Question: i need a quick answer to a financial Accounting beginner course. when calculating loansand interest payment like in this picture(you can ignore the question, its

i need a quick answer to a financial Accounting beginner course. when calculating loansand interest payment like in this picture(you can ignore the question, its just to make an example) under the interest expense column, do you calculate it like 500,0004% or 500,0004%/12, or is there a distinction between them like the first one is for Calculating yearly and second one is monthly

it has been bothering me

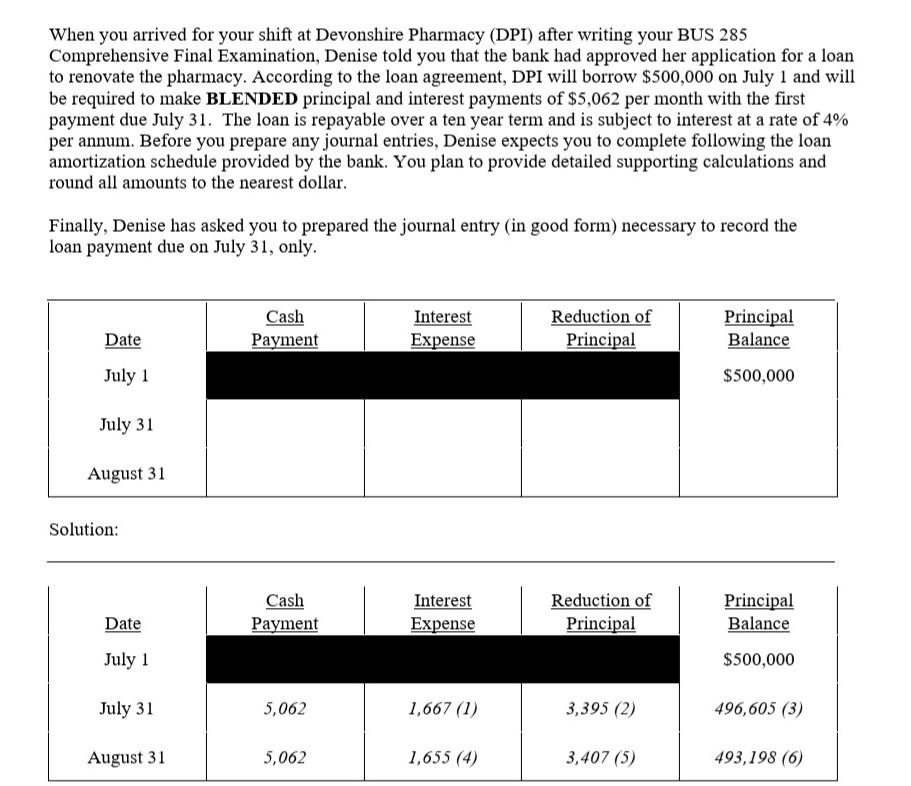

When you arrived for your shift at Devonshire Pharmacy (DPI) after writing your BUS 285 Comprehensive Final Examination, Denise told you that the bank had approved her application for a loan to renovate the pharmacy. According to the loan agreement, DPI will borrow $500,000 on July 1 and will be required to make BLENDED principal and interest payments of $5,062 per month with the first payment due July 31. The loan is repayable over a ten year term and is subject to interest at a rate of 4% per annum. Before you prepare any journal entries, Denise expects you to complete following the loan amortization schedule provided by the bank. You plan to provide detailed supporting calculations and round all amounts to the nearest dollar. Finally, Denise has asked you to prepared the journal entry in good form) necessary to record the loan payment due on July 31, only. Cash Payment Interest Expense Reduction of Principal Principal Balance Date July 1 $500,000 July 31 August 31 Solution: Cash Payment Interest Expense Reduction of Principal Principal Balance Date July 1 $500,000 July 31 5,062 1,667 (1) 3,395 (2) 496,605 (3) August 31 5,062 1,655 (4) 3,407 (5) 493,198 (6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts