Question: I need 5-8 please. Can you provide formulas in excel please. Thank you. Questions 1-4: Time-Value of Money 1- A hypothetical private equity investment is

I need 5-8 please. Can you provide formulas in excel please. Thank you.

I need 5-8 please. Can you provide formulas in excel please. Thank you.

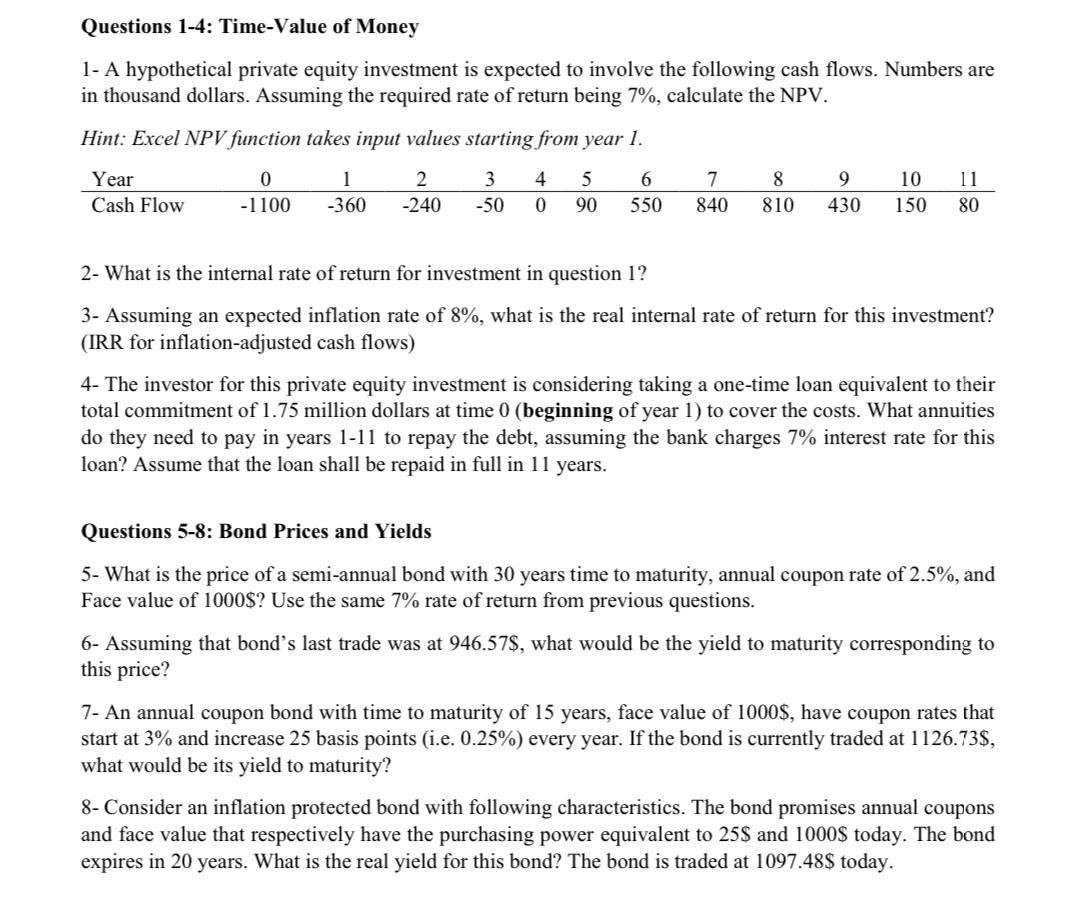

Questions 1-4: Time-Value of Money 1- A hypothetical private equity investment is expected to involve the following cash flows. Numbers are in thousand dollars. Assuming the required rate of return being 7\%, calculate the NPV. Hint: Excel NPV function takes input values starting from year 1. 2- What is the internal rate of return for investment in question 1 ? 3- Assuming an expected inflation rate of 8%, what is the real internal rate of return for this investment? (IRR for inflation-adjusted cash flows) 4- The investor for this private equity investment is considering taking a one-time loan equivalent to their total commitment of 1.75 million dollars at time 0 (beginning of year 1 ) to cover the costs. What annuities do they need to pay in years 1-11 to repay the debt, assuming the bank charges 7% interest rate for this loan? Assume that the loan shall be repaid in full in 11 years. Questions 5-8: Bond Prices and Yields 5 - What is the price of a semi-annual bond with 30 years time to maturity, annual coupon rate of 2.5%, and Face value of 1000$ ? Use the same 7% rate of return from previous questions. 6- Assuming that bond's last trade was at 946.57$, what would be the yield to maturity corresponding to this price? 7- An annual coupon bond with time to maturity of 15 years, face value of 1000$, have coupon rates that start at 3% and increase 25 basis points (i.e. 0.25% ) every year. If the bond is currently traded at 1126.73$, what would be its yield to maturity? 8- Consider an inflation protected bond with following characteristics. The bond promises annual coupons and face value that respectively have the purchasing power equivalent to 25$ and 1000$ today. The bond expires in 20 years. What is the real yield for this bond? The bond is traded at 1097.48$ today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts