Question: I know the first two are correct, but how do I put it into the third part? ! Required information [The following information applies to

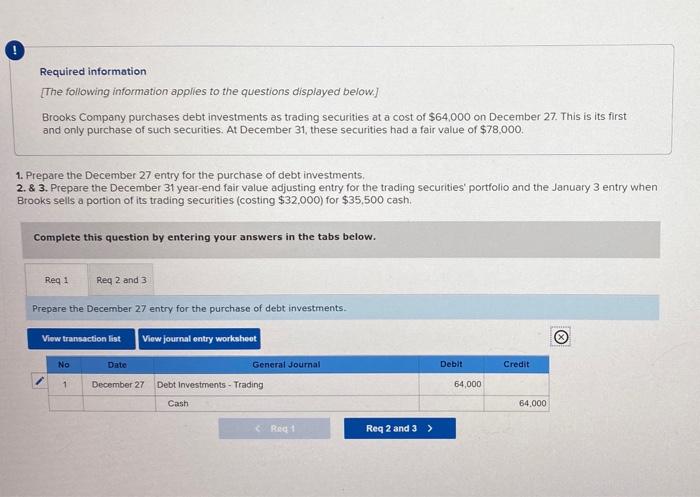

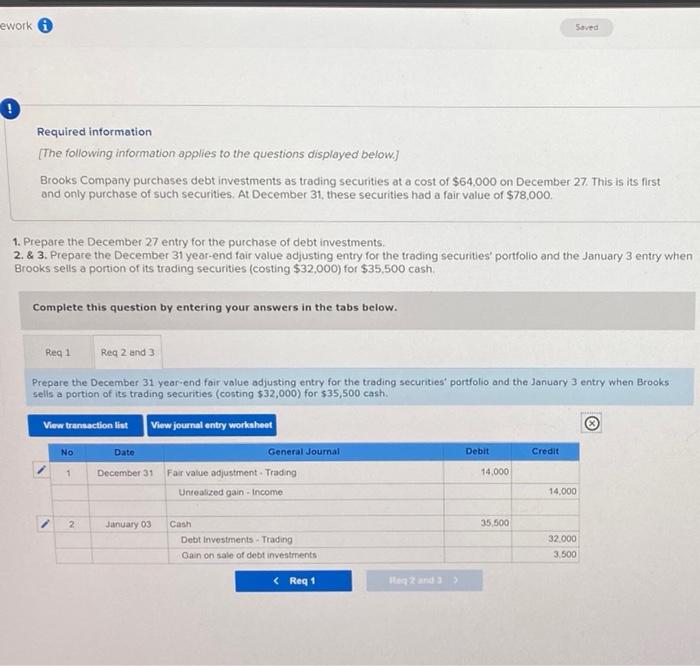

! Required information [The following information applies to the questions displayed below.) Brooks Company purchases debt investments as trading securities at a cost of $64,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $78,000. 1. Prepare the December 27 entry for the purchase of debt investments, 2. & 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $32,000) for $35,500 cash Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Prepare the December 27 entry for the purchase of debt investments View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 December 27 Debt Investments - Trading 64,000 Cash 64.000 RAG Req 2 and 3 > ework Saved Required information [The following information applies to the questions displayed below.) Brooks Company purchases debt investments as trading securities at a cost of $64,000 on December 27 This is its first and only purchase of such securities. At December 31, these securitles had a fair value of $78,000, 1. Prepare the December 27 entry for the purchase of debt investments 2. & 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $32,000) for $35,500 cash Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Prepare the December 31 year-end fair value adjusting entry for the trading securities portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $32,000) for $35,500 cash. View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 December 31 14.000 Fair value adjustment - Trading Unrealized gain -Income 14,000 2 January 03 35,500 Cash Debt investments - Trading Gain on sale of debt investments 32.000 3.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts