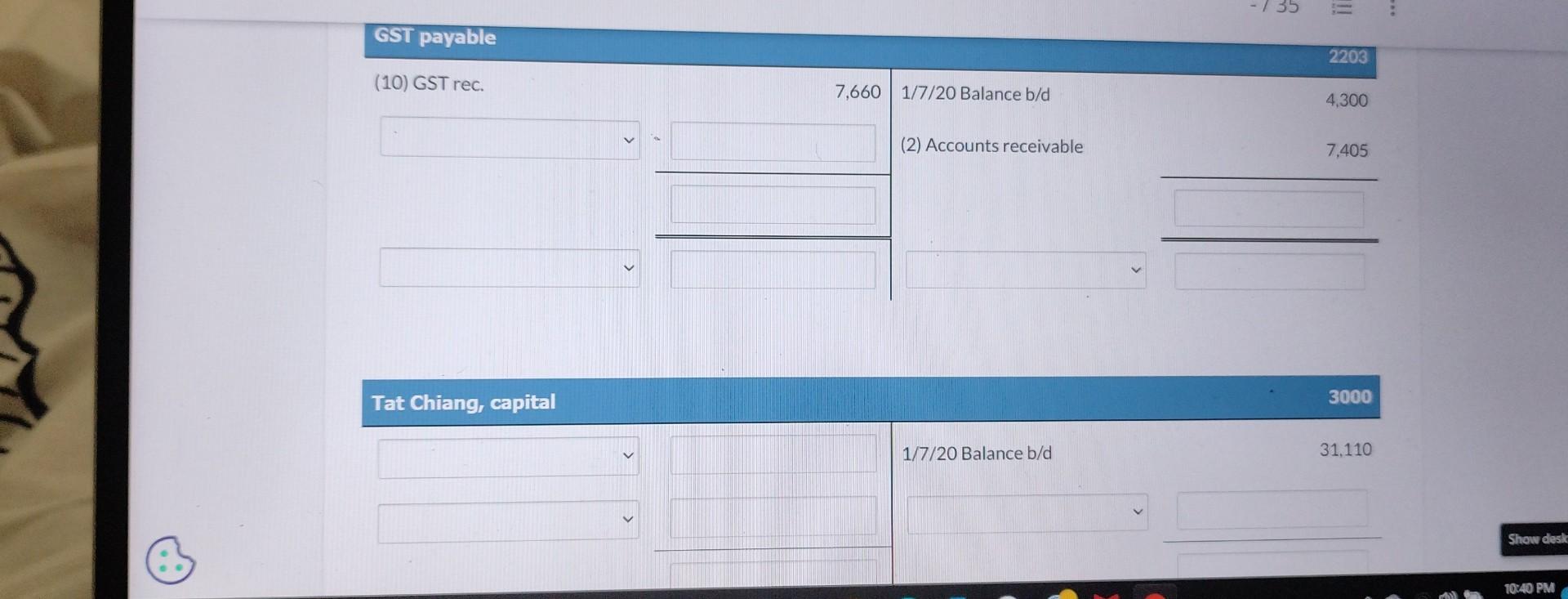

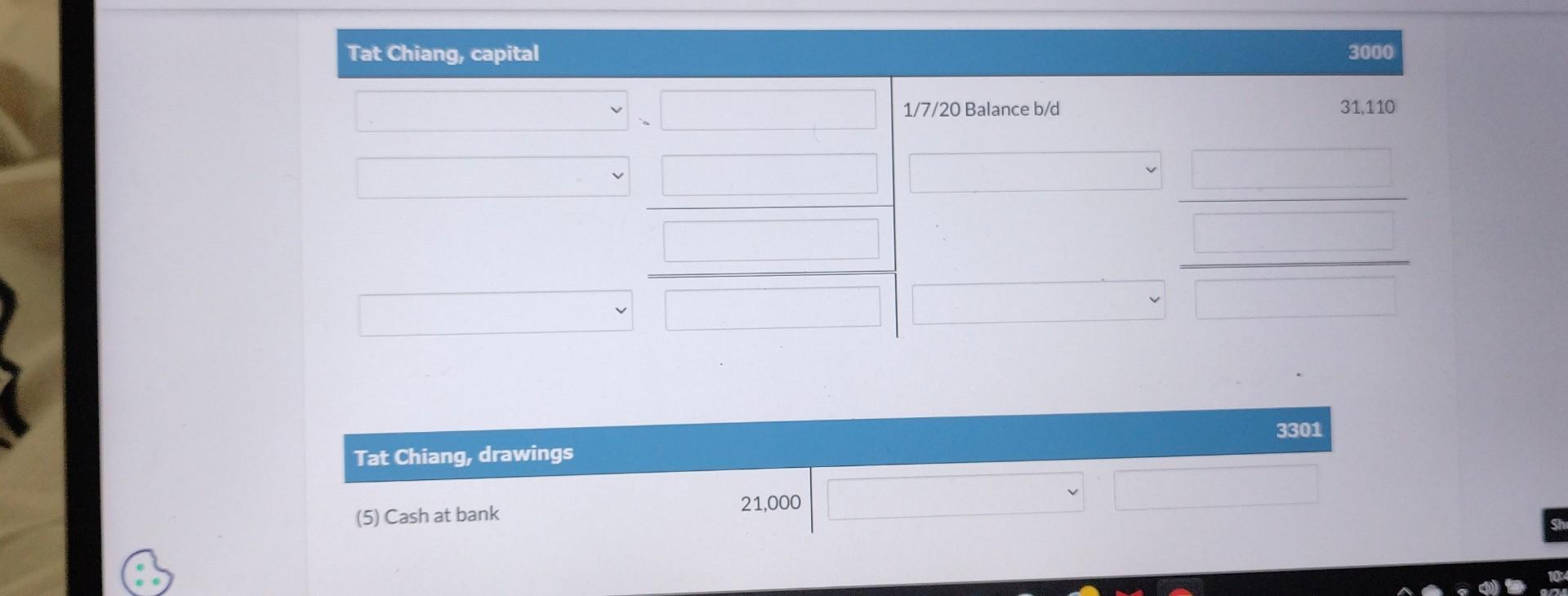

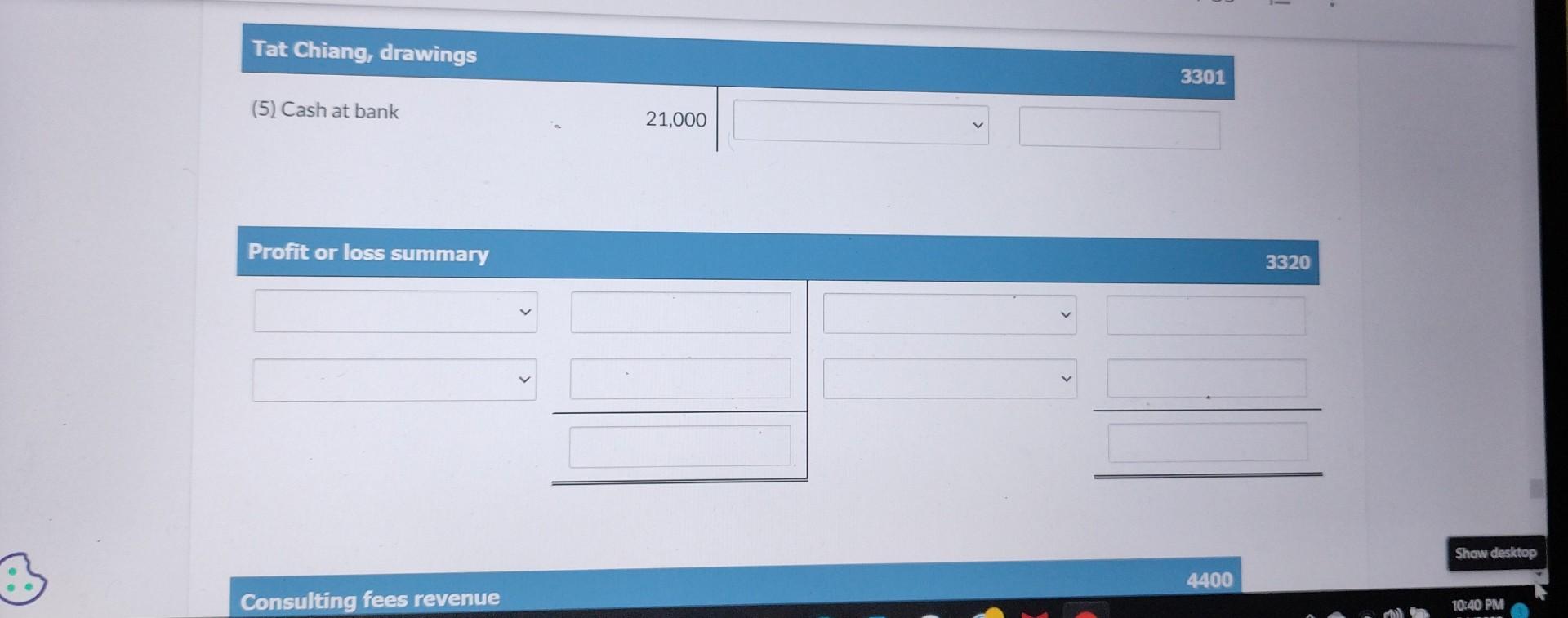

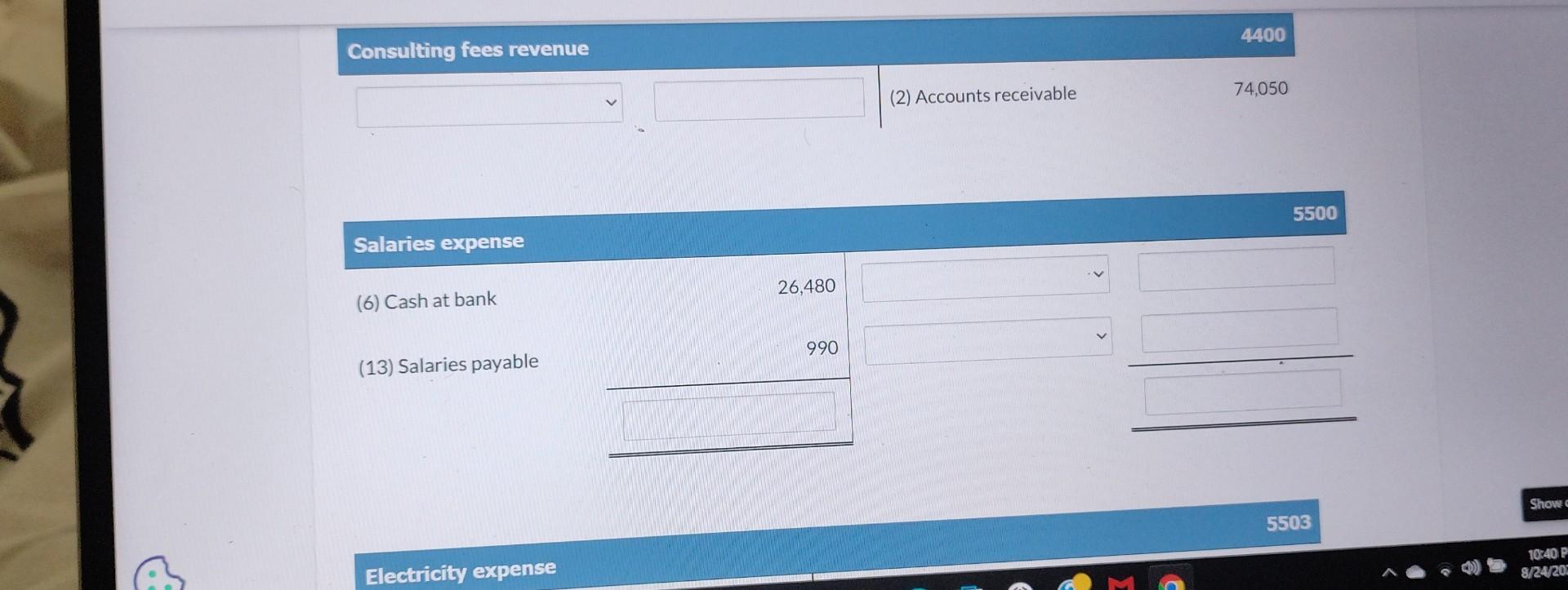

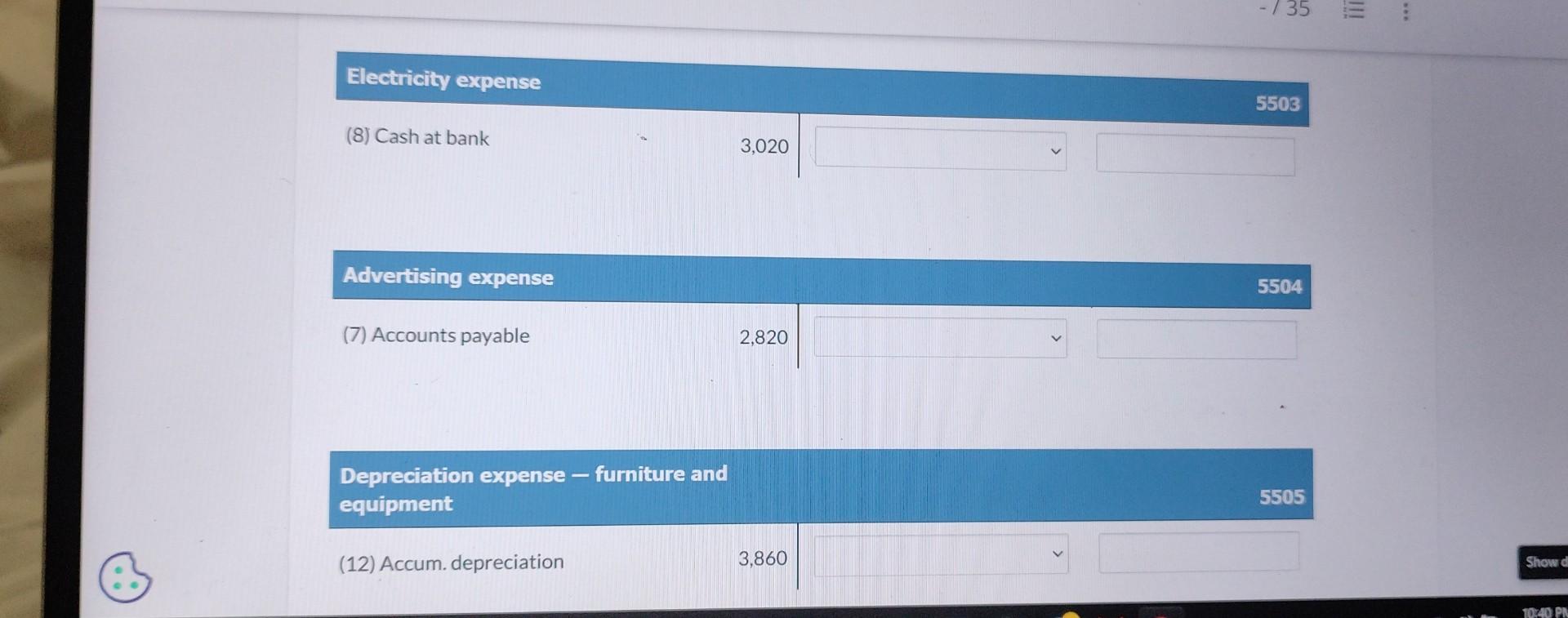

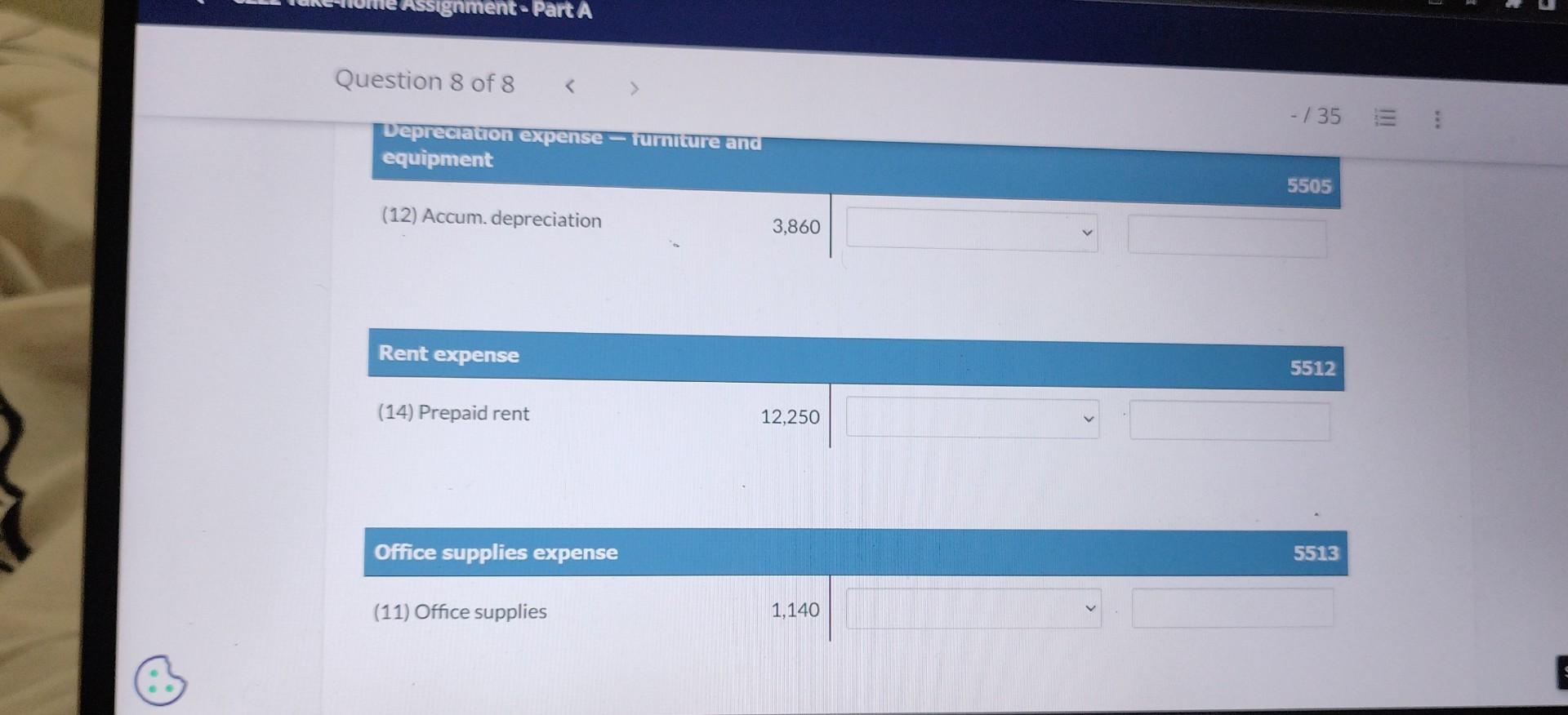

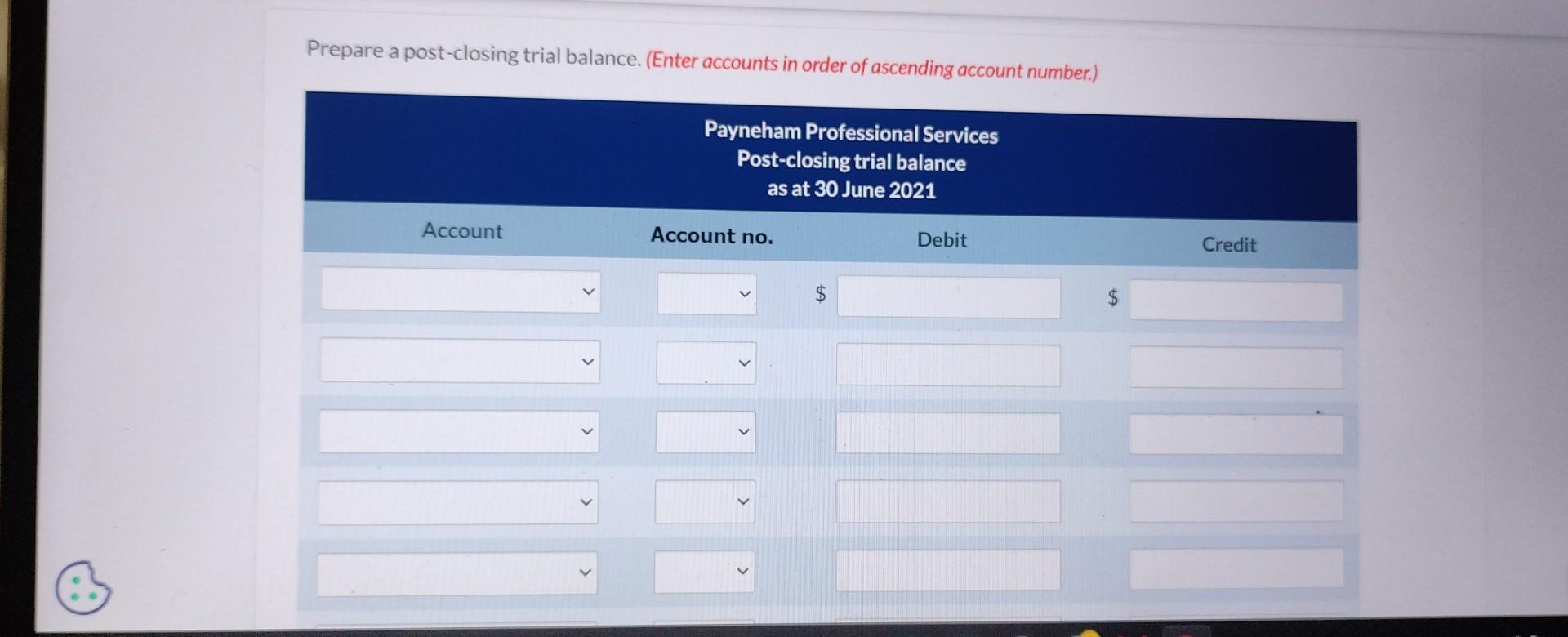

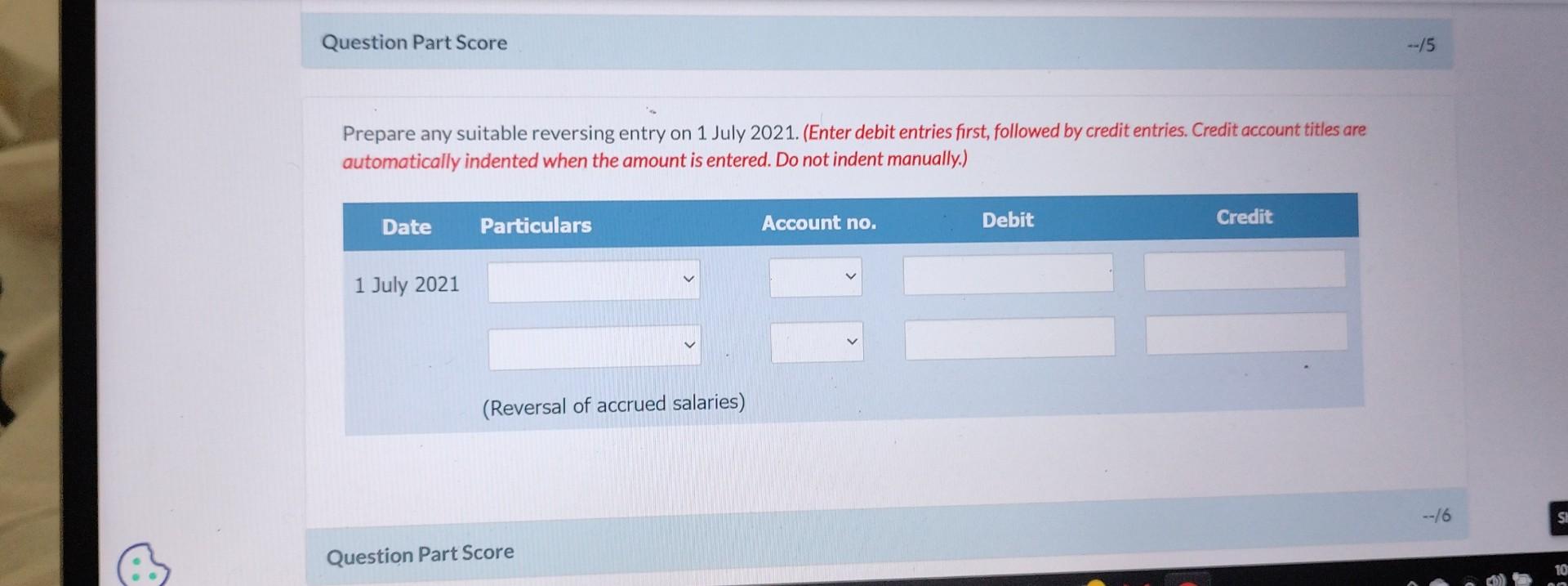

The post-closing trial balance at 30 June 2020 of Payneham Professional Services is shown below. Transactions completed during the year ended 30 June 2021 are summariced halnia. 9. Accounts payable of $2,420 were paid. 10. GST payable of $7,660 less GST receivable of $2,020 were forwarded in cash during the year to the Australian Taxation Office. The following additional information should be considered for adjusting entries: 11. Unused office supplies on hand at the end of the year totalled $640. 12. Depreciation on the furniture and equipment is $3,860. 13. Salaries earned but not paid amount to $990. 14. Rent paid in advance in transaction 3. Rent for 6 months of $6,125 plus GST was paid in advance on 1 August and 1 February. Payneham Professional Services Post-closing trial balance as at 30 June 2020 Prepare journal entries to record the transactions numbered 1-10. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Prepare the ledger of Payneham Professional Services by opening T accounts for the accounts listed in the post-closing trial balance and for the accounts listed below. Post the 30 June 2020 balances. (Leave blank any answer fields that do not require an answer.) Prepare the ledger of Payneham Professional Services by opening T accounts for the accounts listed in the post-closing trial balance and for the accounts listed below. Post the 30 June 2020 balances. (Leave blank any answer fields that do not require an answer.) = (Drawings by owner) 6. (Salaries paid) (Purchase of advertising) (Payments for electricity) 9. (Payment to creditors) 10. Post the entries to the T accounts. (Post entries in the order of journal entries presented in the previous part. Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) Accounts receivable 1/7/20 Balance b/d Prepaid rent 7,930 1102 Prepaid rent 1/7/20 Balance b/d 1,020 GST receivable 1/7/20 Balance b/d Office supplies 1/7/20 Balance b/d 1,110 Furniture and equipment 1110 1/7/20 Balance b/d 24,120 \begin{tabular}{l|l|l|} \hline Acoounts payable & 1/7/2 \\ \hline \multicolumn{1}{|c|}{} & \\ \hline \end{tabular} \( \overline{\hline \hline} \) Journalise the adjusting entries for transactions numbered 11-14. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Journalise the adjusting entries for transactions numbered 11-14. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Post the adjusting entries for transactions numbered 11-14. (Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) required, enter your answer in the nist row and leave the second row blank.) (3) Cash at bank GST receivable 12,250 Office supplies 1/7/20 Balance b/d (4) Cash/accounts payable Furniture and equi 1/7/20 Balance b/d Accumulated depreciation - furniture and equipment 1/7/20 Balance b/d \begin{tabular}{l} Accumulated depreciation - furniture and equipment \\ \hline \begin{tabular}{|l|l|} \hline & 1/7/20 Balance b/d \\ \hline \end{tabular} \end{tabular} \begin{tabular}{|c|} \hline 1111 \\ \hline 8,160 \end{tabular} \begin{tabular}{l} GST payable \\ (10) GST rec. \\ \hline \end{tabular} \begin{tabular}{|l|lc|} \hline 7,660 & 1/7/20 Balance b/d & 2203 \\ \hline & (2) Accounts receivable & 4,300 \\ & & 7,405 \\ \hline \end{tabular} Jat chitang, capical \begin{tabular}{l|l|} \hline & 1/7/20 Balance b/d \end{tabular} Salaries expense (6) Cash at bank 26,480 Advertising expense (7) Accounts payable Advertising expense (7) Accounts payable 2,820 Depreciation expense - furniture and equipment 5505 Prepare a 10-column worksheet for the year ended 30 June 2021. (Leave answer fields blank if no amount is required) Cashat bank 8,321 Accounts receivable 20,455 Prepaid rent 13,270 GST receivable 1,736 Office supplies 1,780 Furniture and equipment 24,120 Accumulated depreciation - furniture and equipment Accounts payable Prepare a 10-column worksheet for the year ended 30 June 2021. (Leave answer fields blank if no amount is required.) Depreciation expense - furniture and equipment Rent expense Office supplies expense Salaries payable for the year Prepare an income statement, a statement of changes in equity and a balance sheet. (List items that increase owner's equity first. Determine the net of GST receivable and GST payable and enter this amount as GST payable in the balance sheet.) (3) Balance sheet as at 30 June 2021 Assets $ () Journalise the closing entries. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Journalise the closing entries. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) (Close expense accounts) (c) (Transfer profit to capital) (d) Post the closing entries and close all of the below accounts. (Post entries in the order of journal entries presented in the question. Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) Post the closing entries and close all of the below accounts. (Post entries in the order of journal entries presented in the question. Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) 125 Prepaid rent 1/7/20 Balance b/d (3) Cash at bank \begin{tabular}{ll|l} \hline GST receivable & 1,880 \\ \hline 1/7/20 Balance b/d & 1,225 & \\ (3) Cash at bank & \end{tabular} GST receivable 1/7/20 Balance b/d (3) Cash at bank (4) Cash/accounts payable (7) Accounts payable (8) Cash at bank Accumulated depreciation - furniture and equipment Accounts payable (9) Cash at bank 2200 4,570 (4) Office supplies/GST rec. 385 (7) Advertising/GST rec. Salaries payable (6) Cash at bank Salaries payable (6) Cash at bank 2201 2203 4,300 Tat Chiang, capital 1/7/20 Balance b/d Tat Chiang, capital Tat Chiang, drawings Tat Chiang, drawings (5) Cash at bank 21,000 Electricity expens (8) Cash at bank 5504 Prepare a post-closing trial balance. (Enter accounts in order of ascending account number.) Prepare any suitable reversing entry on 1 July 2021 . (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) The post-closing trial balance at 30 June 2020 of Payneham Professional Services is shown below. Transactions completed during the year ended 30 June 2021 are summariced halnia. 9. Accounts payable of $2,420 were paid. 10. GST payable of $7,660 less GST receivable of $2,020 were forwarded in cash during the year to the Australian Taxation Office. The following additional information should be considered for adjusting entries: 11. Unused office supplies on hand at the end of the year totalled $640. 12. Depreciation on the furniture and equipment is $3,860. 13. Salaries earned but not paid amount to $990. 14. Rent paid in advance in transaction 3. Rent for 6 months of $6,125 plus GST was paid in advance on 1 August and 1 February. Payneham Professional Services Post-closing trial balance as at 30 June 2020 Prepare journal entries to record the transactions numbered 1-10. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Prepare the ledger of Payneham Professional Services by opening T accounts for the accounts listed in the post-closing trial balance and for the accounts listed below. Post the 30 June 2020 balances. (Leave blank any answer fields that do not require an answer.) Prepare the ledger of Payneham Professional Services by opening T accounts for the accounts listed in the post-closing trial balance and for the accounts listed below. Post the 30 June 2020 balances. (Leave blank any answer fields that do not require an answer.) = (Drawings by owner) 6. (Salaries paid) (Purchase of advertising) (Payments for electricity) 9. (Payment to creditors) 10. Post the entries to the T accounts. (Post entries in the order of journal entries presented in the previous part. Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) Accounts receivable 1/7/20 Balance b/d Prepaid rent 7,930 1102 Prepaid rent 1/7/20 Balance b/d 1,020 GST receivable 1/7/20 Balance b/d Office supplies 1/7/20 Balance b/d 1,110 Furniture and equipment 1110 1/7/20 Balance b/d 24,120 \begin{tabular}{l|l|l|} \hline Acoounts payable & 1/7/2 \\ \hline \multicolumn{1}{|c|}{} & \\ \hline \end{tabular} \( \overline{\hline \hline} \) Journalise the adjusting entries for transactions numbered 11-14. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Journalise the adjusting entries for transactions numbered 11-14. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Post the adjusting entries for transactions numbered 11-14. (Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) required, enter your answer in the nist row and leave the second row blank.) (3) Cash at bank GST receivable 12,250 Office supplies 1/7/20 Balance b/d (4) Cash/accounts payable Furniture and equi 1/7/20 Balance b/d Accumulated depreciation - furniture and equipment 1/7/20 Balance b/d \begin{tabular}{l} Accumulated depreciation - furniture and equipment \\ \hline \begin{tabular}{|l|l|} \hline & 1/7/20 Balance b/d \\ \hline \end{tabular} \end{tabular} \begin{tabular}{|c|} \hline 1111 \\ \hline 8,160 \end{tabular} \begin{tabular}{l} GST payable \\ (10) GST rec. \\ \hline \end{tabular} \begin{tabular}{|l|lc|} \hline 7,660 & 1/7/20 Balance b/d & 2203 \\ \hline & (2) Accounts receivable & 4,300 \\ & & 7,405 \\ \hline \end{tabular} Jat chitang, capical \begin{tabular}{l|l|} \hline & 1/7/20 Balance b/d \end{tabular} Salaries expense (6) Cash at bank 26,480 Advertising expense (7) Accounts payable Advertising expense (7) Accounts payable 2,820 Depreciation expense - furniture and equipment 5505 Prepare a 10-column worksheet for the year ended 30 June 2021. (Leave answer fields blank if no amount is required) Cashat bank 8,321 Accounts receivable 20,455 Prepaid rent 13,270 GST receivable 1,736 Office supplies 1,780 Furniture and equipment 24,120 Accumulated depreciation - furniture and equipment Accounts payable Prepare a 10-column worksheet for the year ended 30 June 2021. (Leave answer fields blank if no amount is required.) Depreciation expense - furniture and equipment Rent expense Office supplies expense Salaries payable for the year Prepare an income statement, a statement of changes in equity and a balance sheet. (List items that increase owner's equity first. Determine the net of GST receivable and GST payable and enter this amount as GST payable in the balance sheet.) (3) Balance sheet as at 30 June 2021 Assets $ () Journalise the closing entries. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Journalise the closing entries. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) (Close expense accounts) (c) (Transfer profit to capital) (d) Post the closing entries and close all of the below accounts. (Post entries in the order of journal entries presented in the question. Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) Post the closing entries and close all of the below accounts. (Post entries in the order of journal entries presented in the question. Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) 125 Prepaid rent 1/7/20 Balance b/d (3) Cash at bank \begin{tabular}{ll|l} \hline GST receivable & 1,880 \\ \hline 1/7/20 Balance b/d & 1,225 & \\ (3) Cash at bank & \end{tabular} GST receivable 1/7/20 Balance b/d (3) Cash at bank (4) Cash/accounts payable (7) Accounts payable (8) Cash at bank Accumulated depreciation - furniture and equipment Accounts payable (9) Cash at bank 2200 4,570 (4) Office supplies/GST rec. 385 (7) Advertising/GST rec. Salaries payable (6) Cash at bank Salaries payable (6) Cash at bank 2201 2203 4,300 Tat Chiang, capital 1/7/20 Balance b/d Tat Chiang, capital Tat Chiang, drawings Tat Chiang, drawings (5) Cash at bank 21,000 Electricity expens (8) Cash at bank 5504 Prepare a post-closing trial balance. (Enter accounts in order of ascending account number.) Prepare any suitable reversing entry on 1 July 2021 . (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts