Question: I know youre only supposed to answer one but could you possibly do both. More info a. Sales of $181,000 ( $164,000 on account; $17,000

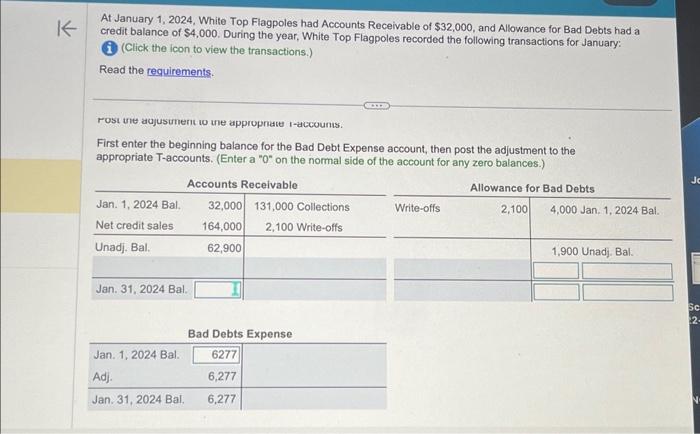

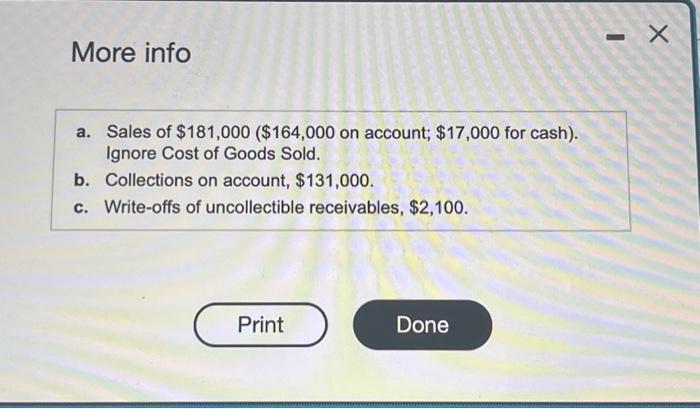

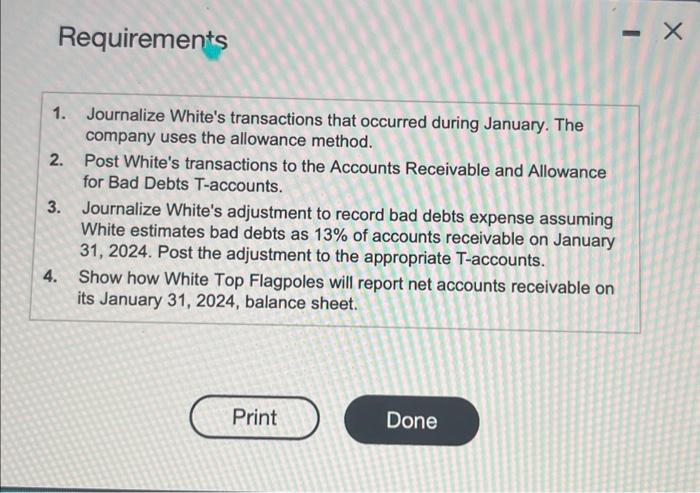

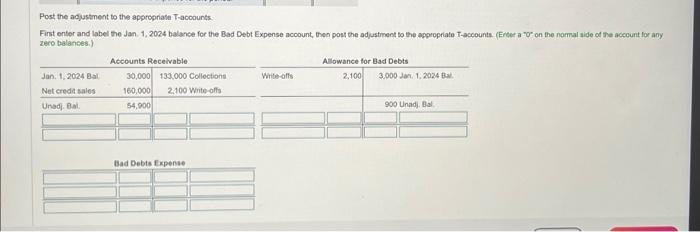

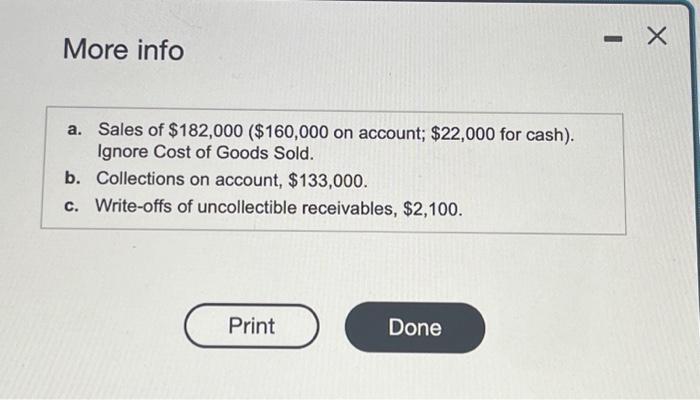

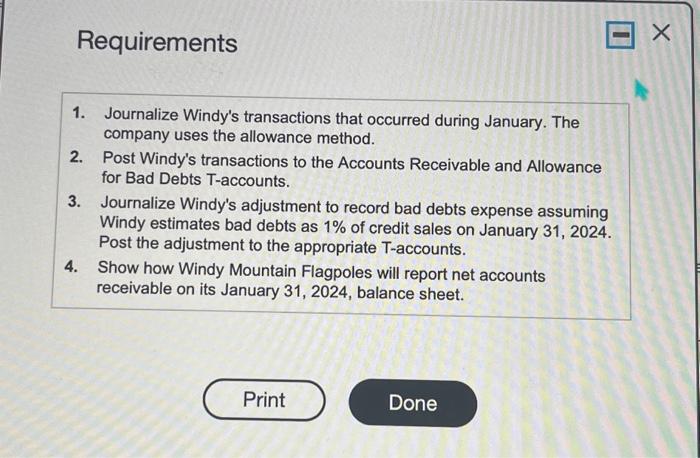

More info a. Sales of $181,000 ( $164,000 on account; $17,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $131,000. c. Write-offs of uncollectible receivables, $2,100. At January 1, 2024, White Top Flagpoles had Accounts Receivable of $32,000, and Allowance for Bad Debts had a credit balance of $4,000. During the year, White Top Flagpoles recorded the following transactions for January: (Click the icon to view the transactions.) Read the requirements. rost the acjusument wo the appropnate t-accouns. First enter the beginning balance for the Bad Debt Expense account, then post the adjustment to the appropriate T-accounts. (Enter a " 0 " on the normal side of the account for any zero balances.) Requirements 1. Journalize Windy's transactions that occurred during January. The company uses the allowance method. 2. Post Windy's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. 3. Journalize Windy's adjustment to record bad debts expense assuming Windy estimates bad debts as 1% of credit sales on January 31,2024. Post the adjustment to the appropriate T-accounts. 4. Show how Windy Mountain Flagpoles will report net accounts receivable on its January 31,2024 , balance sheet. Post the adjustment to the appropriate Tracoounts Fint enter and label the Jan 1,2024 balance for the Bad Debt Expense account, then post the adjustment to the appropriate T-accounts. (Ereer a "Vr- on the normal side of The account for any zero balances.) Requirements 1. Journalize White's transactions that occurred during January. The company uses the allowance method. 2. Post White's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. 3. Journalize White's adjustment to record bad debts expense assuming White estimates bad debts as 13% of accounts receivable on January 31,2024 . Post the adjustment to the appropriate T-accounts. 4. Show how White Top Flagpoles will report net accounts receivable on its January 31, 2024, balance sheet. More info a. Sales of $182,000 ( $160,000 on account; $22,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $133,000. c. Write-offs of uncollectible receivables, $2,100. More info a. Sales of $181,000 ( $164,000 on account; $17,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $131,000. c. Write-offs of uncollectible receivables, $2,100. At January 1, 2024, White Top Flagpoles had Accounts Receivable of $32,000, and Allowance for Bad Debts had a credit balance of $4,000. During the year, White Top Flagpoles recorded the following transactions for January: (Click the icon to view the transactions.) Read the requirements. rost the acjusument wo the appropnate t-accouns. First enter the beginning balance for the Bad Debt Expense account, then post the adjustment to the appropriate T-accounts. (Enter a " 0 " on the normal side of the account for any zero balances.) Requirements 1. Journalize Windy's transactions that occurred during January. The company uses the allowance method. 2. Post Windy's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. 3. Journalize Windy's adjustment to record bad debts expense assuming Windy estimates bad debts as 1% of credit sales on January 31,2024. Post the adjustment to the appropriate T-accounts. 4. Show how Windy Mountain Flagpoles will report net accounts receivable on its January 31,2024 , balance sheet. Post the adjustment to the appropriate Tracoounts Fint enter and label the Jan 1,2024 balance for the Bad Debt Expense account, then post the adjustment to the appropriate T-accounts. (Ereer a "Vr- on the normal side of The account for any zero balances.) Requirements 1. Journalize White's transactions that occurred during January. The company uses the allowance method. 2. Post White's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. 3. Journalize White's adjustment to record bad debts expense assuming White estimates bad debts as 13% of accounts receivable on January 31,2024 . Post the adjustment to the appropriate T-accounts. 4. Show how White Top Flagpoles will report net accounts receivable on its January 31, 2024, balance sheet. More info a. Sales of $182,000 ( $160,000 on account; $22,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $133,000. c. Write-offs of uncollectible receivables, $2,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts