Question: I need A, B, and C answered using the table provided please r 2016 is as follows (1) Projected sales 2) Cost of goods sold

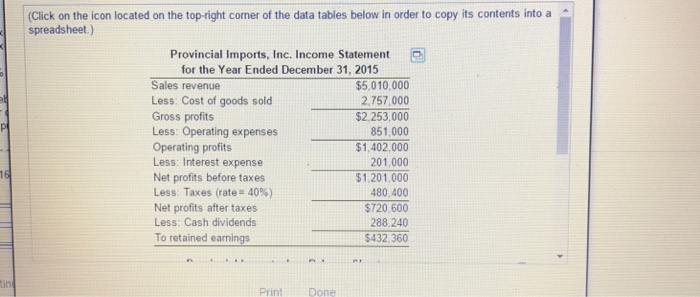

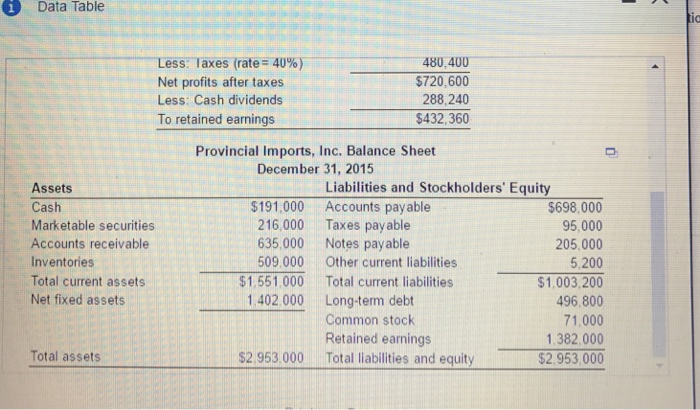

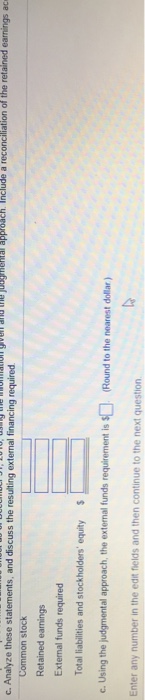

r 2016 is as follows (1) Projected sales 2) Cost of goods sold in 2015 includes $997 000 in fixed costs (3) Operating expense in 2015 includes $249,000 in fixed costs. (4) Interest (5) The firm will pay cash dividends amounting to 40% of net profits after taxes (6) Cash and double h Marketable securtios, notes payable long term debt, and common stock will remain unchanged 7) Marketable securities, notes accounts payable, and other current liabilitios will change in direct response to the change in sales (8) Accounts receivable (9) A new o (10) The tax rate wil remain at 40% a. Prepare a pro forma income statement for the year ended December 31, 2016, using the fixed cost data given to improv b. Prepare a pro forma balance sheet as of December 31, 2016, using the information given and the judgmental approac e. Analyze these statements, and dscuss the resulting extermal financing required stem costing $363,000 will be purchased during the year Total depreciation expens e for the year will be $107,000 e the accuracy of the percent of sales method en and the judgmental approach Include a reconclilation of the retained eamings account for the Year Ended December 31, 2016 Sales Less Cost of goods sold Gross profits Enter any number in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts