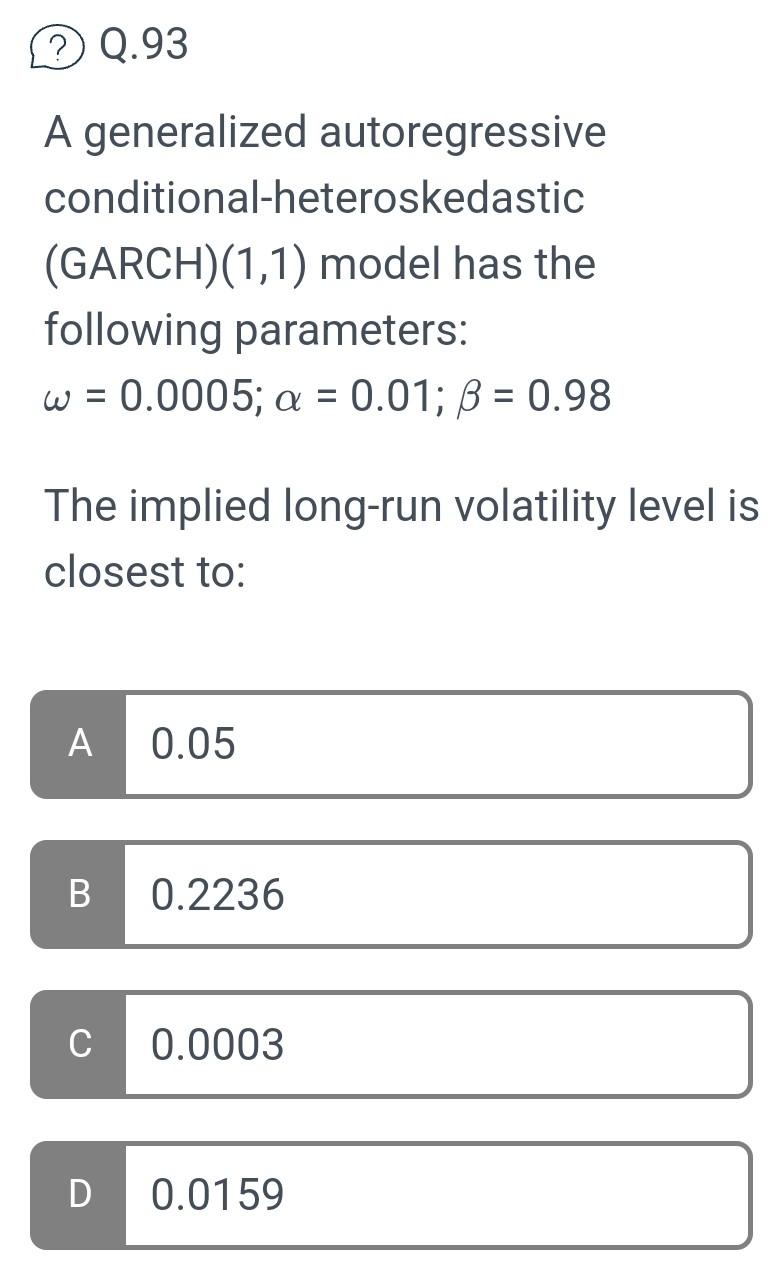

Question: I need 100% correct answer will be upvote A generalized autoregressive conditional-heteroskedastic ( GARCH )(1,1) model has the following parameters: =0.0005;=0.01;=0.98 The implied long-run volatility

I need 100% correct answer will be upvote

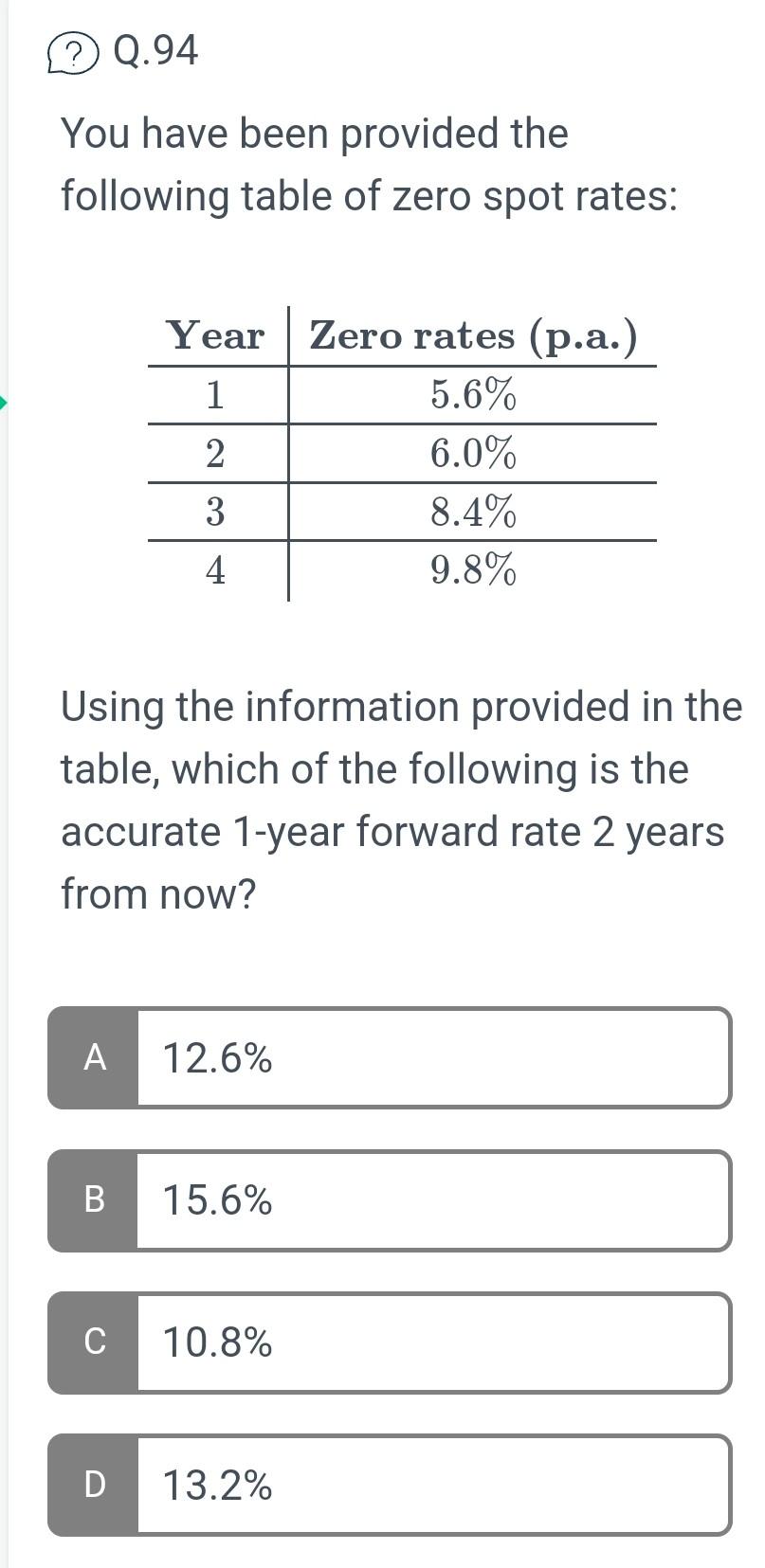

A generalized autoregressive conditional-heteroskedastic ( GARCH )(1,1) model has the following parameters: =0.0005;=0.01;=0.98 The implied long-run volatility level closest to: You have been provided the following table of zero spot rates: Using the information provided in the table, which of the following is the accurate 1-year forward rate 2 years from now

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock