Question: I: Multiple choice (30 points): These statements are True or False? 1. Demand deposits are among the most volatile and least predictable of a bank's

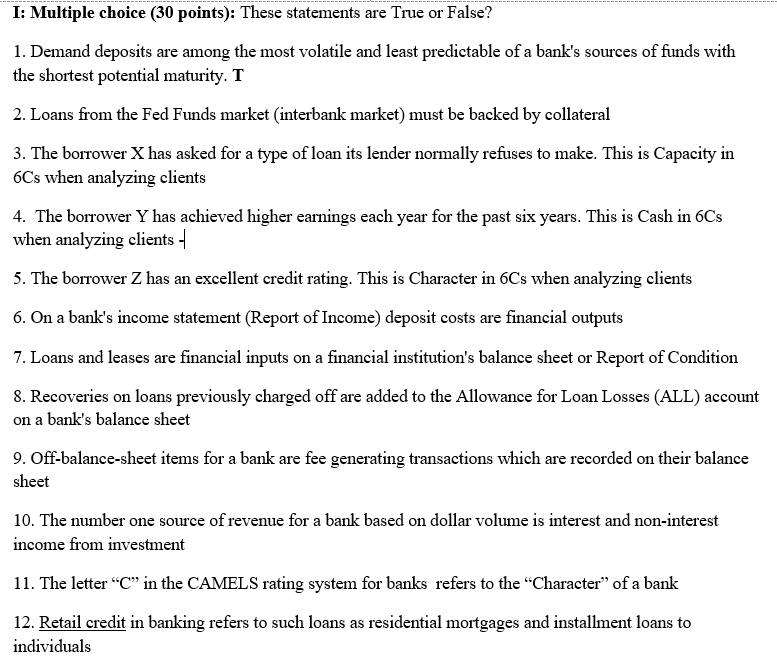

I: Multiple choice (30 points): These statements are True or False? 1. Demand deposits are among the most volatile and least predictable of a bank's sources of funds with the shortest potential maturity. T 2. Loans from the Fed Funds market (interbank market) must be backed by collateral 3. The borrower X has asked for a type of loan its lender normally refuses to make. This is Capacity in 6Cs when analyzing clients 4. The borrower Y has achieved higher earnings each year for the past six years. This is Cash in 6Cs when analyzing clients 5. The borrower Z has an excellent credit rating. This is Character in 6Cs when analyzing clients 6. On a bank's income statement (Report of Income) deposit costs are financial outputs 7. Loans and leases are financial inputs on a financial institution's balance sheet or Report of Condition 8. Recoveries on loans previously charged off are added to the Allowance for Loan Losses (ALL) account on a bank's balance sheet 9. Off-balance-sheet items for a bank are fee generating transactions which are recorded on their balance sheet 10. The number one source of revenue for a bank based on dollar volume is interest and non-interest income from investment 11. The letter C in the CAMELS rating system for banks refers to the "Character" of a bank 12. Retail credit in banking refers to such loans as residential mortgages and installment loans to individuals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts