Question: i need a balance sheet on this information please here is the missing part, now can a balance sheet be done? Part A: Enter the

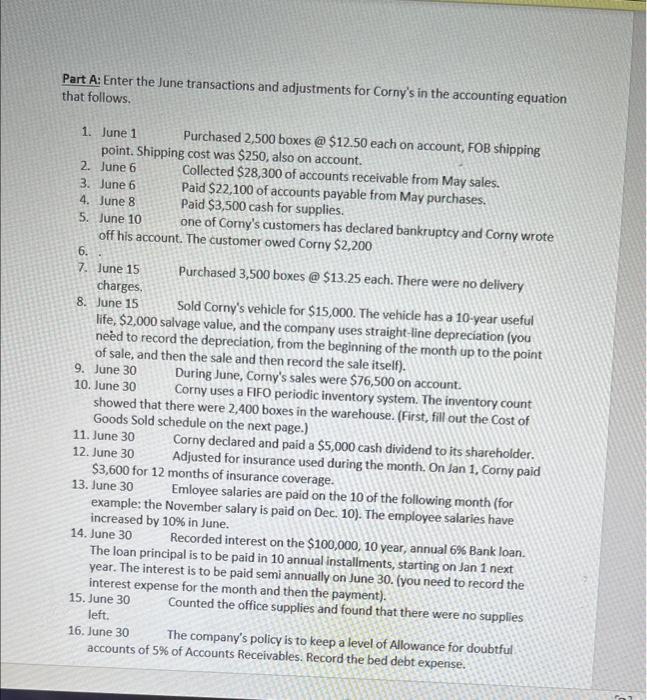

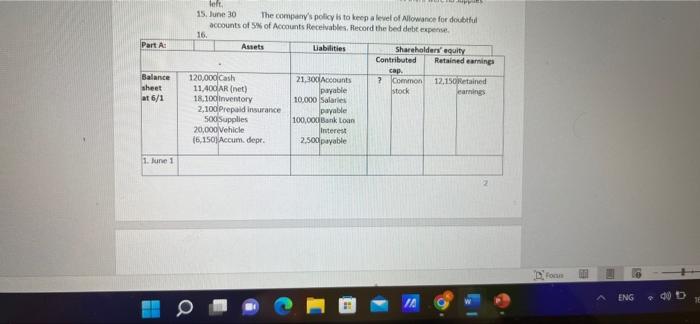

Part A: Enter the June transactions and adjustments for Corny's in the accounting equation that follows. 1. June 1 Purchased 2,500 boxes @ $12.50 each on account, FOB shipping point. Shipping cost was $250, also on account. June 6 2. 3. June 6 Collected $28,300 of accounts receivable from May sales. Paid $22,100 of accounts payable from May purchases. Paid $3,500 cash for supplies. 4. June 8 5. June 10 one of Corny's customers has declared bankruptcy and Corny wrote off his account. The customer owed Corny $2,200 6. 7. June 15 Purchased 3,500 boxes @ $13.25 each. There were no delivery charges. 8. June 15 Sold Corny's vehicle for $15,000. The vehicle has a 10-year useful life, $2,000 salvage value, and the company uses straight-line depreciation (you need to record the depreciation, from the beginning of the month up to the point of sale, and then the sale and then record the sale itself). 9. June 30 10. June 30 During June, Corny's sales were $76,500 on account. Corny uses a FIFO periodic inventory system. The inventory count showed that there were 2,400 boxes in the warehouse. (First, fill out the Cost of Goods Sold schedule on the next page.) 11. June 30 12. June 30 Corny declared and paid a $5,000 cash dividend to its shareholder. Adjusted for insurance used during the month. On Jan 1, Corny paid $3,600 for 12 months of insurance coverage. 13. June 30 Emloyee salaries are paid on the 10 of the following month (for example: the November salary is paid on Dec. 10). The employee salaries have increased by 10% in June. 14. June 30 Recorded interest on the $100,000, 10 year, annual 6% Bank loan. The loan principal is to be paid in 10 annual installments, starting on Jan 1 next year. The interest is to be paid semi annually on June 30. (you need to record the interest expense for the month and then the payment). 15. June 30 Counted the office supplies and found that there were no supplies left. 16. June 30 The company's policy is to keep a level of Allowance for doubtful accounts of 5% of Accounts Receivables. Record the bed debt expense. Part A: Balance sheet at 6/1 1. June 1 left. 15, June 30 The company's policy is to keep a level of Allowance for doubtful accounts of 5% of Accounts Receivables. Record the bed debt expense. 16. Assets Liabilities Shareholders' equity Contributed Retained earnings cap. 120,000 Cash 21,300 Accounts ? Common 12.150Retained 11,400 AR (net) payable stock earnings 18.100 Inventory 10,000 Salaries 2,100 Prepaid insurance payable 500Supplies 100,000 Bank Loan Interest 20,000 Vehicle (6,150) Accum. depr. 2,500 payable a Fors ENG . D 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts