Question: i meed help for this question! can someone explain me how to get answer. Under current economic conditions, the real rate of return is estimated

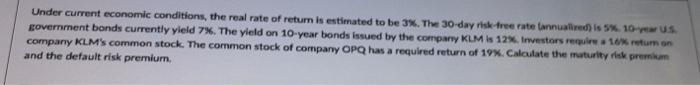

Under current economic conditions, the real rate of return is estimated to be 3%. The 30 day risk tree rate annualid) is 5%. 10-US government bonds currently yield 7%. The yield on 10-year bonds issued by the company KLM is 12.restors require 10% retum on company KLM's common stock. The common stock of company OPQ has a required return of 19%. Calculate the maturity risk premium and the default risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts