Question: I need a statement of Cash Flows Indirect Method. . *** dos Grace Grace Enterprises, Inc - Balance Sheet Enterpr ises, Change 2010 2009 Cash

I need a statement of Cash Flows Indirect Method.

I need a statement of Cash Flows Indirect Method.

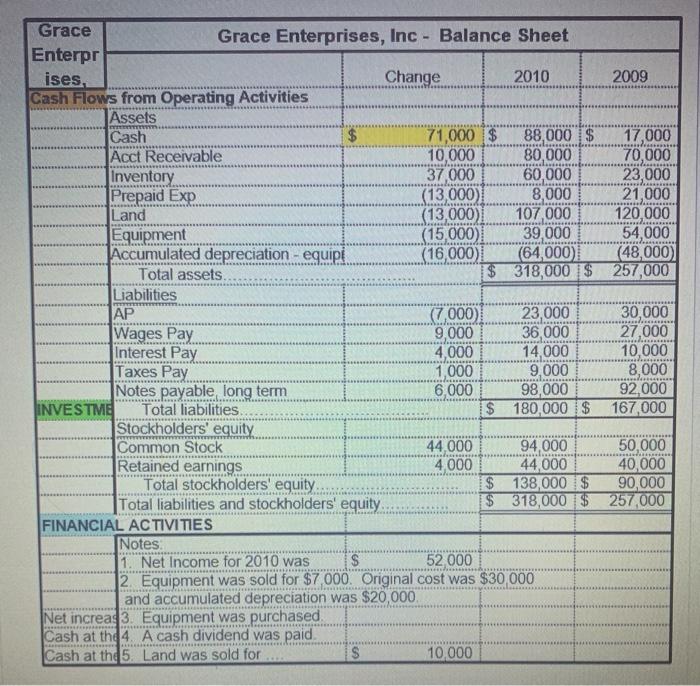

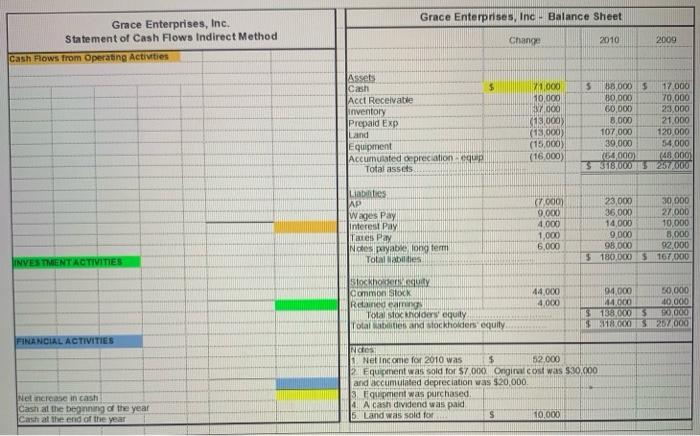

. *** dos Grace Grace Enterprises, Inc - Balance Sheet Enterpr ises, Change 2010 2009 Cash Flows from Operating Activities Assets Cash $ 71,000 $ 88,000 $ 17,000 Acct Receivable 10,000 80,000 70,000 Inventory 37,000 60,000 23,000 Prepaid Exp (13,000) 8,000 21,000 Land (13,000) 107,000 120,000 Equipment (15,000) 39,000 54,000 Accumulated depreciation - equipi (16,000) (64,000) (48,000) Total assets. $ 318,000 $ 257,000 Liabilities AP (7,000) 23,000 30,000 Wages Pay. 9,000 36,000 27,000 Interest Pay 4,000 14,000 10,000 Taxes Pay 1,000 9,000 8,000 Notes payable long term 6,000 98,000 92,000 JINVESTME Total liabilities $ 180,000 $ 167,000 Stockholders' equity Common Stock 44,000 94,000 50,000 Retained earnings 4,000 44,000 40,000 Total stockholders' equity. $ 138,000 $ 90,000 Total liabilities and stockholders' equity $ 318,000 $ 257,000 FINANCIAL ACTIVITIES Notes 1. Net Income for 2010 was $ 52 000 12. Equipment was sold for $7,000. Original cost was $30 000 and accumulated depreciation was $20,000 Net increas 3. Equipment was purchased Cash at thg 4. A cash dividend was paid. Cash at thd 5. Land was sold for S 10,000 7. Grace Enterprises, Inc - Balance Sheet Grace Enterprises, Inc. Statement of Cash Flows Indirect Method Cash Flows from Operating Activities Change 2010 2009 Assets Cash $ Acct Receivable inventory Prepaid Exp Land Equipment Accumulated opreciation equp Total assets 71.000 10,000 37 000 (15000) (18,000) (15,000) (16.000 5 BB DOS 17 000 B0.000 70,000 60,000) 23.000 3.000 21000 107 000 120.000 39,000 54.000 (5000) 3 318,000257000 148 000) Liabities AP Wages Pay interest Pay Tanes Pay Notes payable long term Total abilities (7.000 9,000 4,000 1,000 6,000 23,000 30.000 36,000 27.000 14,000 10,000 9,000 3.000 98,000 $2,000 $ 180 DOX) 5107 000 INVESTMENT ACTIVITIES Stockholm Common Stock Rademang Total stockholder equity Totalities and stockholders equity 44,000 4.000 94,000 50,000 44.000 40,000 $ 138.000 3 0,000 $XOS 267 000 FINANCIAL ACTIVITIES Notes Net income for 2010 was $ 52.000 2 Equipment was sold for 57 000. Ongira cost was $30.000 and accumulated depreciation was $20,000 3 Equipment was purchased A cash dividend was paid 5. Land was sold for S 10,000 Net increase in cash Cash at the beginning of the year Cast at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts