Question: I need 24th answer based on 23 question. thanks The data is given in 23 question. we use same data for 24 question 23. Net

I need 24th answer based on 23 question. thanks

The data is given in 23 question. we use same data for 24 question

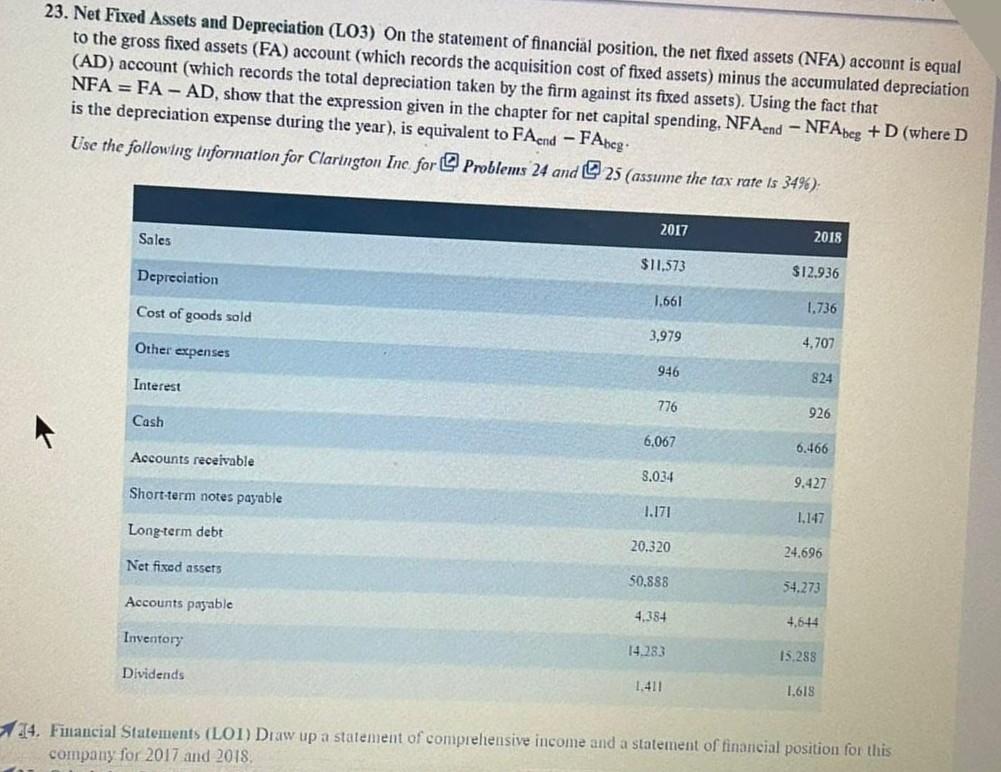

23. Net Fixed Assets and Depreciation (LO3) On the statement of financial position, the net fixed assets (NFA) account is equal to the gross fixed assets (FA) account (which records the acquisition cost of fixed assets) minus the accumulated depreciation (AD) account (which records the total depreciation taken by the firm against its fixed assets). Using the fact that NFA = FA - AD, show that the expression given in the chapter for net capital spending, NFAend - NFAbeg +D (where D is the depreciation expense during the year), is equivalent to FAend -FAbcg. Use the following Information for Clarington Inc. for Problems 24 and 25 (assume the tax rate is 34%) 2017 Sales 2018 $11,573 Depreciation $12.936 1.661 Cost of goods sold 1.736 3,979 Other expenses 4,707 946 Interest 824 776 926 Cash 6,067 6.466 Accounts receivable 8.034 9.427 Short-term notes payable 1.171 Long-term debt 20.320 24.696 Net fixed assets 50.888 54.273 Accounts payable 4,384 4,644 Inventory 14.283 15.288 Dividends 1,411 1.618 14. Financial Statements (LOI) Draw up a statement of comprehensive income and a statement of financial position for this company for 2017 and 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts