Question: i need a specified soution, amd an explanation for what we do with the fraction when the construction end before the loan end do we

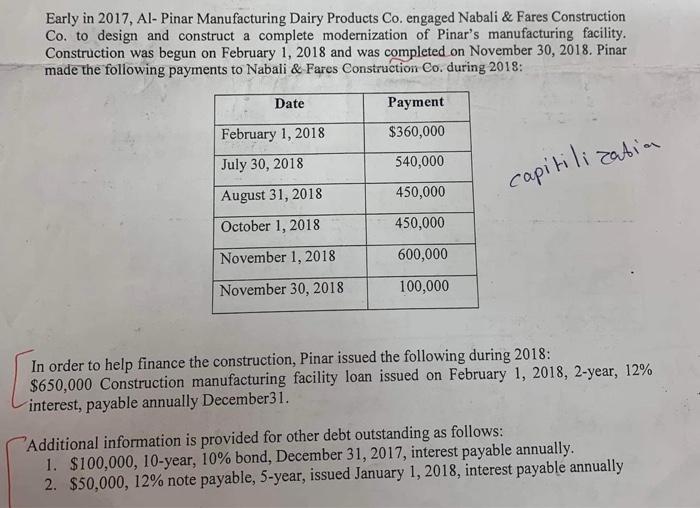

Early in 2017, Al- Pinar Manufacturing Dairy Products Co. engaged Nabali & Fares Construction Co. to design and construct a complete modernization of Pinar's manufacturing facility. Construction was begun on February 1, 2018 and was completed on November 30, 2018. Pinar made the following payments to Nabali & Fares Construction Co. during 2018: Date Payment $360,000 February 1, 2018 July 30, 2018 540,000 capitilization August 31, 2018 450,000 October 1, 2018 450,000 November 1, 2018 600,000 November 30, 2018 100,000 In order to help finance the construction, Pinar issued the following during 2018: $650,000 Construction manufacturing facility loan issued on February 1, 2018, 2-year, 12% interest, payable annually December 31. Additional information is provided for other debt outstanding as follows: 1. $100,000, 10-year, 10% bond, December 31, 2017, interest payable annually. 2. $50,000, 12% note payable, 5-year, issued January 1, 2018, interest payable annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts