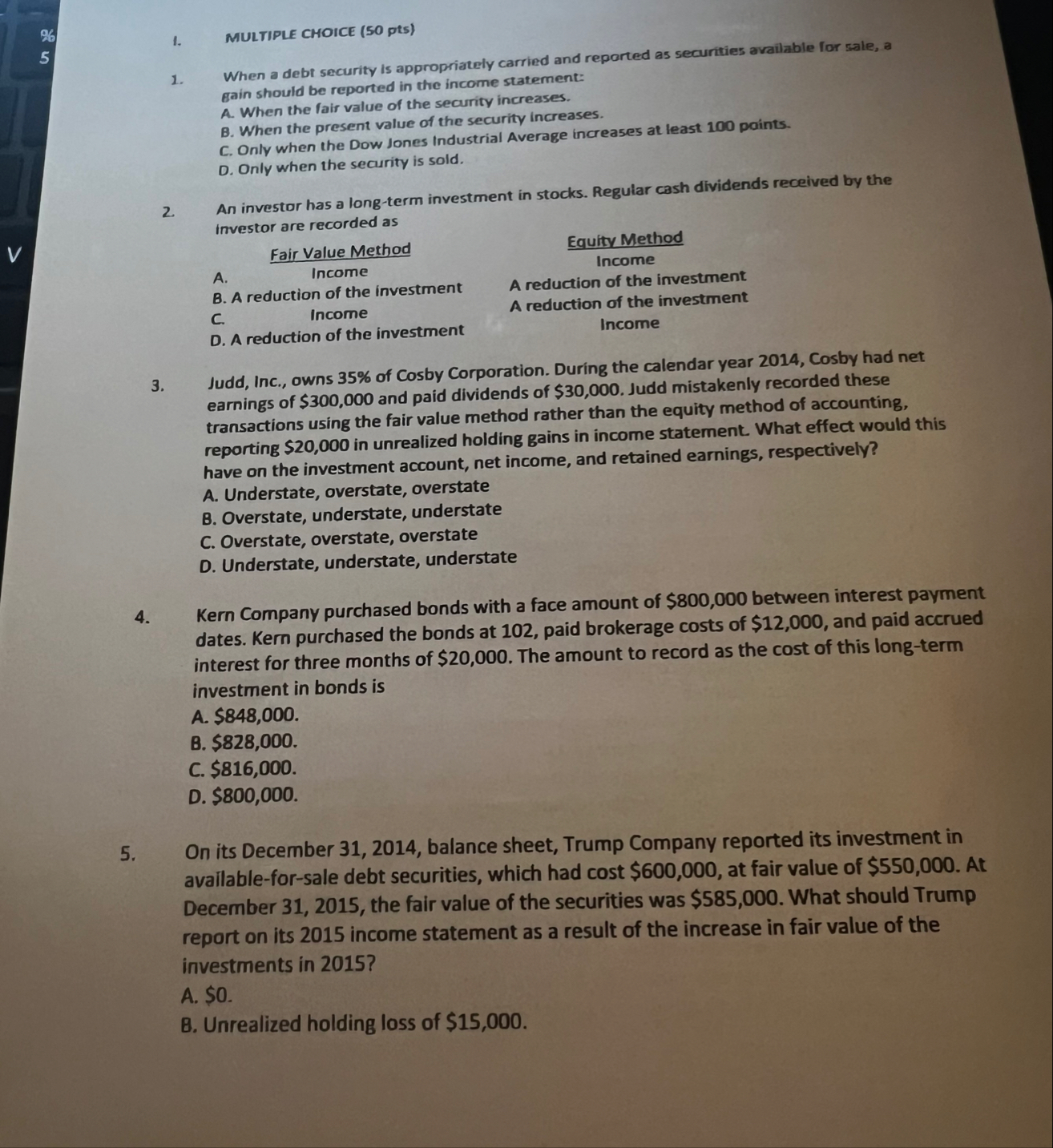

Question: I. MULTIPLE CHOICE ( 5 0 pts ) When a debt security is appropriately carried and reported as securties available for sale, a gain should

I. MULTIPLE CHOICE pts

When a debt security is appropriately carried and reported as securties available for sale, a gain should be reported in the income statement:

A When the fair value of the security increases.

B When the present value of the security increases.

C Only when the Dow Jones Industrial Average increases at least points.

D Only when the security is sold.

An investor has a longterm investment in stocks. Regular cash dividends received by the investor are recorded as

Fair Value Method

A

Income

B A reduction of the investment

C Income

D A reduction of the investment

Equity Method

Income

A reduction of the investment

A reduction of the investment Income

Judd, Inc., owns of Cosby Corporation. During the calendar year Cosby had net earnings of $ and paid dividends of $ Judd mistakenly recorded these transactions using the fair value method rather than the equity method of accounting, reporting $ in unrealized holding gains in income statement. What effect would this have on the investment account, net income, and retained earnings, respectively?

A Understate, overstate, overstate

B Overstate, understate, understate

C Overstate, overstate, overstate

D Understate, understate, understate

Kern Company purchased bonds with a face amount of $ between interest payment dates. Kern purchased the bonds at paid brokerage costs of $ and paid accrued interest for three months of $ The amount to record as the cost of this longterm investment in bonds is

A $

B $

C $

D $

On its December balance sheet, Trump Company reported its investment in availableforsale debt securities which had cost $ at fair value of $ At December the fair value of the securities was $ What should Trump report on its income statement as a result of the increase in fair value of the investments in

A $

B Unrealized holding loss of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock