Question: I need a completed version of the forms asked in the question please. 1:9-65 TAX FORM/RETURN PREPARATION PROBLEMS Heather and Nikolay Laubert are married and

I need a completed version of the forms asked in the question please.

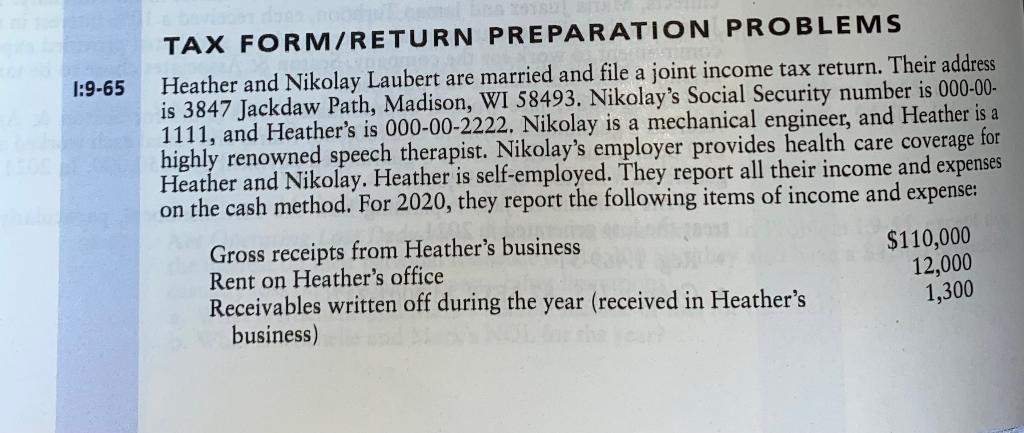

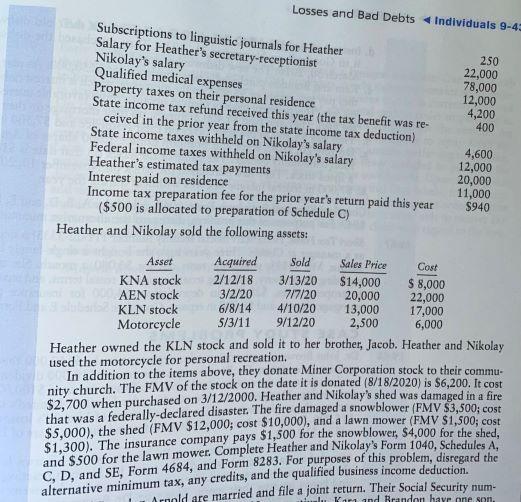

1:9-65 TAX FORM/RETURN PREPARATION PROBLEMS Heather and Nikolay Laubert are married and file a joint income tax return. Their address is 3847 Jackdaw Path, Madison, WI 58493. Nikolay's Social Security number is 000-00- 1111, and Heather's is 000-00-2222. Nikolay is a mechanical engineer, and Heather is a highly renowned speech therapist. Nikolay's employer provides health care coverage for Heather and Nikolay. Heather is self-employed. They report all their income and expenses on the cash method. For 2020, they report the following items of income and expense: Gross receipts from Heather's business $110,000 Rent on Heather's office Receivables written off during the year (received in Heather's business) 12,000 1,300 Losses and Bad Debts Individuals 9-43 Subscriptions to linguistic journals for Heather Salary for Heather's secretary-receptionist 250 Nikolay's salary 22,000 Qualified medical expenses 78,000 Property taxes on their personal residence 12,000 State income tax refund received this year (the tax benefit was re- 4,200 ceived in the prior year from the state income tax deduction) 400 State income taxes withheld on Nikolay's salary Federal income taxes withheld on Nikolay's salary 4,600 Heather's estimated tax payments 12,000 Interest paid on residence 20,000 11,000 Income tax preparation fee for the prior year's return paid this year $940 ($500 is allocated to preparation of Schedule C) Heather and Nikolay sold the following assets: Asset Acquired Sold Sales Price Cost KNA stock 2/12/18 3/13/20 $14,000 $ 8,000 AEN stock 3/2/20 7/7/20 20,000 22,000 KLN stock 6/8/14 4/10/20 13,000 17,000 5/3/11 9/12/20 Motorcycle 2,500 6,000 Heather owned the KLN stock and sold it to her brother, Jacob. Heather and Nikolay used the motorcycle for personal recreation. In addition to the items above, they donate Miner Corporation stock to their commu- nity church. The FMV of the stock on the date it is donated (8/18/2020) is $6,200. It cost $2,700 when purchased on 3/12/2000. Heather and Nikolay's shed was damaged in a fire that was a federally-declared disaster . The fire damaged a snowblower (FMV 53,500; cost a $5,000), the shed (FMV $12,000, cost $10,000), and a lawn mower (FMV $1,500; cost $1,300). The insurance company pays $1,500 for the snowblower, $4,000 for the shed, and $500 for the lawn mower . Complete Heather and Nikolay's Form 1040, Schedules A. C, D, and SE, Form 4684, and Form 8283. For purposes of this problem, disregard the alternative minimum tax, any credits, and the qualified business income deduction Arnold are married and file a joint return. Their Social Security num- Kan and Brandon hayr one son 1:9-65 TAX FORM/RETURN PREPARATION PROBLEMS Heather and Nikolay Laubert are married and file a joint income tax return. Their address is 3847 Jackdaw Path, Madison, WI 58493. Nikolay's Social Security number is 000-00- 1111, and Heather's is 000-00-2222. Nikolay is a mechanical engineer, and Heather is a highly renowned speech therapist. Nikolay's employer provides health care coverage for Heather and Nikolay. Heather is self-employed. They report all their income and expenses on the cash method. For 2020, they report the following items of income and expense: Gross receipts from Heather's business $110,000 Rent on Heather's office Receivables written off during the year (received in Heather's business) 12,000 1,300 Losses and Bad Debts Individuals 9-43 Subscriptions to linguistic journals for Heather Salary for Heather's secretary-receptionist 250 Nikolay's salary 22,000 Qualified medical expenses 78,000 Property taxes on their personal residence 12,000 State income tax refund received this year (the tax benefit was re- 4,200 ceived in the prior year from the state income tax deduction) 400 State income taxes withheld on Nikolay's salary Federal income taxes withheld on Nikolay's salary 4,600 Heather's estimated tax payments 12,000 Interest paid on residence 20,000 11,000 Income tax preparation fee for the prior year's return paid this year $940 ($500 is allocated to preparation of Schedule C) Heather and Nikolay sold the following assets: Asset Acquired Sold Sales Price Cost KNA stock 2/12/18 3/13/20 $14,000 $ 8,000 AEN stock 3/2/20 7/7/20 20,000 22,000 KLN stock 6/8/14 4/10/20 13,000 17,000 5/3/11 9/12/20 Motorcycle 2,500 6,000 Heather owned the KLN stock and sold it to her brother, Jacob. Heather and Nikolay used the motorcycle for personal recreation. In addition to the items above, they donate Miner Corporation stock to their commu- nity church. The FMV of the stock on the date it is donated (8/18/2020) is $6,200. It cost $2,700 when purchased on 3/12/2000. Heather and Nikolay's shed was damaged in a fire that was a federally-declared disaster . The fire damaged a snowblower (FMV 53,500; cost a $5,000), the shed (FMV $12,000, cost $10,000), and a lawn mower (FMV $1,500; cost $1,300). The insurance company pays $1,500 for the snowblower, $4,000 for the shed, and $500 for the lawn mower . Complete Heather and Nikolay's Form 1040, Schedules A. C, D, and SE, Form 4684, and Form 8283. For purposes of this problem, disregard the alternative minimum tax, any credits, and the qualified business income deduction Arnold are married and file a joint return. Their Social Security num- Kan and Brandon hayr one son

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts