Question: I most definately need help with the chart, but also if the other parts could get answered so I know if I dis them right,

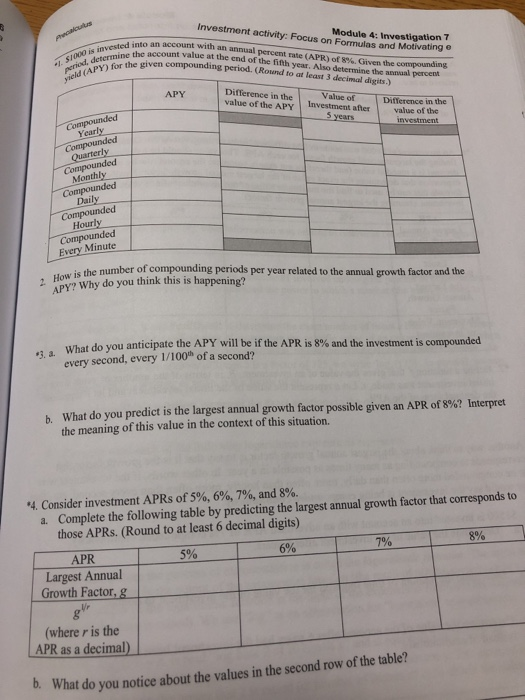

Investment activity: Focus on Formulas and Motivating e is investe the account value at the end of the fifth year. Also determine the annual perceni ddeter mor the given compounding period.(Round to at least 3 decimal git.) Module 4: Investigation 7 into an account with an annual percent rate (APR) of 8% Given the compounding Difference in the value of the APY APY Value of Investment after value of the Difference in the Compounded Yearly Compounded 5 years arterly Compounded Monthly Compounded Daily Compounded Hourly Minute dow is the number of compounding periods per year related to the annual growth factor and the APY? Why do you think this is happening!? what do you anticipate the APY will be if the APR is 8% and the investment is compounded every second, every 1/100th of a second? 3. a What do you predict is the largest annual growth factor possible given an APR of 8%? Interpret the meaning of this value in the context of this situation. b Consider investment APRs of 5%, 6%, 7%, and 8%. a. Complete the following table by predicting the largest annual growth factor that corresponds to those APRs. (Round to at least 6 decimal digits) 5% | 6% 7% 8% APR Largest Annual Growth Factor.g (where r is the APR as a decimal) What do you notice about the values in the second row of the table? b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts