Question: I need a number answer. If multiple numbers are given I will down vote. Please be clear I need answer not explanation LeMond Incorporated, a

I need a number answer. If multiple numbers are given I will down vote. Please be clear I need answer not explanation

I need a number answer. If multiple numbers are given I will down vote. Please be clear I need answer not explanation

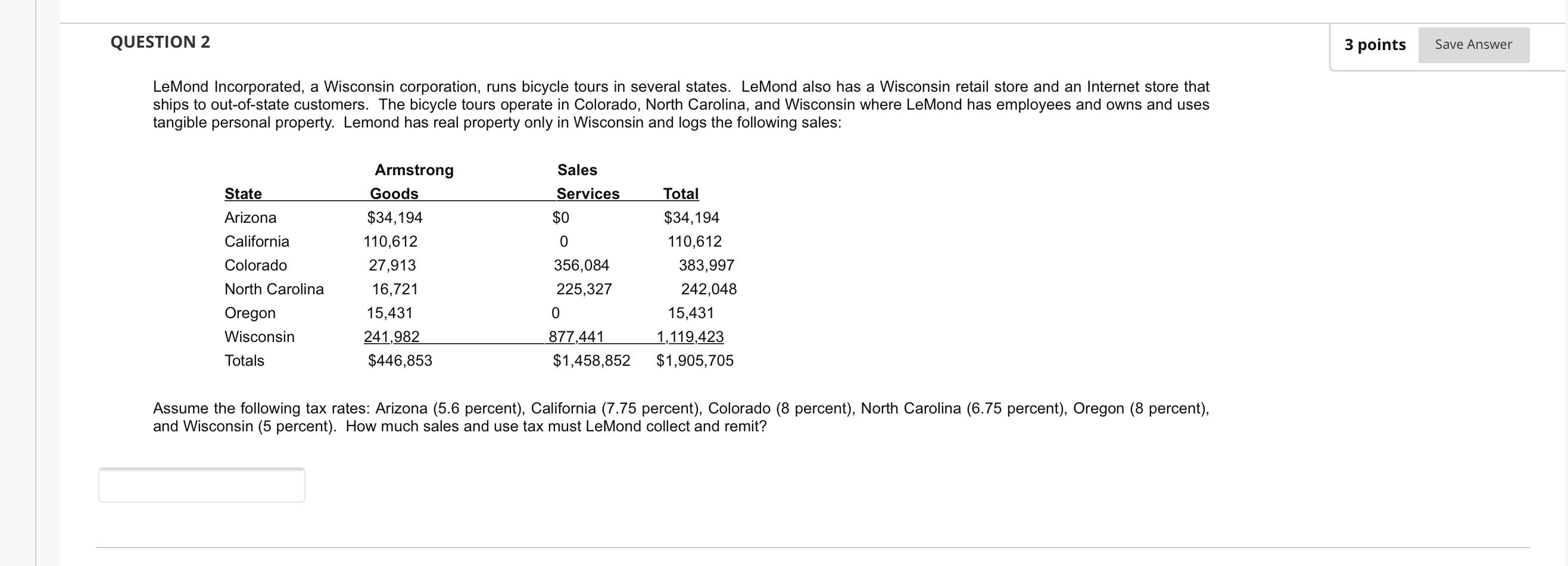

LeMond Incorporated, a Wisconsin corporation, runs bicycle tours in several states. LeMond also has a Wisconsin retail store and an Internet store that ships to out-of-state customers. The bicycle tours operate in Colorado, North Carolina, and Wisconsin where LeMond has employees and owns and uses tangible personal property. Lemond has real property only in Wisconsin and logs the following sales: Assume the following tax rates: Arizona (5.6 percent), California (7.75 percent), Colorado (8 percent), North Carolina (6.75 percent), Oregon (8 percent), and Wisconsin (5 percent). How much sales and use tax must LeMond collect and remit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts