Question: I know that the answer to 48 is A while 49 is B but could someone explain why money is leaving retained earnings in 48

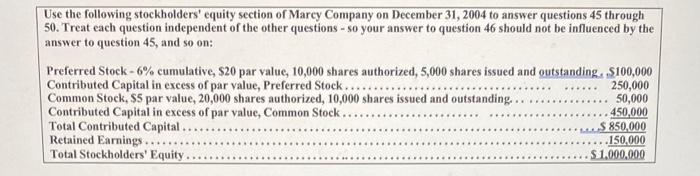

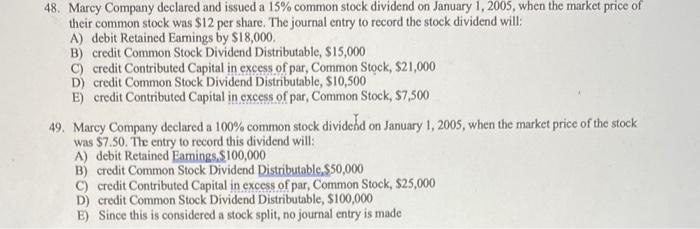

Use the following stockholders' equity section of Marcy Company on December 31, 2004 to answer questions 45 through 50. Treat each question independent of the other questions - so your answer to question 46 should not be influenced by the answer to question 45 , and so on: Preferred Stock - 6% cumulative, $20 par value, 10,000 shares authorized, 5,000 shares issued and outstanding. $100,000 Common Stock, $5 par value, 20,000 shares authorized, 10,000 shares issued and outstanding. .50,000 Contributed Capital in excess of par value, Common Stock . Total Contributed Capital . Retained Earnings ....... Total Stockholders' Equity . 48. Marcy Company declared and issued a 15% common stock dividend on January 1,2005 , when the market price of their common stock was $12 per share. The journal entry to record the stock dividend will: A) debit Retained Eamings by $18,000. B) credit Common Stock Dividend Distributable, $15,000 C) credit Contributed Capital in excess of par, Common Stock, $21,000 D) credit Common Stock Dividend Distributable, $10,500 E) credit Contributed Capital in excess of par, Common Stock, \$7,500 49. Marcy Company declared a 100% common stock dividend on January 1, 2005, when the market price of the stock was $7.50. The entry to record this dividend will: A) debit Retained Eamings, $100,000 B) credit Common Stock Dividend Distributable, 550,000 C) credit Contributed Capital in excess of par, Common Stock, $25,000 D) credit Common Stock Dividend Distributable, $100,000 E) Since this is considered a stock split, no journal entry is made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts