Question: I need 100% correct answer will be upvote (2) Q.88 A risk manager wants to stress a bank's USD 320 million real-estate loan portfolio. Although

I need 100% correct answer will be upvote

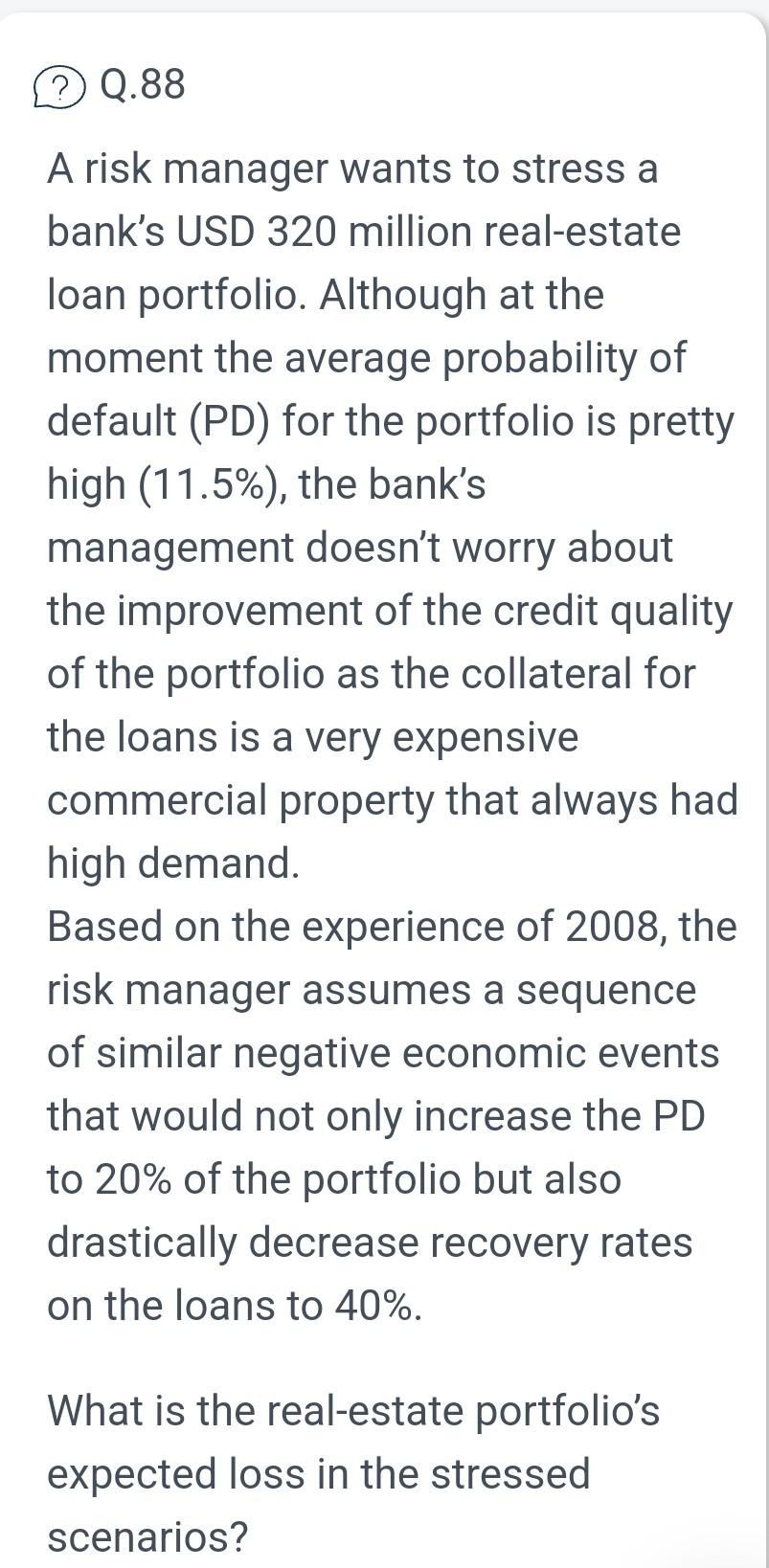

(2) Q.88 A risk manager wants to stress a bank's USD 320 million real-estate loan portfolio. Although at the moment the average probability of default (PD) for the portfolio is pretty high (11.5%), the bank's management doesn't worry about the improvement of the credit quality of the portfolio as the collateral for the loans is a very expensive commercial property that always had high demand. Based on the experience of 2008 , the risk manager assumes a sequence of similar negative economic events that would not only increase the PD to 20% of the portfolio but also drastically decrease recovery rates on the loans to 40%. What is the real-estate portfolio's expected loss in the stressed scenarios? A USD 10,800,000 B USD 14,720,000. C USD 25,600,000. D USD 38,400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts