Question: I know its a time consuming projest, but please help me, ill rate you all A+ 1. Weltin Industrial Gas Corporation supplies acetylene and other

I know its a time consuming projest, but please help me, ill rate you all A+ 1. Weltin Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow: Sales are budgeted at $390,000 for November, $370,000 for December, and $380,000 for January. Collections are expected to be 90% in the month of sale, 5% in the month following the sale, and 5% uncollectible. The cost of goods sold is 60% of sales. The company purchases 70% of its merchandise in the month prior to the month of sale and 30% in the month of sale. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $21,800. Monthly depreciation is $18,000. Ignore taxes.  Required: a. Prepare a Schedule of Expected Cash Collections for November and December. b. Prepare a Merchandise Purchases Budget for November and December. c. Prepare Cash Budgets for November and December. d. Prepare Budgeted Income Statements for November and December. e. Prepare a Budgeted Balance Sheet for the end of December.

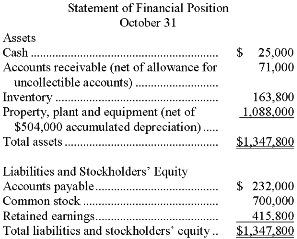

Required: a. Prepare a Schedule of Expected Cash Collections for November and December. b. Prepare a Merchandise Purchases Budget for November and December. c. Prepare Cash Budgets for November and December. d. Prepare Budgeted Income Statements for November and December. e. Prepare a Budgeted Balance Sheet for the end of December.

I know its a time consuming projest, but please help me, ill rate you all A+ 1. Weltin Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow: Sales are budgeted at $390,000 for November, $370,000 for December, and $380,000 for January. Collections are expected to be 90% in the month of sale, 5% in the month following the sale, and 5% uncollectible. The cost of goods sold is 60% of sales. The company purchases 70% of its merchandise in the month prior to the month of sale and 30% in the month of sale. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $21,800. Monthly depreciation is $18,000. Ignore taxes.Required: a. Prepare a Schedule of Expected Cash Collections for November and December. b. Prepare a Merchandise Purchases Budget for November and December. c. Prepare Cash Budgets for November and December. d. Prepare Budgeted Income Statements for November and December. e. Prepare a Budgeted Balance Sheet for the end of December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts