Question: i need a detailed solution please, from A to Z ! Advanced Accounting ACCT442 ACCT432 Case 2 - Foreign Currency Financial Statements FASB No. 52,

i need a detailed solution please, from A to Z !

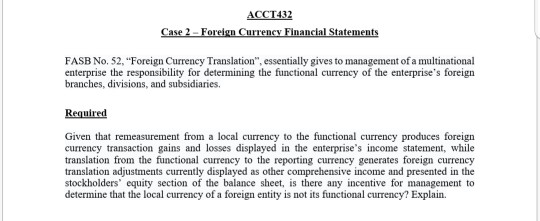

"Advanced Accounting "ACCT442"

ACCT432 Case 2 - Foreign Currency Financial Statements FASB No. 52, "Foreign Currency Translation", essentially gives to management of a multinational enterprise the responsibility for determining the functional currency of the enterprise's foreign branches, divisions, and subsidiaries. Required Given that remeasurement from a local currency to the functional currency produces foreign currency transaction gains and losses displayed in the enterprise's income statement, while translation from the functional currency to the reporting currency generates foreign currency translation adjustments currently displayed as other comprehensive income and presented in the stockholders' equity section of the balance sheet, is there any incentive for management to determine that the local currency of a foreign entity is not its functional currency? Explain. ACCT432 Case 2 - Foreign Currency Financial Statements FASB No. 52, "Foreign Currency Translation", essentially gives to management of a multinational enterprise the responsibility for determining the functional currency of the enterprise's foreign branches, divisions, and subsidiaries. Required Given that remeasurement from a local currency to the functional currency produces foreign currency transaction gains and losses displayed in the enterprise's income statement, while translation from the functional currency to the reporting currency generates foreign currency translation adjustments currently displayed as other comprehensive income and presented in the stockholders' equity section of the balance sheet, is there any incentive for management to determine that the local currency of a foreign entity is not its functional currency? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts