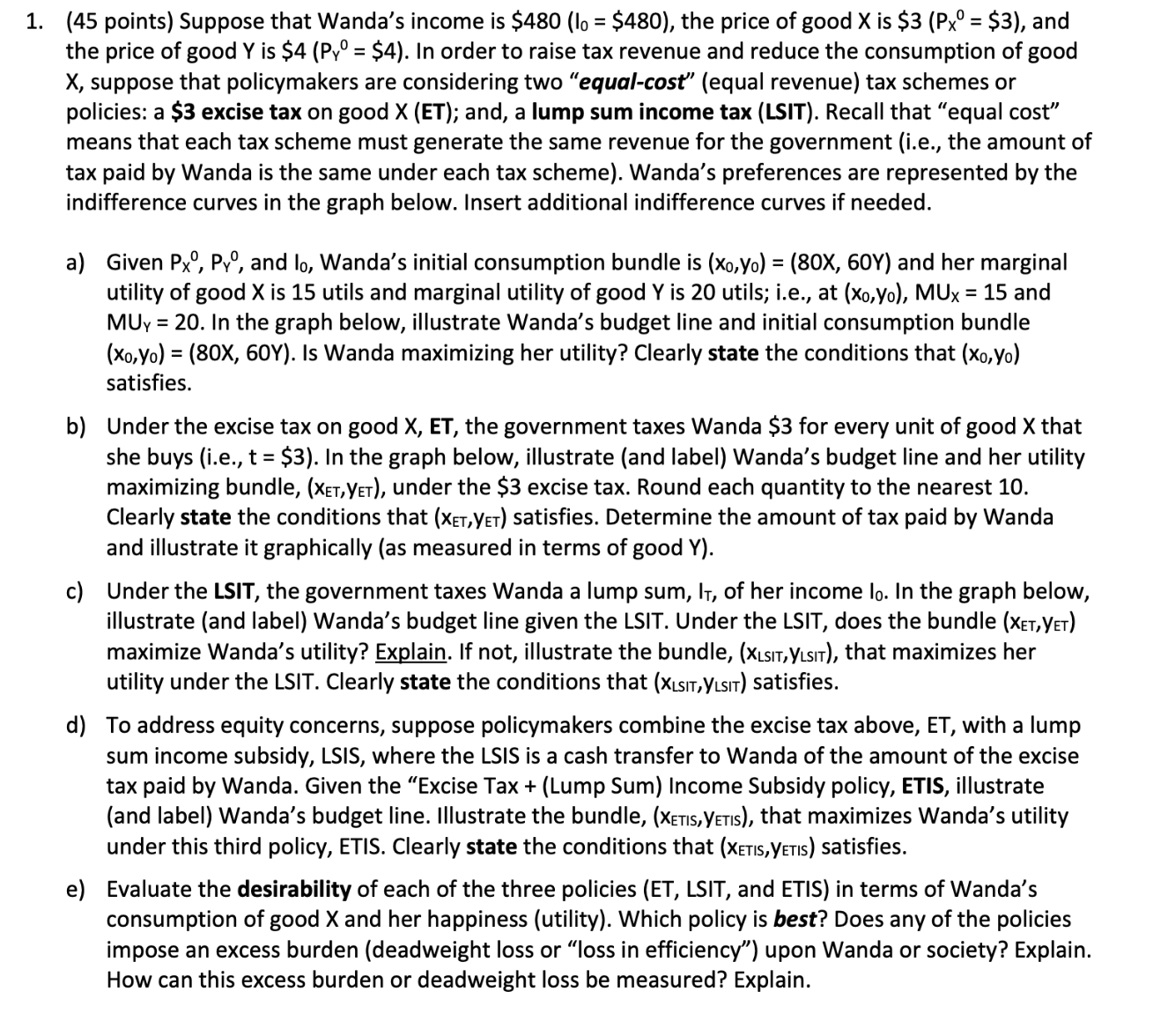

Question: ( I L L U S T R A T E and SOLVE FULLY ) Suppose that Wanda's income i s $ 4 8 0

and SOLVE FULLY Suppose that Wanda's income $$ the price $$ and

the price good $$ order raise tax revenue and reduce the consumption good

suppose that policymakers are considering two "equal revenue tax schemes

policies: $ excise tax good ; and, a lump sum income tax Recall that "equal cost"

means that each tax scheme must generate the same revenue for the government the amount

tax paid Wanda the same under each tax scheme Wanda's preferences are represented the

indifference curves the graph below. Insert additional indifference curves needed.

and Wanda's initial consumption bundle and her marginal

utility good utils and marginal utility good and

the graph below, illustrate Wanda's budget line and initial consumption bundle

$$: under the $ her income :: satisfies.

and her happiness Which policy best? Does any the policies

impose excess burden loss "loss efficiency" upon Wanda society? Explain.

How can this excess burden deadweight loss measured? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock