Question: i need 3-19 in excel would be greatly helpful Problems 2.3-17 Kenneth Brown is the principal owner of Brown Oil, Inc. After quitting his university

i need 3-19 in excel would be greatly helpful

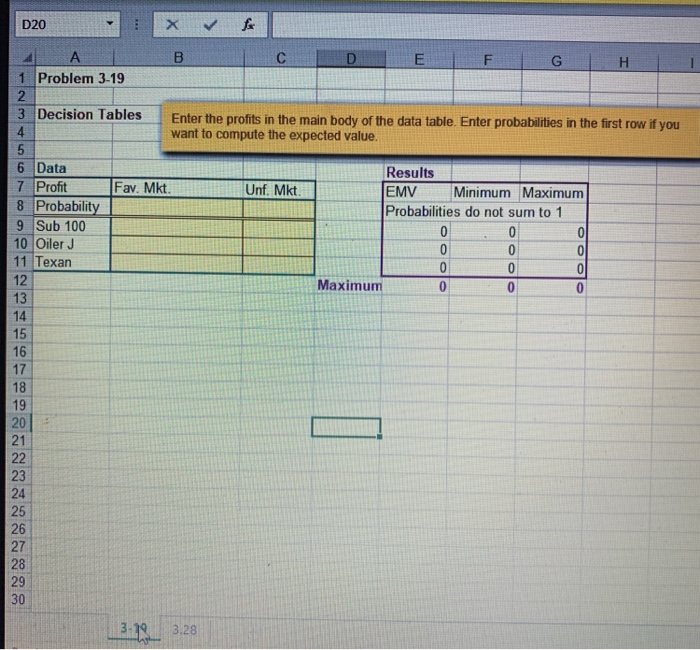

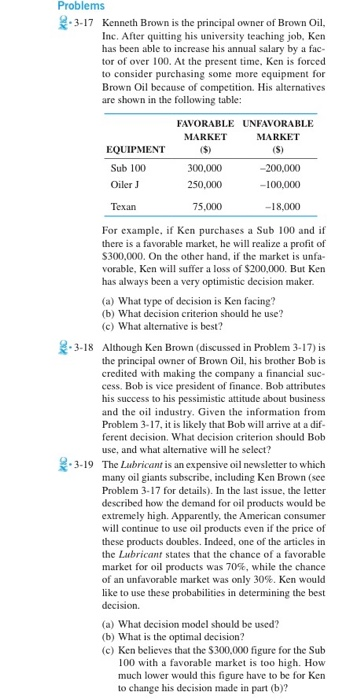

Problems 2.3-17 Kenneth Brown is the principal owner of Brown Oil, Inc. After quitting his university teaching job, Ken has been able to increase his annual salary by a fac- tor of over 100. At the present time, Ken is forced to consider purchasing some more equipment for Brown Oil because of competition. His alternatives are shown in the following table: FAVORABLE UNFAVORABLE MARKET MARKET EQUIPMENT (S) Sub 100 300,000 -200,000 Oiler 250,000 -100,000 Texan 75,000 -18,000 For example, if Ken purchases a Sub 100 and if there is a favorable market, he will realize a profit of $300,000. On the other hand, if the market is unfa- vorable, Ken will suffer a loss of $200,000. But Ken has always been a very optimistic decision maker. (a) What type of decision is Ken facing? (b) What decision criterion should he use? (c) What alternative is best? 8-3-18 Although Ken Brown (discussed in Problem 3-17) is the principal owner of Brown Oil, his brother Bob is credited with making the company a financial suc- cess. Bob is vice president of finance. Bob attributes his success to his pessimistic attitude about business and the oil industry. Given the information from Problem 3-17, it is likely that Bob will arrive at a dif- ferent decision. What decision criterion should Bob use, and what alternative will he select? 3-19 The Lubricant is an expensive oil newsletter to which many oil giants subscribe, including Ken Brown (see Problem 3-17 for details). In the last issue, the letter described how the demand for oil products would be extremely high. Apparently, the American consumer will continue to use oil products even if the price of these products doubles. Indeed, one of the articles in the Lubricant states that the chance of a favorable market for oil products was 70%, while the chance of an unfavorable market was only 30%. Ken would like to use these probabilities in determining the best decision (a) What decision model should be used? (b) What is the optimal decision? (C) Ken believes that the $300,000 figure for the Sub 100 with a favorable market is too high. How much lower would this figure have to be for Ken to change his decision made in part (b)? D20 fo A B D E G H 1 Problem 3-19 2 3 Decision Tables Enter the profits in the main body of the data table. Enter probabilities in the first row if you 4 want to compute the expected value. 5 6 Data Results 7 Profit Fav. Mkt. Unf. Mkt. EMV Minimum Maximum 8 Probability Probabilities do not sum to 1 9 Sub 100 0 0 10 Oiler J 0 0 0 11 Texan 0 0 0 12 Maximum 0 0 0 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 3-18 3.28

i need 3-19 in excel would be greatly helpful

i need 3-19 in excel would be greatly helpful