Question: I ' m not sure what i ' m doing wrong in this question. Laurel Enterprises expects earnings next year of $ 4 . 4

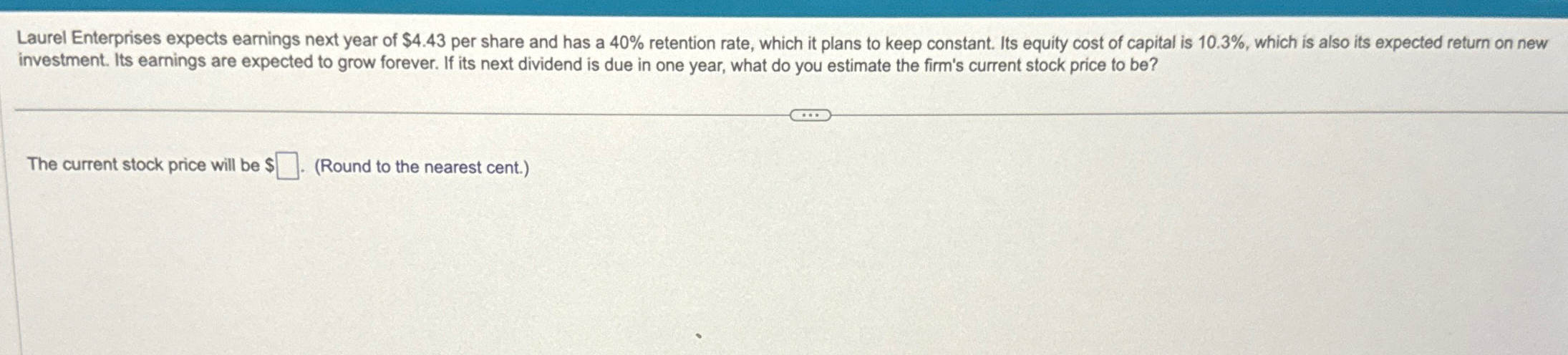

Im not sure what im doing wrong in this question. Laurel Enterprises expects earnings next year of $ per share and has a retention rate, which it plans to keep constant. Its equity cost of capital is which is also its expected return on new investment. Its earnings are expected to grow forever. If its next dividend is due in one year, what do you estimate the firm's current stock price to be

The current stock price will be $Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock