Question: I need a help please. I will really appriciate. Thank you. Required information The Foundational 15 (LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-7, LO6-8) [The following

I need a help please. I will really appriciate. Thank you.

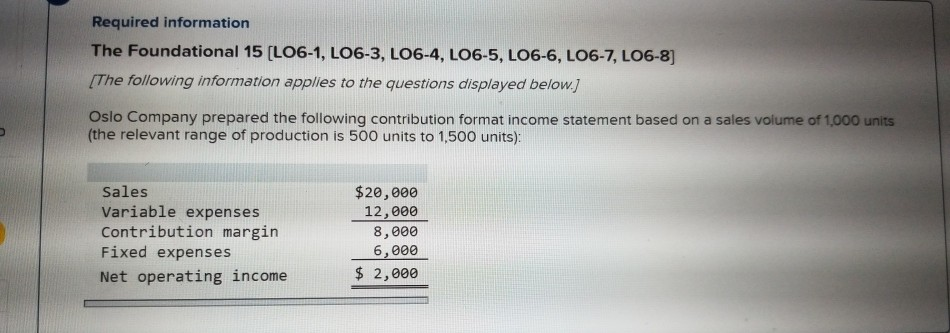

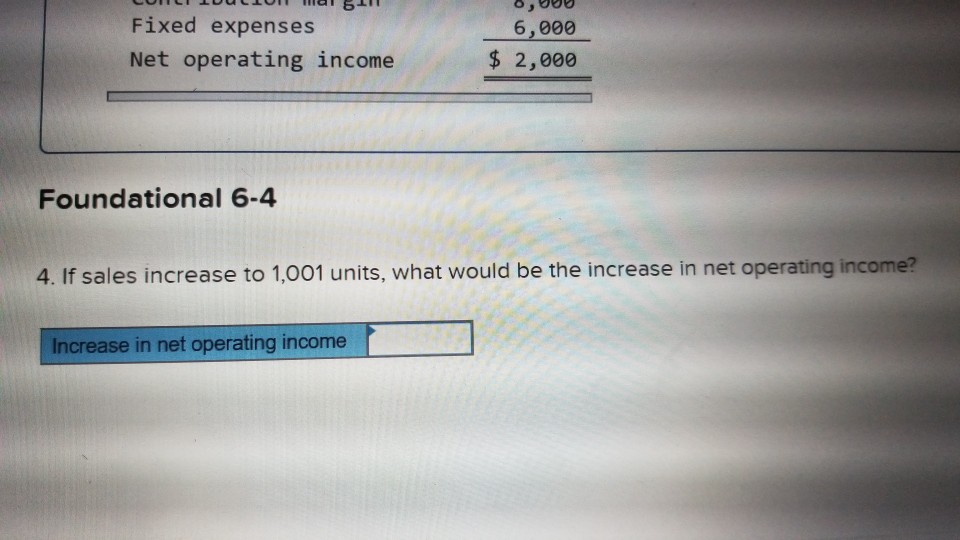

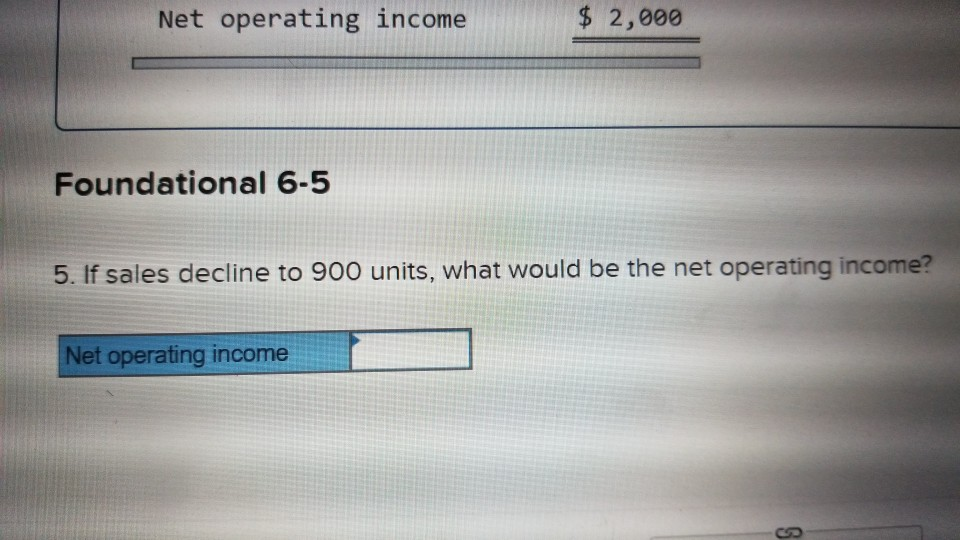

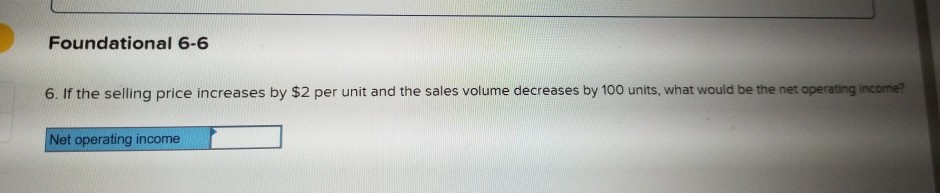

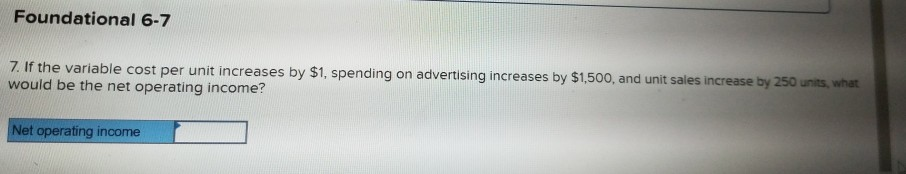

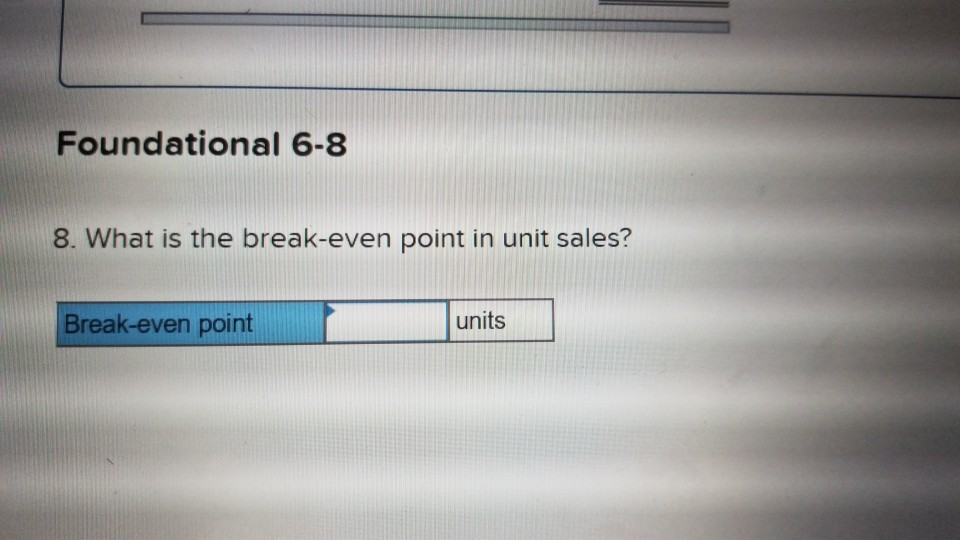

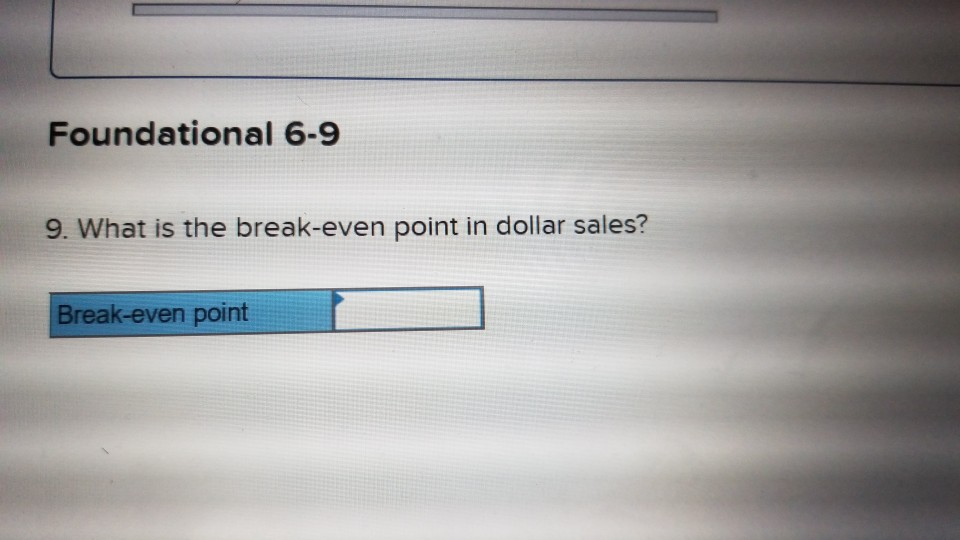

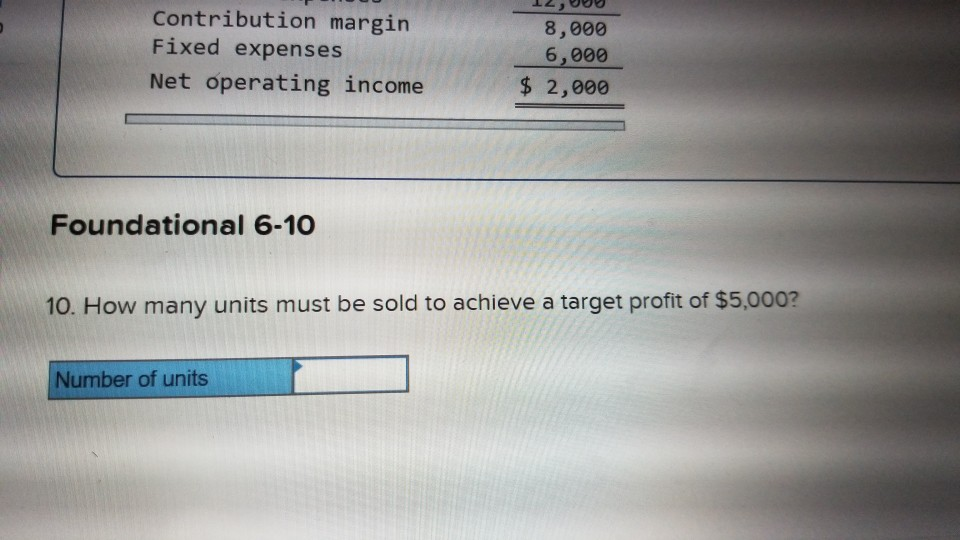

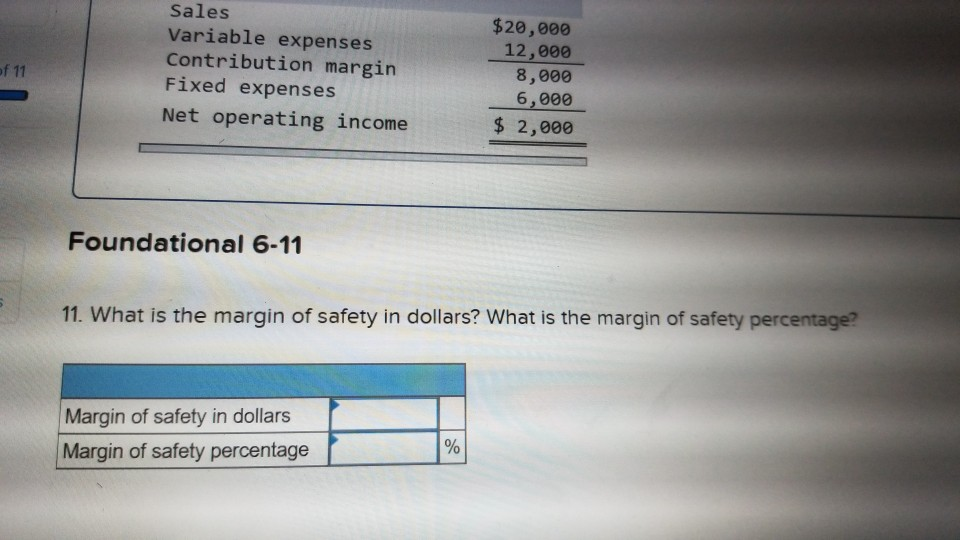

Required information The Foundational 15 (LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-7, LO6-8) [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses Net operating income $20,000 12,000 8,000 6,000 $ 2,000 Foundational 6-1 Required: 1. What is the contribution margin per unit? Foundational 6-2 2. What is the contribution margin ratio? Contribution margin ratio Foundational 6-3 3. What is the variable expense ratio? Variable expense ratio CUILI IUULIUH Hal 61 Fixed expenses Net operating income O,DU 6,000 $ 2,000 Foundational 6-4 4. If sales increase to 1,001 units, what would be the increase in net operating income? Increase in net operating income Net operating income $ 2,000 Foundational 6-5 5. If sales decline to 900 units, what would be the net operating income? Net operating income Foundational 6-6 6. If the selling price increases by $2 per unit and the sales volume decreases by 100 units, what would be the net operating income? Net operating income Foundational 6-7 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,500, and unit sales increase by 250 units, what would be the net operating income? Net operating income Foundational 6-8 8. What is the break-even point in unit sales? Break-even point units Foundational 6-9 9. What is the break-even point in dollar sales? Break-even point 12,00 Contribution margin Fixed expenses Net operating income 8,000 6,000 $ 2,000 Foundational 6-10 10. How many units must be sold to achieve a target profit of $5,000? Number of units of 11 Sales Variable expenses Contribution margin Fixed expenses Net operating income $20,000 12,000 8,900 6,000 $ 2,000 Foundational 6-11 11. What is the margin of safety in dollars? What is the margin of safety percentage? Margin of safety in dollars Margin of safety percentage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts