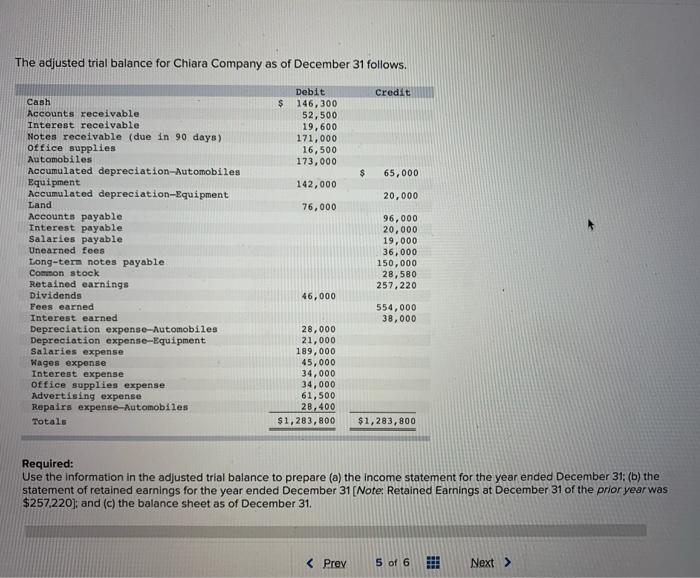

Question: i meed helpmsolving this problem! The adjusted trial balance for Chiara Company as of December 31 follows. Credit $ Debit 146,300 52,500 19,600 171,000 16,500

The adjusted trial balance for Chiara Company as of December 31 follows. Credit $ Debit 146,300 52,500 19,600 171,000 16,500 173,000 $ 65,000 142,000 20,000 76,000 Cash Accounts receivable Interest receivable Notes receivable (due in 90 days) Office supplies Automobiles Accumulated depreciation Automobiles Equipment Accumulated depreciation-Equipment Land Accounts payable Interest payable Salaries payable Unearned fees Long-term notes payable Common stock Retained earnings Dividends Fees earned Interest earned Depreciation expense-Automobiles Depreciation expense-Equipment Salaries expense Wages expense Interest expense Office supplies expense Advertising expense Repairs expense-Automobiles Totals 96,000 20,000 19,000 36,000 150,000 28,580 257,220 46,000 554,000 38,000 28,000 21,000 189,000 45,000 34,000 34,000 61,500 28, 400 $1,283,800 $1,283, 800 Required: Use the information in the adjusted trial balance to prepare (a) the income statement for the year ended December 31; (b) the statement of retained earnings for the year ended December 31 (Note: Retained Earnings at December 31 of the prior year was $257.220); and (c) the balance sheet as of December 31. 5 Prepare Chiara Company's balance sheet as of December 31. CHLARA COMPANY Balance Sheet 3.33 points December 31 eBook Prim 0 $ 0 $ 0 ME Graw atv 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts