Question: I know this is a multiple choice question. the first part, I feel like the correct answer isnt present and I need assistance with the

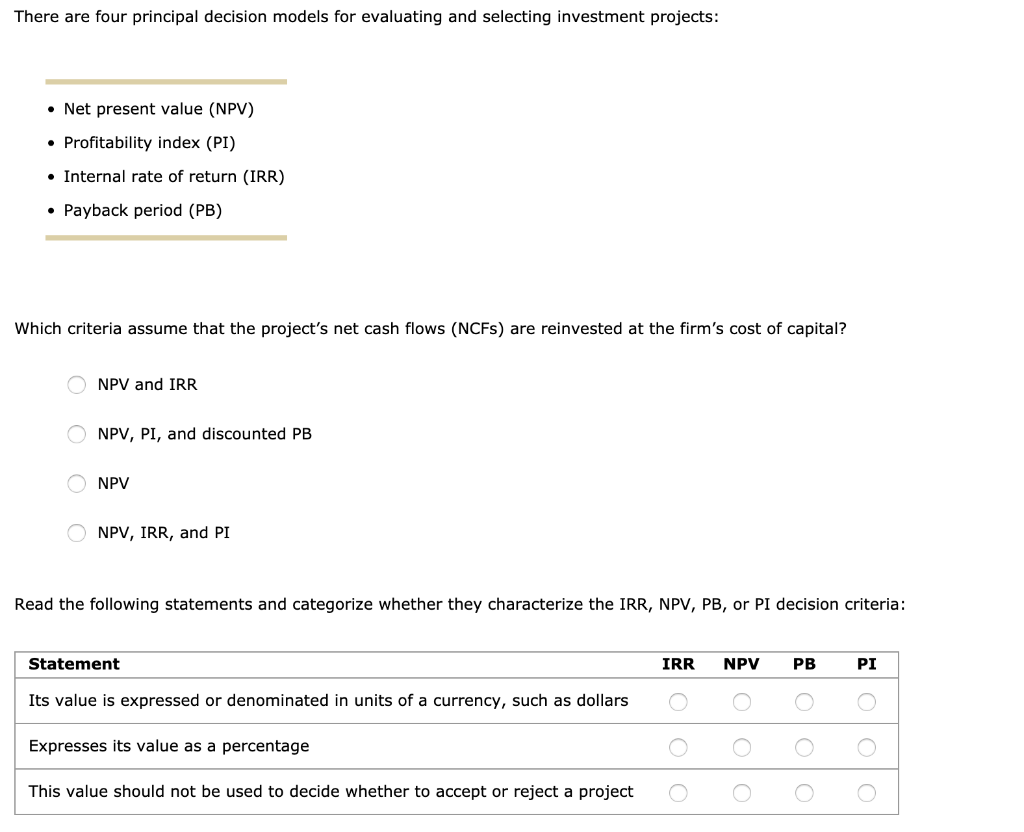

There are four principal decision models for evaluating and selecting investment projects: Net present value (NPV) Profitability index (PI) Internal rate of return (IRR) Payback period (PB) Which criteria assume that the project's net cash flows (NCFs) are reinvested at the firm's cost of capital? O NPV and IRR O NPV, PI, and discounted PB ONPV O NPV, IRR, and PI Read the following statements and categorize whether they characterize the IRR, NPV, PB, or PI decision criteria: Statement IRR 0 NPV 0 PB 0 PI 0 Its value is expressed or denominated in units of a currency, such as dollars Expresses its value as a percentage This value should not be used to decide whether to accept or reject a project 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts