Question: I need 100% correct answer will be upvote Malala Pham is an equity analyst. She has been asked to derive the beta of a stock

I need 100% correct answer will be upvote

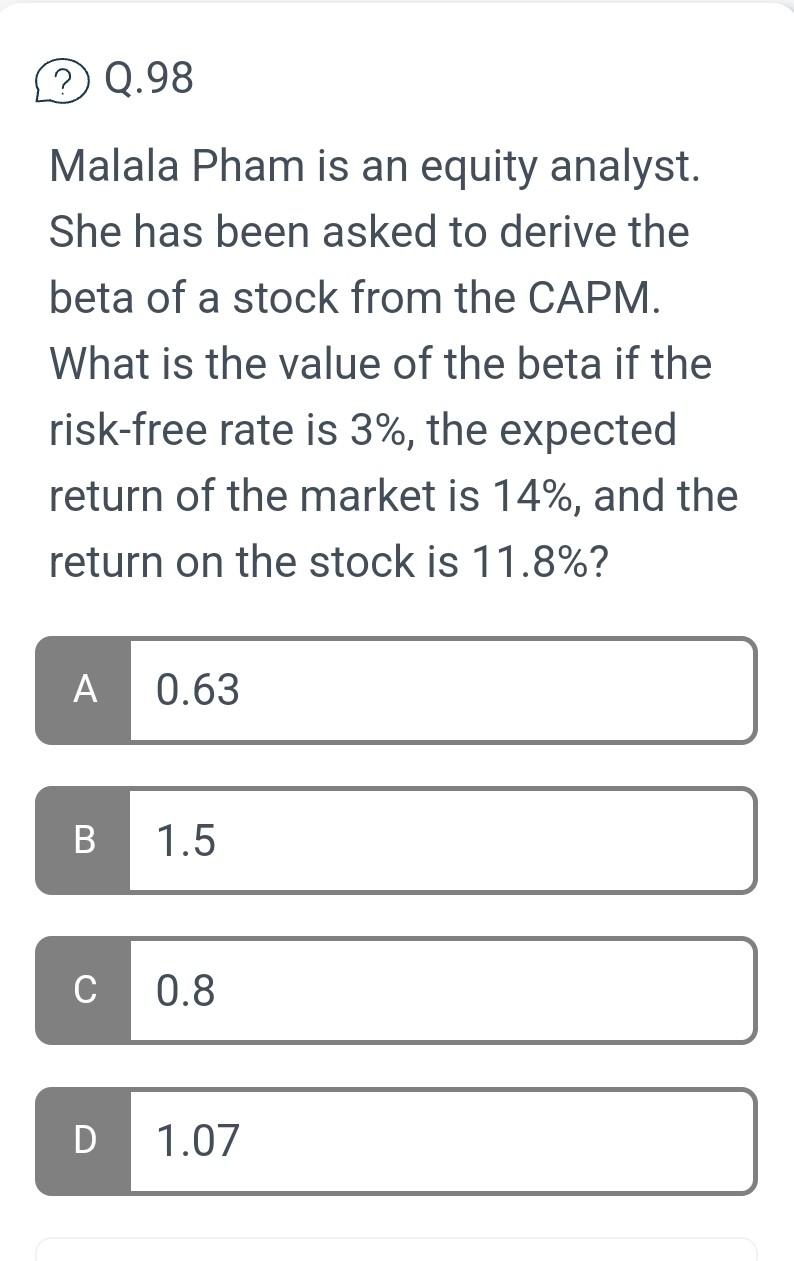

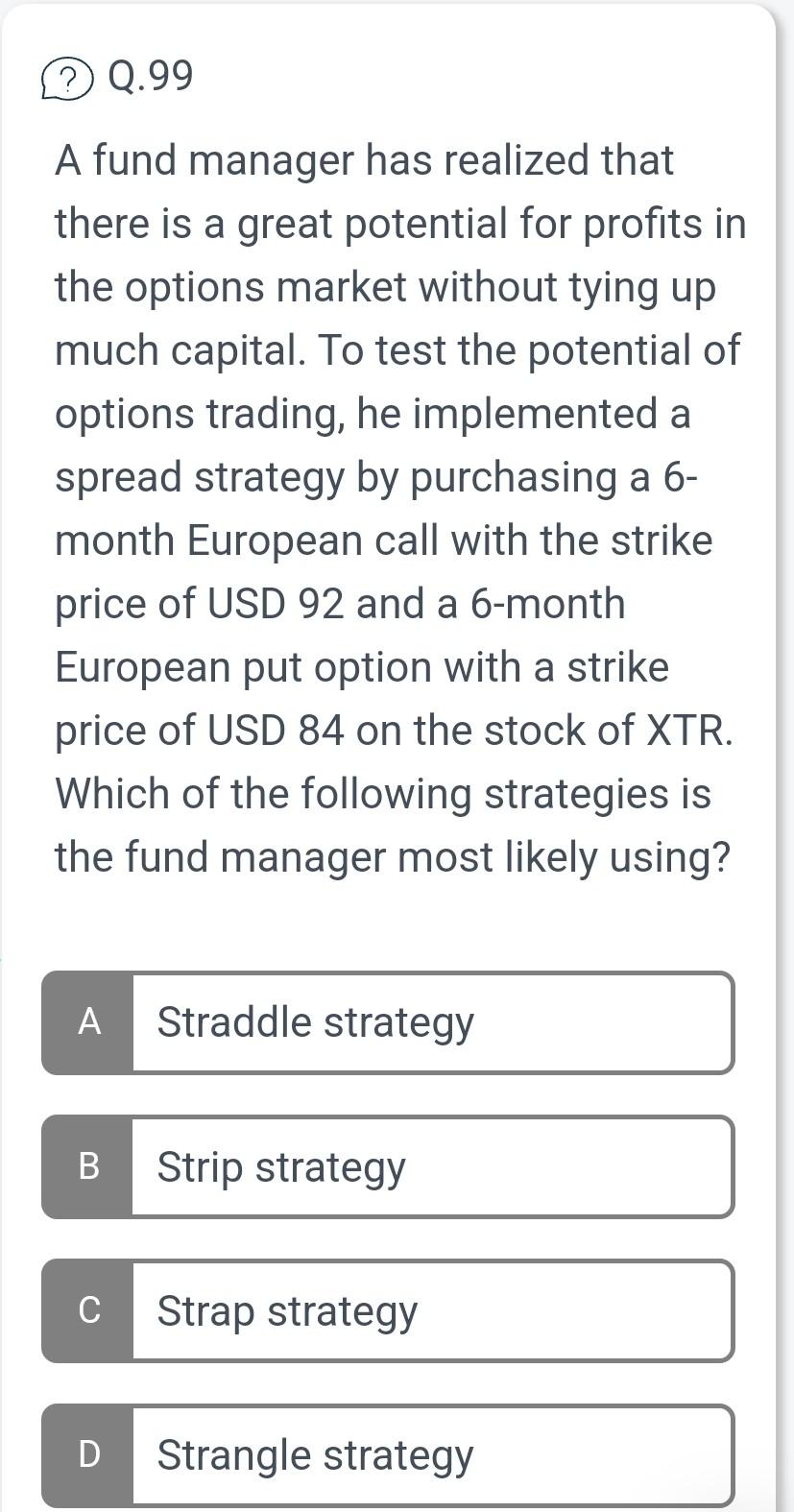

Malala Pham is an equity analyst. She has been asked to derive the beta of a stock from the CAPM. What is the value of the beta if the risk-free rate is 3%, the expected return of the market is 14%, and the return on the stock is 11.8% ? A fund manager has realized that there is a great potential for profits in the options market without tying up much capital. To test the potential of options trading, he implemented a spread strategy by purchasing a 6month European call with the strike price of USD 92 and a 6-month European put option with a strike price of USD 84 on the stock of XTR. Which of the following strategies is the fund manager most likely using

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts