Question: I need 100% answer will be upvote A risk analyst uses the EWMA model with =0.85 to carry out an update of correlation and covariance

I need 100% answer will be upvote

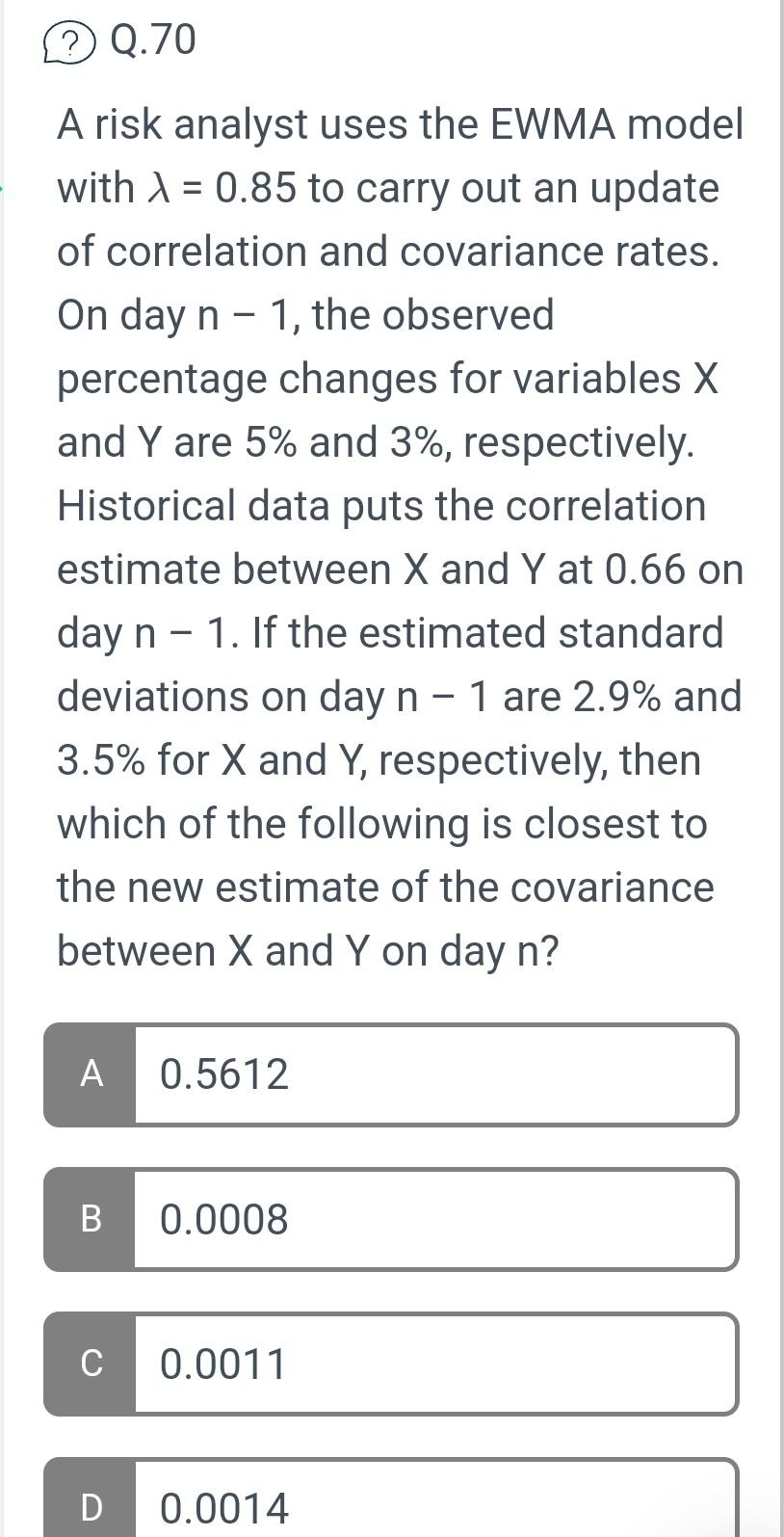

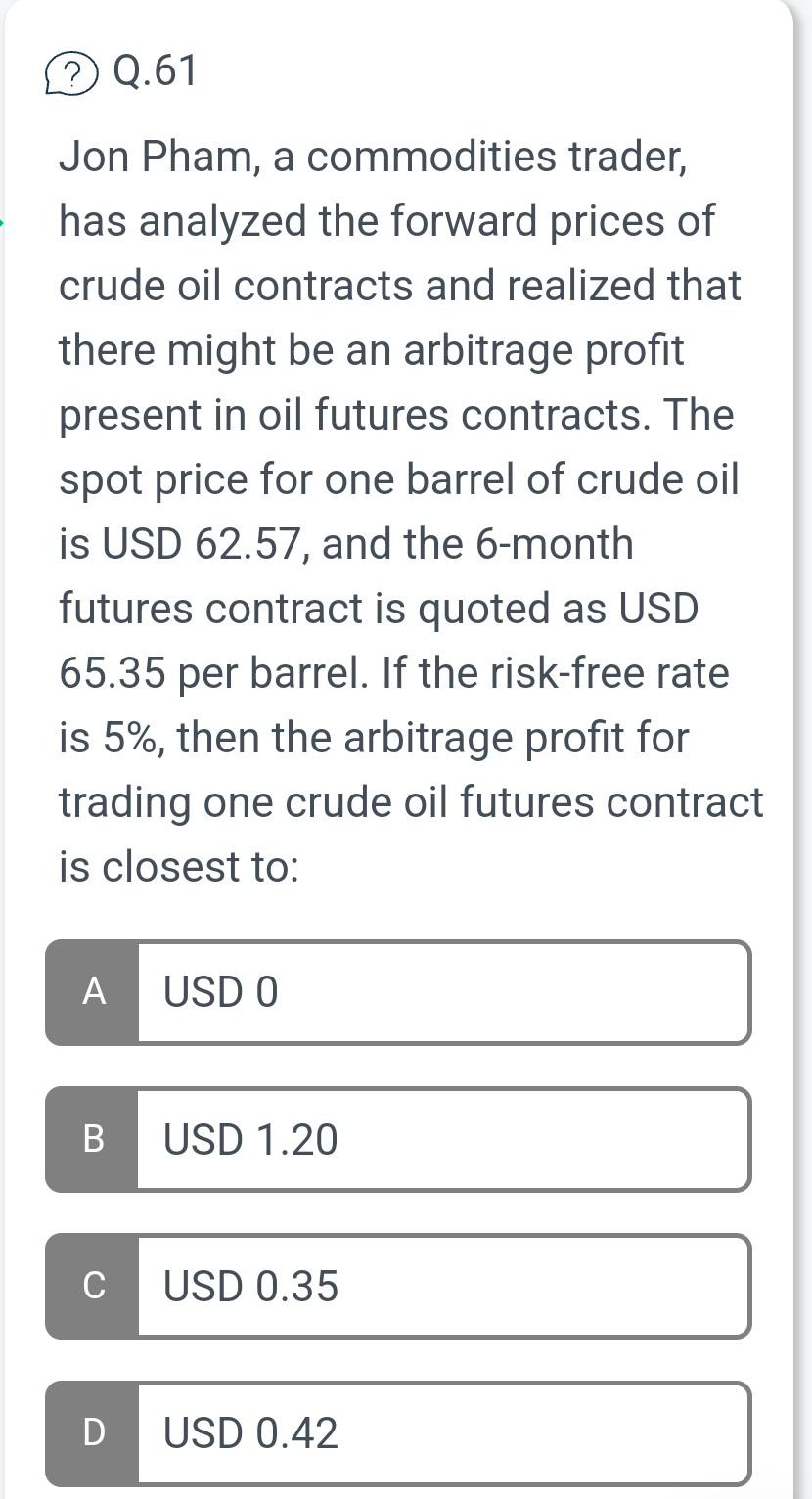

A risk analyst uses the EWMA model with =0.85 to carry out an update of correlation and covariance rates. On day n1, the observed percentage changes for variables X and Y are 5% and 3%, respectively. Historical data puts the correlation estimate between X and Y at 0.66 on day n1. If the estimated standard deviations on day n1 are 2.9% and 3.5% for X and Y, respectively, then which of the following is closest to the new estimate of the covariance between X and Y on day n ? Jon Pham, a commodities trader, has analyzed the forward prices of crude oil contracts and realized that there might be an arbitrage profit present in oil futures contracts. The spot price for one barrel of crude oil is USD 62.57, and the 6-month futures contract is quoted as USD 65.35 per barrel. If the risk-free rate is 5%, then the arbitrage profit for trading one crude oil futures contract is closest to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts