Question: I know my first two entries are correct. I nees help woth 12/31/x2 and then the rest of the entries until 12/28/x3 Thank you! I

I know my first two entries are correct. I nees help woth 12/31/x2 and then the rest of the entries until 12/28/x3 Thank you! I need 12/31/x2 journal and for 12/28/x3.

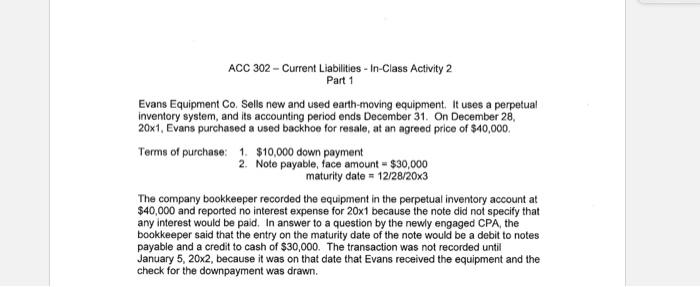

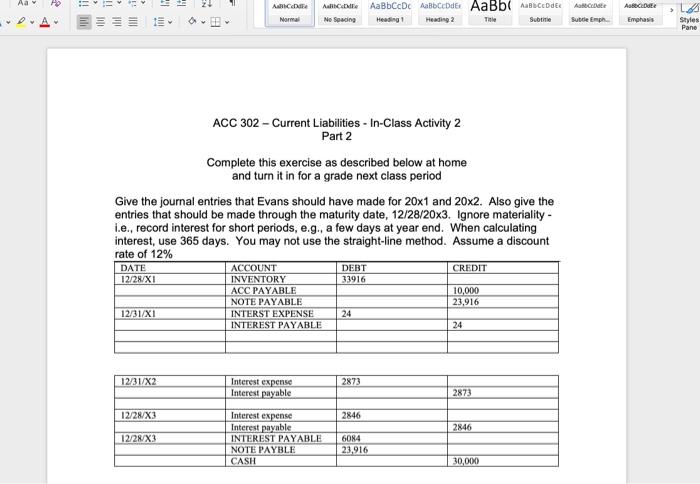

ACC 302 - Current Liabilities - In-Class Activity 2 Part 1 Evans Equipment Co. Sells new and used earth-moving equipment. It uses a perpetual inventory system, and its accounting period ends December 31. On December 28, 20x1, Evans purchased a used backhoe for resale, at an agreed price of $40,000 Terms of purchase: 1 $10,000 down payment 2. Note payable, face amount = $30,000 maturity date = 12/28/20x3 The company bookkeeper recorded the equipment in the perpetual inventory account at $40,000 and reported no interest expense for 20x1 because the note did not specify that any interest would be paid. In answer to a question by the newly engaged CPA, the bookkeeper said that the entry on the maturity date of the note would be a debit to notes payable and a credit to cash of $30,000. The transaction was not recorded until January 5, 20x2, because it was on that date that Evans received the equipment and the check for the downpayment was drawn. Aa ABCDE ABC AaBbCcDc AaBb DdEx AaBb ABCDE No Spacing Heading Heading Title Subtitle Aalbot Submp ABOUT Emphasis IE y Normal Styles Pane ACC 302 - Current Liabilities - In-Class Activity 2 Part 2 Complete this exercise as described below at home and turn it in for a grade next class period Give the journal entries that Evans should have made for 20x1 and 20x2. Also give the entries that should be made through the maturity date, 12/28/20x3. Ignore materiality - i.e., record interest for short periods, e.g., a few days at year end. When calculating interest, use 365 days. You may not use the straight-line method. Assume a discount rate of 12% DATE ACCOUNT 12/28/X1 INVENTORY ACC PAYABLE 10,000 NOTE PAYABLE 23,916 12/31/X1 INTERST EXPENSE INTEREST PAYABLE CREDIT DEBT 33916 24 24 1231/X2 2873 Interest expense Interest payable 2873 12/28/X3 2846 2846 12/28/X3 Interest expense Interest payable INTEREST PAYABLE NOTE PAYBLE CASH 6084 23,916 30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts