Question: i know that the answer is $255,369,000 put I do not know how to get it from the calcalculator, can someone explain to me how

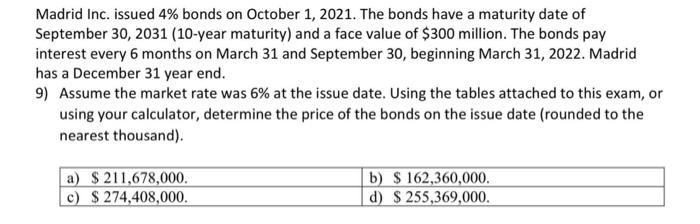

Madrid Inc. issued 4% bonds on October 1,2021 . The bonds have a maturity date of September 30, 2031 (10-year maturity) and a face value of $300 million. The bonds pay interest every 6 months on March 31 and September 30, beginning March 31, 2022. Madrid has a December 31 year end. 9) Assume the market rate was 6% at the issue date. Using the tables attached to this exam, or using your calculator, determine the price of the bonds on the issue date (rounded to the nearest thousand). Madrid Inc. issued 4% bonds on October 1,2021 . The bonds have a maturity date of September 30, 2031 (10-year maturity) and a face value of $300 million. The bonds pay interest every 6 months on March 31 and September 30, beginning March 31, 2022. Madrid has a December 31 year end. 9) Assume the market rate was 6% at the issue date. Using the tables attached to this exam, or using your calculator, determine the price of the bonds on the issue date (rounded to the nearest thousand)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts