Question: i meed help solving this problem! Year 1 Jan. 1 Paid $254,000 cash plus $10,160 in sales tax and $1,500 in transportation (FOB shipping point)

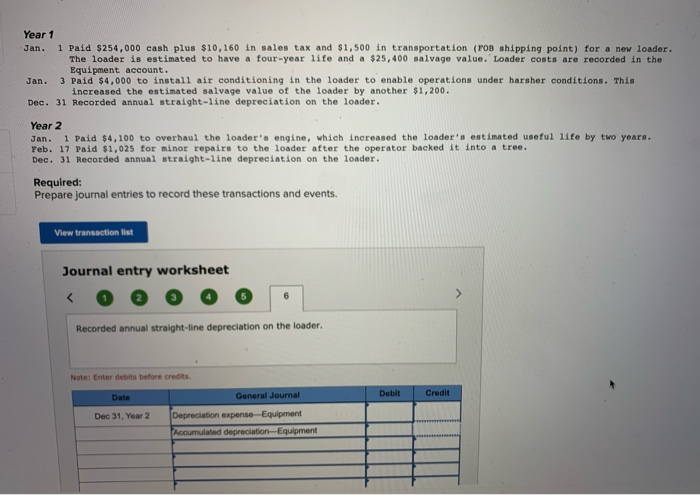

Year 1 Jan. 1 Paid $254,000 cash plus $10,160 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $25,400 salvage value. Loader costs are recorded in the Equipment account. Jan. 3 Paid $4,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,200. Dec. 31 Recorded annual straight-line depreciation on the loader. Year 2 Jan. 1 Paid $4,100 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. Feb. 17 Paid $1,025 for minor repairs to the loader after the operator backed it into a tree. Dec. 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events. View transaction list nsaction list Journal entry worksheet Recorded annual straight-line depreciation on the loader. Note: Enter debits before credits Debit General Journal Date Credit Dec 31, Year 2 Depreciation expense Equipment Accumulated depreciation Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts