Question: I May need some help with this question please show detailed steps please thank you. AP 4-5 (Comprehensive Tax Payable) Ms. Tanja Umstead is 46

I May need some help with this question please show detailed steps please thank you.

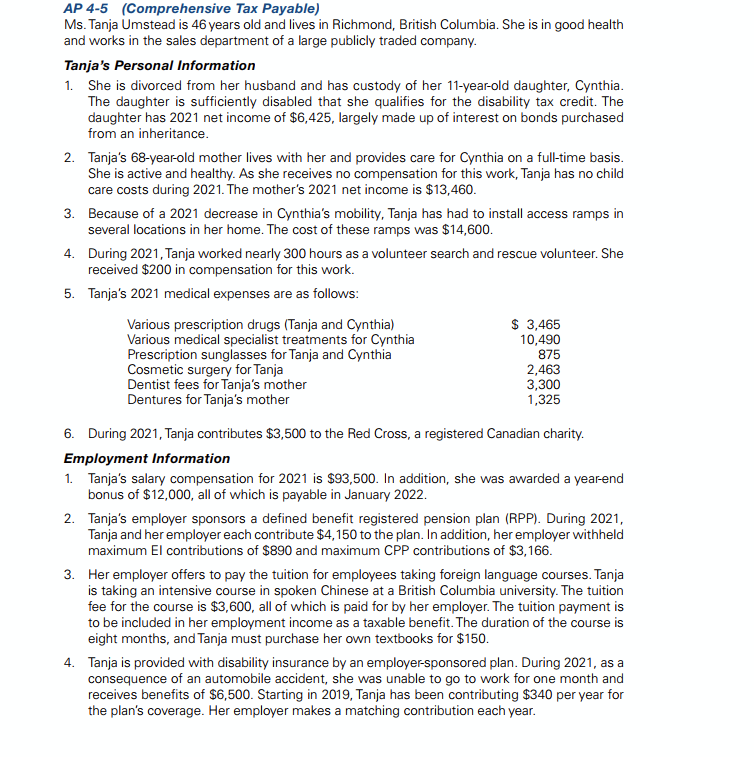

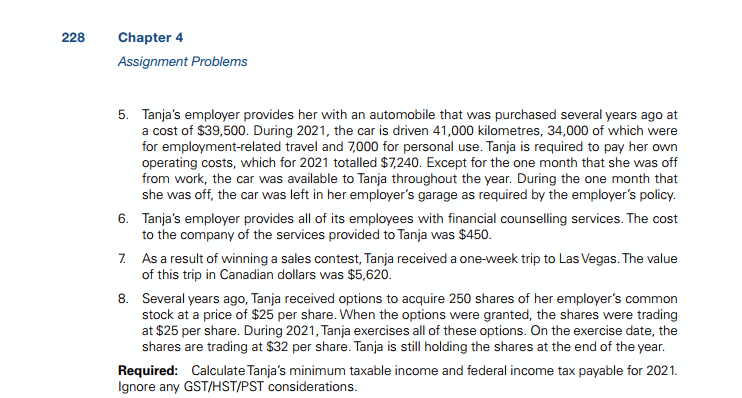

AP 4-5 (Comprehensive Tax Payable) Ms. Tanja Umstead is 46 years old and lives in Richmond, British Columbia. She is in good health and works in the sales department of a large publicly traded company. Tanja's Personal Information 1. She is divorced from her husband and has custody of her 11-year-old daughter, Cynthia. The daughter is sufficiently disabled that she qualifies for the disability tax credit. The daughter has 2021 net income of $6,425, largely made up of interest on bonds purchased from an inheritance. 2. Tanja's 68-year-old mother lives with her and provides care for Cynthia on a full-time basis. She is active and healthy. As she receives no compensation for this work, Tanja has no child care costs during 2021. The mother's 2021 net income is $13,460 3. Because of a 2021 decrease in Cynthia's mobility, Tanja has had to install access ramps in several locations in her home. The cost of these ramps was $14,600 4. During 2021, Tanja worked nearly 300 hours as a volunteer search and rescue volunteer. She received $200 in compensation for this work. 5. Tanja's 2021 medical expenses are as follows: Various prescription drugs (Tanja and Cynthia) $ 3,465 Various medical specialist treatments for Cynthia 10,490 Prescription sunglasses for Tanja and Cynthia 875 Cosmetic surgery for Tanja 2,463 Dentist fees for Tanja's mother 3,300 Dentures for Tanja's mother 1,325 6. During 2021, Tanja contributes $3,500 to the Red Cross, a registered Canadian charity. Employment Information 1. Tanja's salary compensation for 2021 is $93,500. In addition, she was awarded a year-end bonus of $12,000, all of which is payable in January 2022. 2. Tanja's employer sponsors a defined benefit registered pension plan (RPP). During 2021, Tanja and her employer each contribute $4, 150 to the plan. In addition, her employer withheld maximum El contributions of $890 and maximum CPP contributions of $3,166. 3. Her employer offers to pay the tuition for employees taking foreign language courses. Tanja is taking an intensive course in spoken Chinese at a British Columbia university. The tuition fee for the course is $3,600, all of which is paid for by her employer. The tuition payment is to be included in her employment income as a taxable benefit. The duration of the course is eight months, and Tanja must purchase her own textbooks for $150. 4. Tanja is provided with disability insurance by an employer-sponsored plan. During 2021, as a consequence of an automobile accident, she was unable to go to work for one month and receives benefits of $6,500. Starting in 2019, Tanja has been contributing $340 per year for the plan's coverage. Her employer makes a matching contribution each year.223 Chapter 4 Assignment Problems 5. Tanja's employer provides her with an automobile that was purchased several years ago at a cost of $35,500. During 2(321, the car is dn'ven 41,[} kilometres, 34.300 of which were for employment-related travel and TIGER} for personal use. Tanja is required to pay her own operating costs, which for 2&21 totalled $1243 Except for the one month that she was off from work, the car was available toTanja throughout the year. During the one morrth that she was off, the car was le'l't in her em ployer's garage as required by the employer's policy. Tanja's employer provides all of its employees with financial counselling services. The cost to the company of the services provided toTa nia was $453. As a result of winning a sales contest. Ta nja received a oneweek trip to Las 1|ul'egas. The value of this trip in Canadian dollars was $5,631. Several years ago, Tanja received options to acquire 25D shares of her employer's common Stock at a price of $25 per share. II..I"l.l'hen the options were grantedr the shares were trading at $25 per share. During 2321, Tanja exercises all of these options. 0n the exercise date, the shares are trading at $32 per share. Tanja is still holding the shares at the end of the year. Required: CalculateTanja's minimum taxable income and federal income tat-t payable for 221. Ignore any GSTlHSTlPST considerations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts