Question: 11. SELECT THE BEST ANSWER (60 points) 1. Generally accepted accounting principles require that certain lease agreements be accounted for as purchases. The theoretical

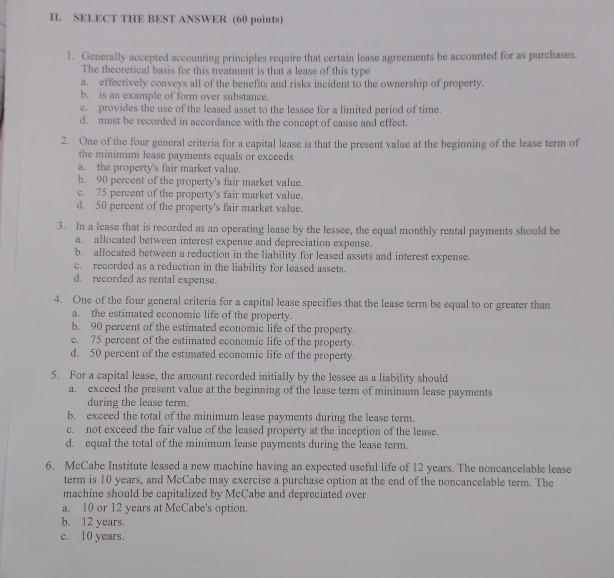

11. SELECT THE BEST ANSWER (60 points) 1. Generally accepted accounting principles require that certain lease agreements be accounted for as purchases. The theoretical basis for this treatment is that a lease of this type a. effectively conveys all of the benefits and risks incident to the ownership of property.. b. is an example of form over substance. c. provides the use of the leased asset to the lessee for a limited period of time. d. must be recorded in accordance with the concept of causse and effect. 2. One of the four general criteria for a capital lease is that the present value at the beginning of the lease term of the minimum lease payments equals or exceeds a. the property's fair market value. b. 90 percent of the property's fair market value. c. 75 percent of the property's fair market value. d. 50 percent of the property's fair market value. 3. In a lease that is recorded as an operating lease by the lessee, the equal monthly rental payments should be a. allocated between interest expense and depreciation expense. b. allocated between a reduction in the liability for leased assets and interest expense. c. recorded as a reduction in the liability for leased assets. d. recorded as rental expense. 4. One of the four general criteria for a capital lease specifies that the lease term be equal to or greater than a. the estimated economic life of the property. b. 90 percent of the estimated economic life of the property. c. 75 percent of the estimated economic life of the property. d. 50 percent of the estimated economic life of the property. 5. For a capital lease, the amount recorded initially by the lessee as a liability should a. exceed the present value at the beginning of the lease term of minimum lease payments during the lease term. b. exceed the total of the minimum lease payments during the lease term. C. not exceed the fair value of the leased property at the inception of the lease. d. equal the total of the minimum lease payments during the lease term. 6. McCabe Institute leased a new machine having an expected useful life of 12 years. The noncancelable lease term is 10 years, and McCabe may exercise a purchase option at the end of the noncancelable term. The machine should be capitalized by McCabe and depreciated over a. 10 or 12 years at McCabe's option. b. 12 years. c. 10 years.

Step by Step Solution

There are 3 Steps involved in it

StepbyStep Answer with Explanation Question 1 Theoretical Basis for Lease Accounting Answer a Effectively conveys all of the benefits and risks incident to the ownership of property Explanation Genera... View full answer

Get step-by-step solutions from verified subject matter experts