Question: I ' m creating a loan amortization schedule in Excel with the following assumptions: Loan Amount: EUR 1 , 0 0 0 , 0 0

Im creating a loan amortization schedule in Excel with the following assumptions:

Loan Amount: EUR

Interest Rate: pa

Loan Term: years

Grace Period: years

Repayment Period: years

Loan Closing Date:

Payment Frequency: Quarterly every months

Number of Periods: years quarters

Rate per Period: quarterly

Fixed Principal Repayment: EUR EUR

Total Payments: EUR Principal Interest

Total Interest: EUR

Questions:

First Payment Date

Loan closes on and has a year grace period. Should the first payment be on or I originally calculated it as EOloanclosingdate, graceperiod but I feel like I got it wrong.

Interest Calculation Days Count

Im using fixed principal repayment EUR per period

For interest, should I include the extra day when counting days between periods?

Example: days instead of If I do this, my total days per year becomes instead of which doesnt seem right.Should I include or exclude the extra day?

Excel Table Format

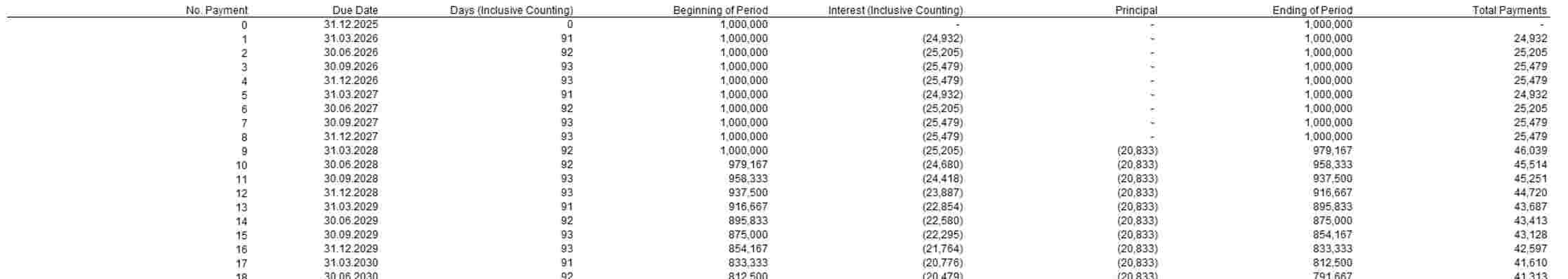

My table includes the following columns:

No Payment

Due Date

Days Helper Column

Beginning of Period Balance

Interest

Principal

Ending of Period Balance

Total Payment

Would appreciate any guidance on whether my calculations are correct, especially regarding the first payment date and day count for interest calculations.

Thank you!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock