Question: I need a different example for this question than this one on chegg In your initial post, you will need to include the following: 1.

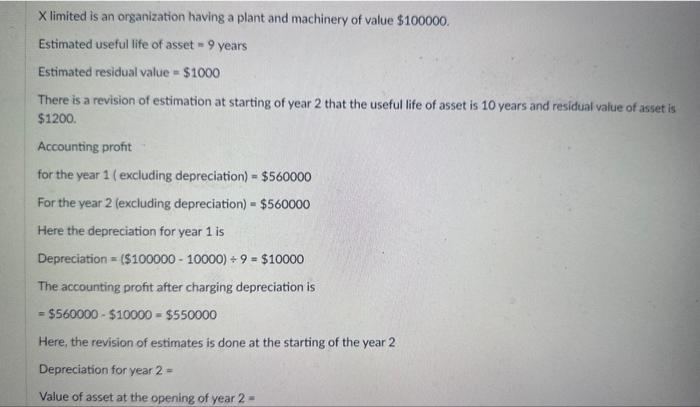

In your initial post, you will need to include the following: 1. What are the estimates when calculating depreciation 2. Which estimates may be revised 3. What happens when you make a change in estimate 4. How the change affects future calculations 5. Provide a simple example (if you cannot find one, make up your own) 6. Cite and give credit to the author that you are citing Reply to a Classmate After you have completed the initial post, you will need to reply to at least one classmate. The reply may contain any of the following: 1. Reinstate briefly, what your classmate has discussed 2. Extend your classmate's posting with additional information 3. If available, suggest alternatives to your classmate's opinion. X limited is an organization having a plant and machinery of value $100000. Estimated useful life of asset =9 years Estimated residual value =$1000 There is a revision of estimation at starting of year 2 that the useful life of asset is 10 years and residual value of asset is $1200. Accounting profit for the year 1 (excluding depreciation) =$560000 For the year 2 (excluding depreciation) =$560000 Here the depreciation for year 1 is Depreciation =($10000010000)9=$10000 The accounting profit after charging depreciation is =$560000$10000=$550000 Here, the revision of estimates is done at the starting of the year 2 Depreciation for year 2= Value of asset at the opening of year 2=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts