Question: I ne I need help solving this within an hours pleasee Daloma Company has four employees. FICA Social Security taxes are 6.2% of the first

I ne

I need help solving this within an hours pleasee

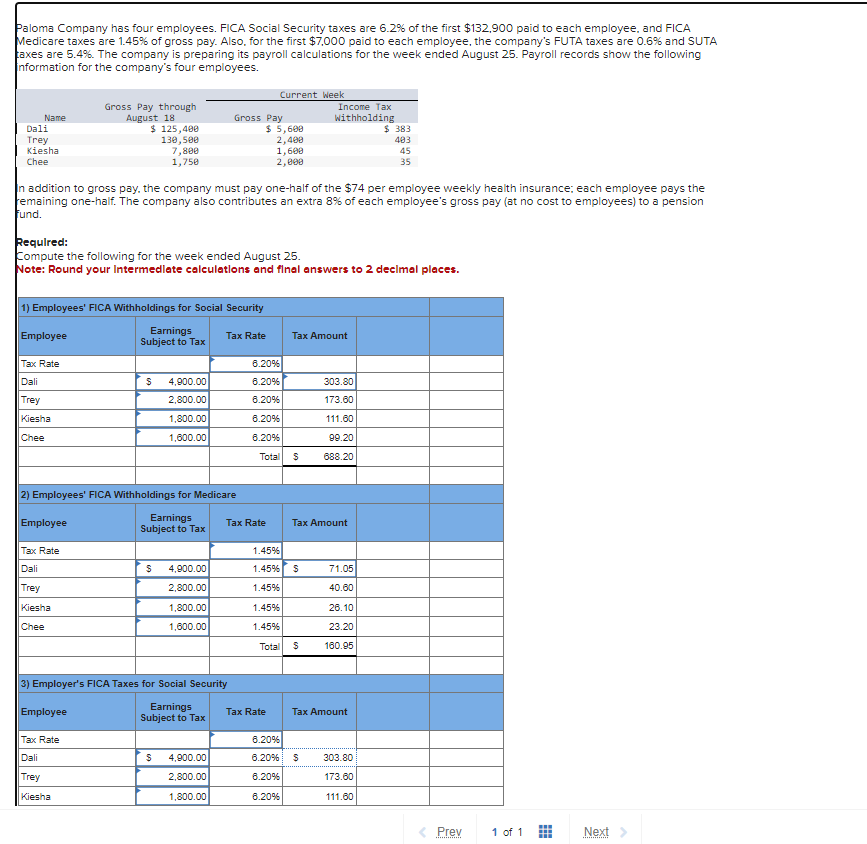

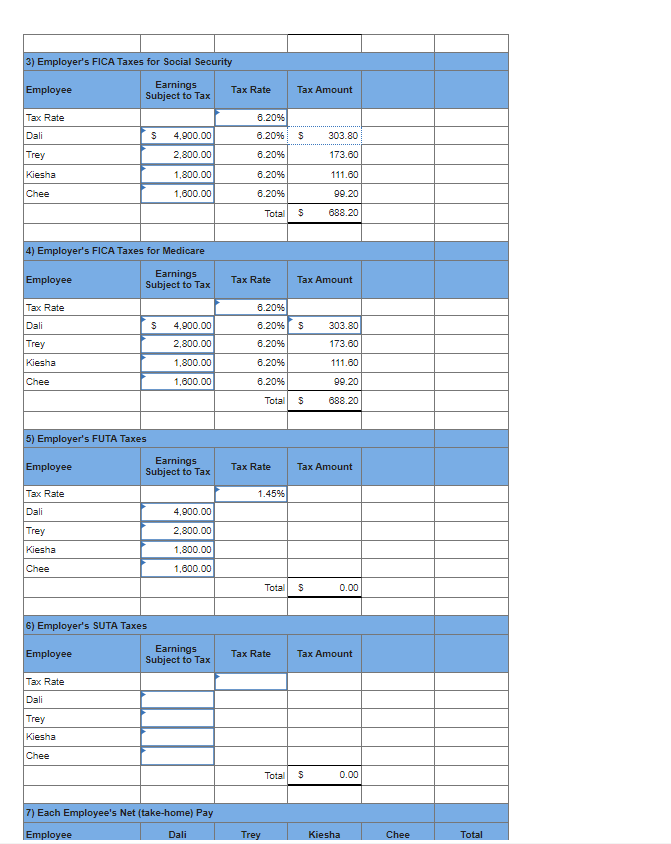

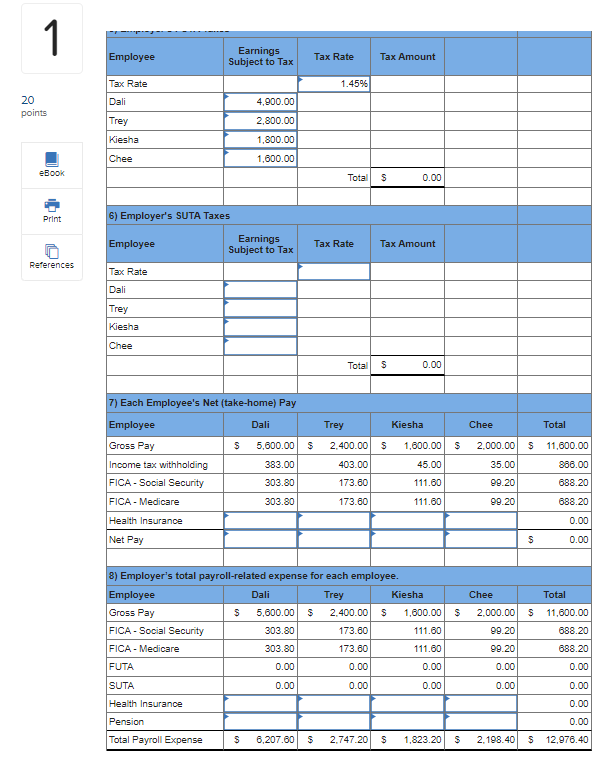

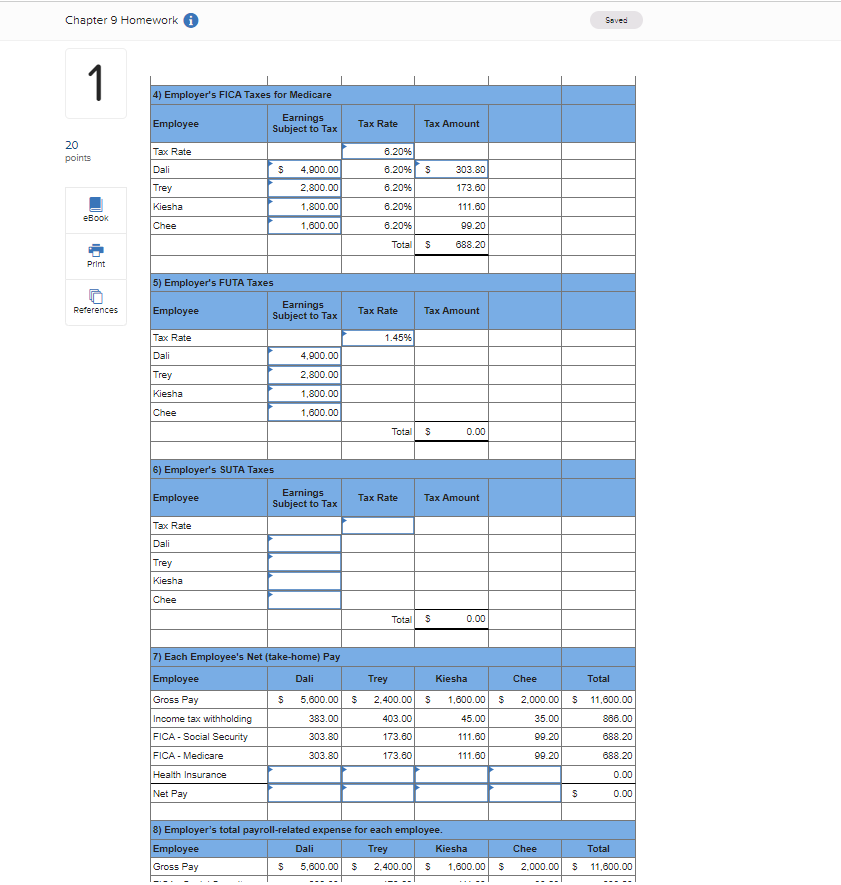

Daloma Company has four employees. FICA Social Security taxes are 6.2% of the first $132,900 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA iaxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25 . Payroll records show the following nformation for the company's four employees. n addition to gross pay, the company must pay one-half of the $74 per employee weekly health insurance; each employee pays the 'emaining one-half. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension und. equlred: Compute the following for the week ended August 25. Note: Round your Intermedlete calculations and flnal answers to 2 decimal pleces. 4) Employer's FICA Taxes for Medicare 5) Employer's FUTA Taxes Chapter 9 Homework i)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts