Question: I need a explain why 'No journal entry required' part is no journal entry Exercise 2-22 (Static) Reversing entries [Appendix 2B] The following transactions occurred

![no journal entry Exercise 2-22 (Static) Reversing entries [Appendix 2B] The following](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea5feccd6aa_01266ea5fec5a200.jpg)

I need a explain why 'No journal entry required' part is no journal entry

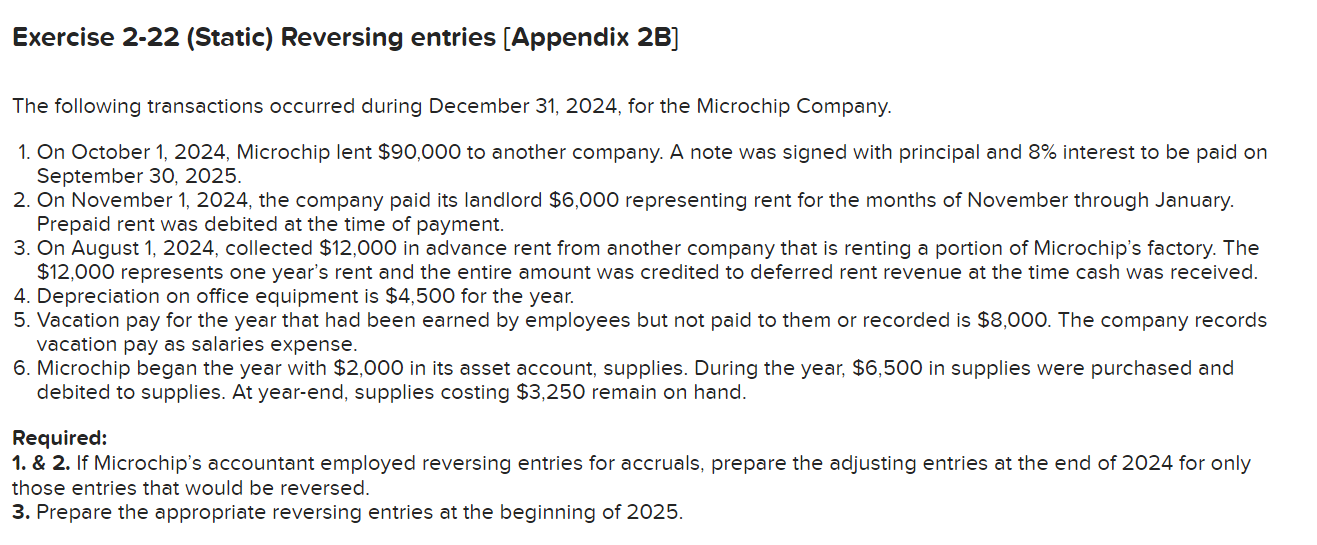

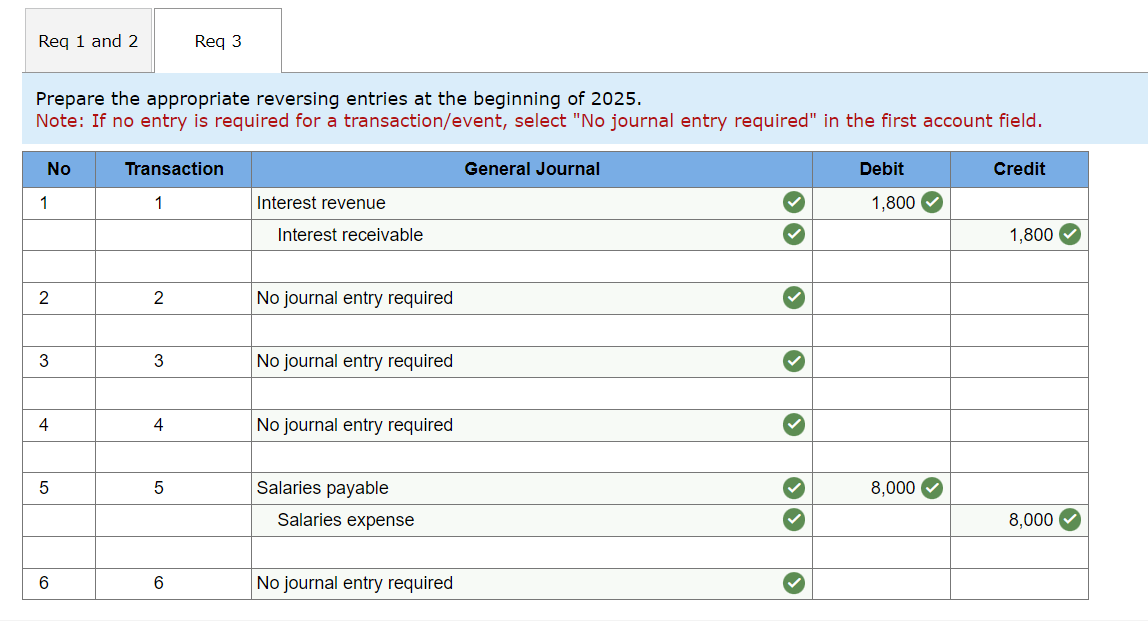

Exercise 2-22 (Static) Reversing entries [Appendix 2B] The following transactions occurred during December 31, 2024, for the Microchip Company. 1. On October 1, 2024, Microchip lent $90,000 to another company. A note was signed with principal and 8% interest to be paid on September 30, 2025. 2. On November 1, 2024, the company paid its landlord $6,000 representing rent for the months of November through January. Prepaid rent was debited at the time of payment. 3. On August 1, 2024, collected $12,000 in advance rent from another company that is renting a portion of Microchip's factory. The $12,000 represents one year's rent and the entire amount was credited to deferred rent revenue at the time cash was received. 4. Depreciation on office equipment is $4,500 for the year. 5. Vacation pay for the year that had been earned by employees but not paid to them or recorded is $8,000. The company records vacation pay as salaries expense. 6. Microchip began the year with $2,000 in its asset account, supplies. During the year, $6,500 in supplies were purchased and debited to supplies. At year-end, supplies costing $3,250 remain on hand. Required: 1. \& 2. If Microchip's accountant employed reversing entries for accruals, prepare the adjusting entries at the end of 2024 for only those entries that would be reversed. 3. Prepare the appropriate reversing entries at the beginning of 2025 . If Microchip's accountant employed reversing entries for accruals, prepare the adjusting entries at the end of 2024 for only those entries that would be reversed. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Prepare the appropriate reversing entries at the beginning of 2025 . Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts