Question: I know that the correct answer for the first is the letter D and for the second is the letter B, but I need the

I know that the correct answer for the first is the letter D and for the second is the letter B, but I need the work for both exercises.

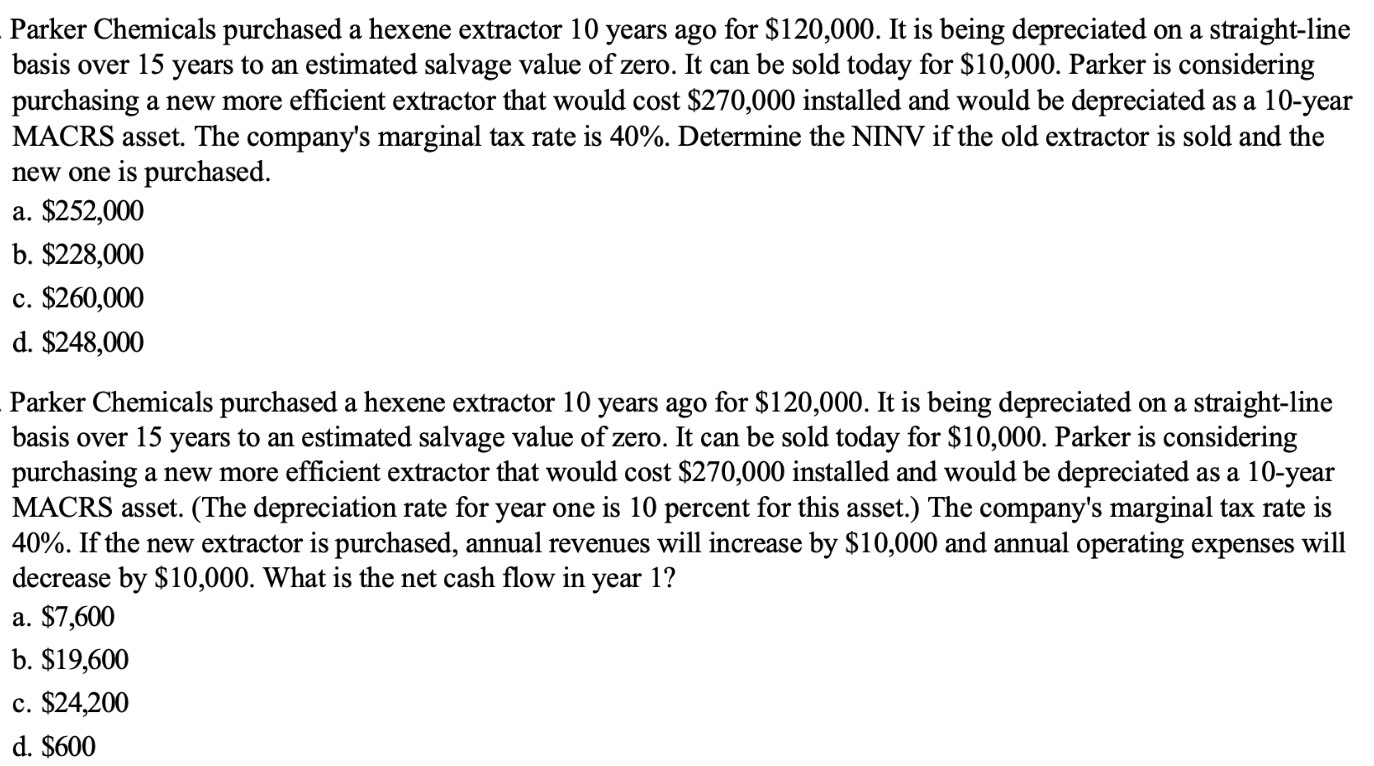

Parker Chemicals purchased a hexene extractor 10 years ago for $120,000. It is being depreciated on a straight-line basis over 15 years to an estimated salvage value of zero. It can be sold today for $10,000. Parker is considering purchasing a new more efficient extractor that would cost $270,000 installed and would be depreciated as a 10-year MACRS asset. The company's marginal tax rate is 40%. Determine the NINV if the old extractor is sold and the new one is purchased. a. $252,000 b. $228,000 c. $260,000 d. $248,000 Parker Chemicals purchased a hexene extractor 10 years ago for $120,000. It is being depreciated on a straight-line basis over 15 years to an estimated salvage value of zero. It can be sold today for $10,000. Parker is considering purchasing a new more efficient extractor that would cost $270,000 installed and would be depreciated as a 10-year MACRS asset. (The depreciation rate for year one is 10 percent for this asset.) The company's marginal tax rate is 40%. If the new extractor is purchased, annual revenues will increase by $10,000 and annual operating expenses will decrease by $10,000. What is the net cash flow in year 1? a. $7,600 b. $19,600 c. $24,200 d. $600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts