Question: i need 10-11-12 bhoot Chapter 4 Worksheet 3 9. On April 1, 2018, Lancaster's Landscaping paid $36,000 for 12 months of rent to store their

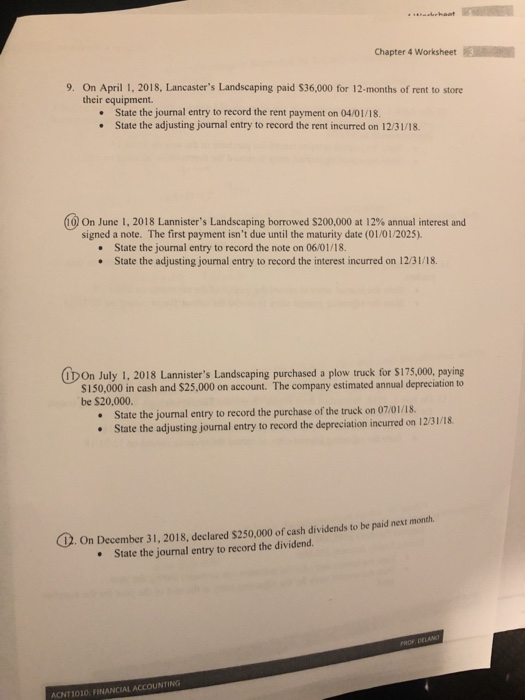

bhoot Chapter 4 Worksheet 3 9. On April 1, 2018, Lancaster's Landscaping paid $36,000 for 12 months of rent to store their equipment. State the journal entry to record the rent payment on 04/01/18. State the adjusting journal entry to record the rent incurred on 12/31/18. 60 On June 1, 2018 Lannister's Landscaping borrowed $200,000 at 12% annual interest and signed a note. The first payment isn't due until the maturity date (01/01/2025). State the journal entry to record the note on 06/01/18. State the adjusting journal entry to record the interest incurred on 12/31/18 (IDOn July 1, 2018 Lannister's Landscaping purchased a plow truck for $175,000, paying S150,000 in cash and $25,000 on account. The company estimated annual depreciation to be $20,000. State the journal entry to record the purchase of the truck on 07/01/18 State the adjusting journal entry to record the depreciation incurred on 12/31/18 2. On December 31, 2018, declared $250,000 of cash dividends to be paid next month State the journal entry to record the dividend. ACNT1010: FINANCIAL ACCOUNTING

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts