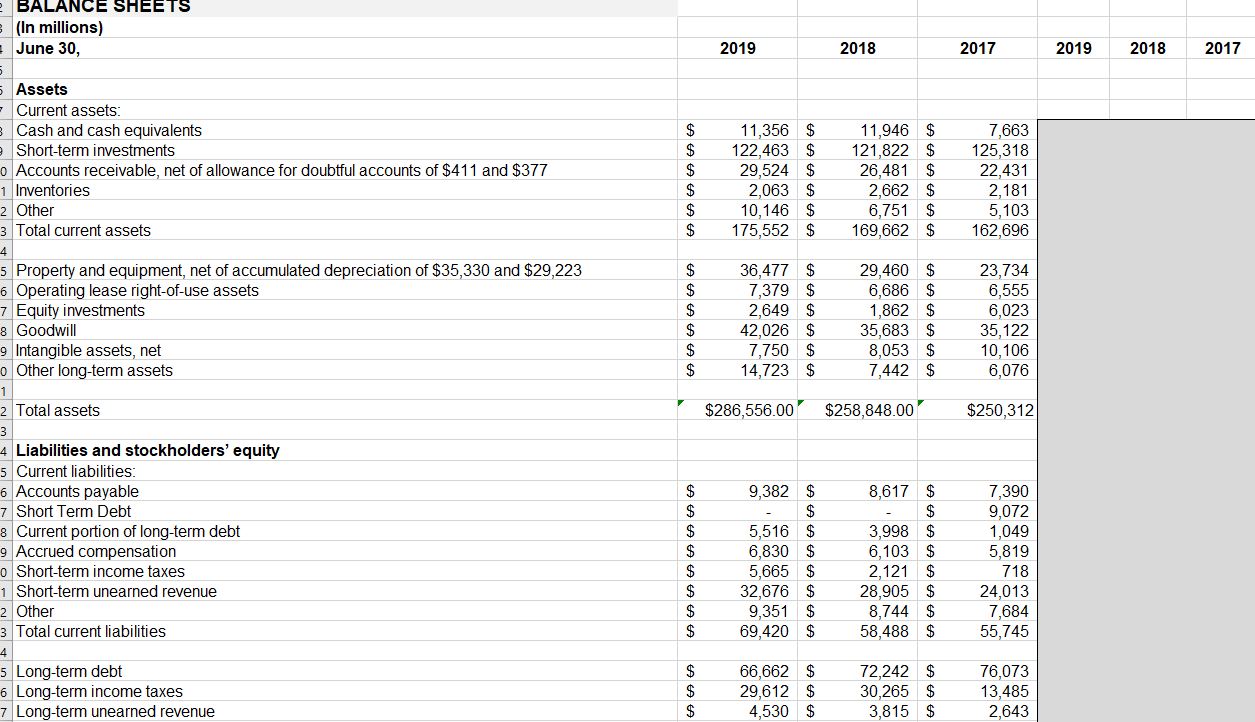

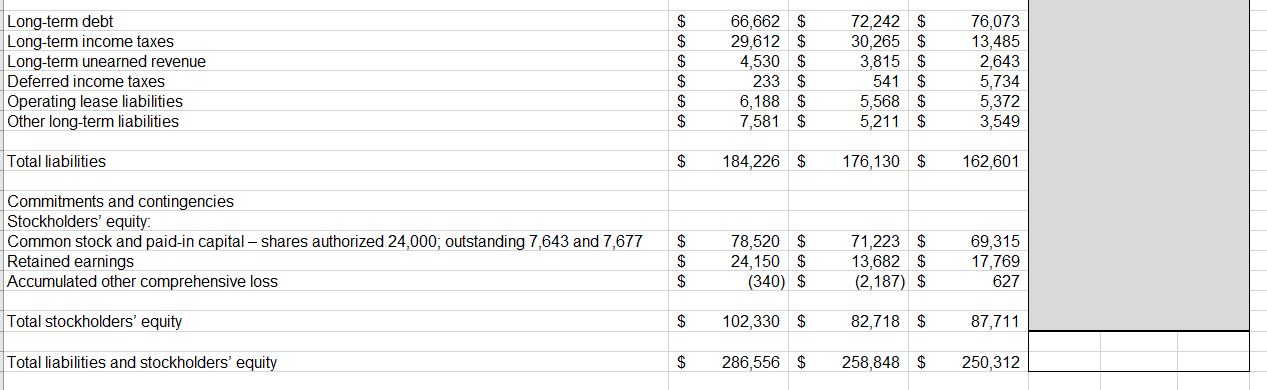

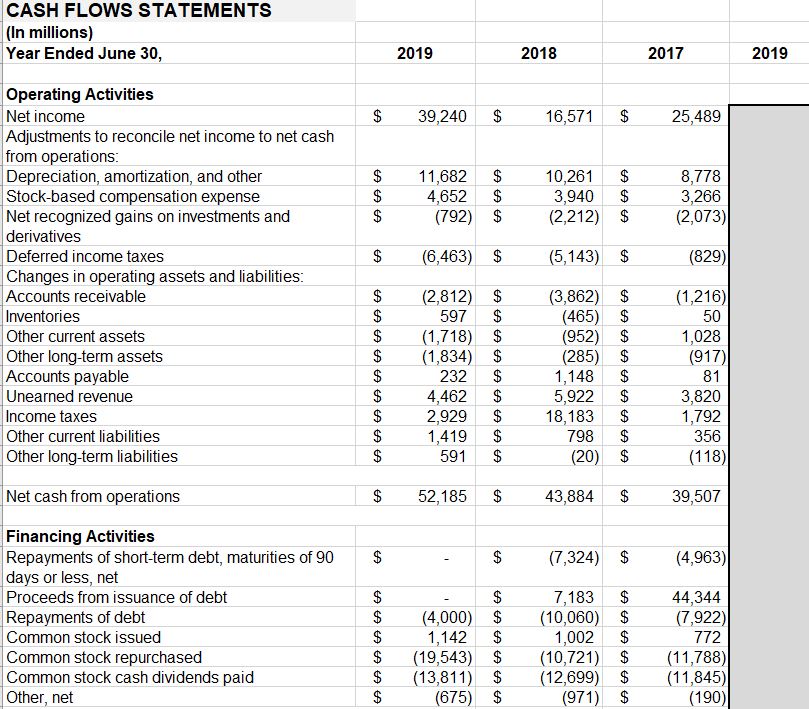

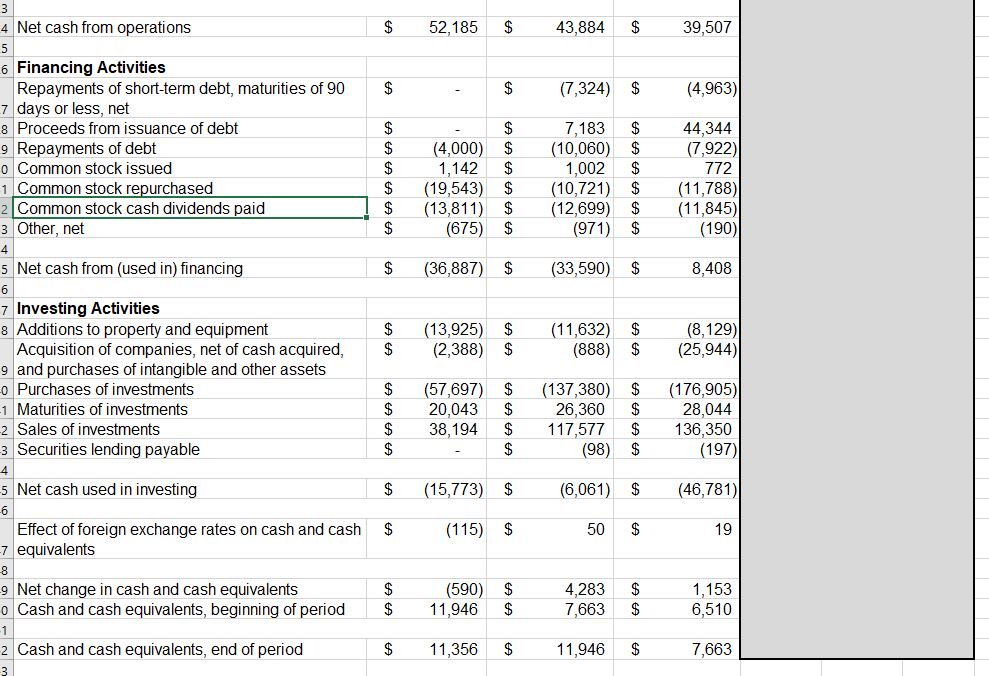

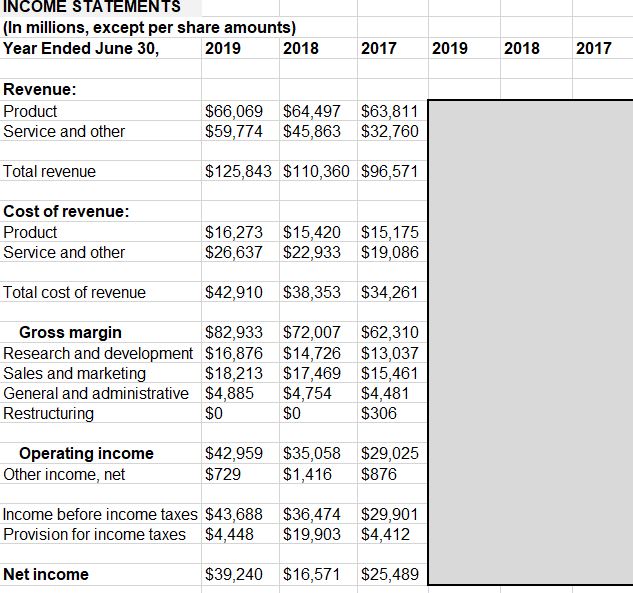

Question: I need a three year Common Size Analysis and Trend Analysis for the Income Statement, Balance Sheet and Cash Flows Statement that I have included.

I need a three year Common Size Analysis and Trend Analysis for the Income Statement, Balance Sheet and Cash Flows Statement that I have included. Please also include a written analysis of the common size and trend. (Excel would be most welcome)

Common Size

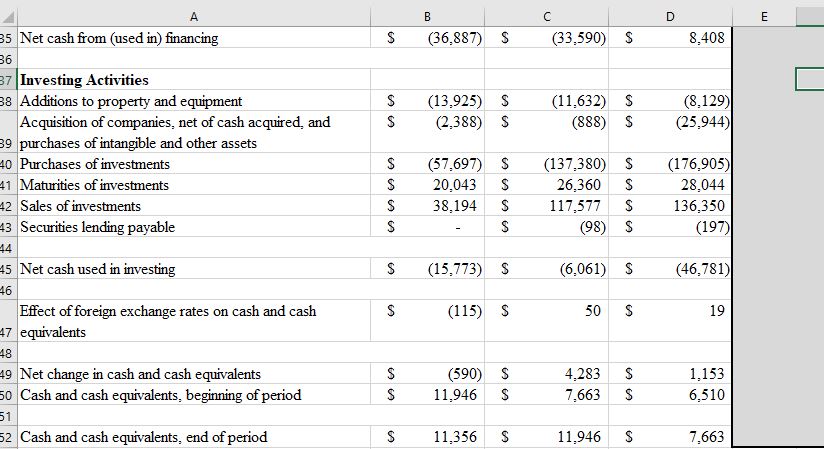

\f\fCASH FLOWS STATEMENTS {in millions} Year Ended June 3!}, Operating Activities Net income Adjustments to reconcile net income to net cash from operations: Depreciation, amorlization, and other Stockbased compensation expense Net recognized gains on investments and derivatives Deferred income taxes ,, Changes in operating assets and liabilities: Accounts receivable lmentories Other current assets Other longterm assets Accounts payable Unearned revenue income taxes Other current liabilities Other longrterm liabilities Net cash from operations Financing Activities Repayments of shortterm debt, maturities of 93 days or less, net Proceeds from issuance of debt Repayments of debt Common stock issued Common stock repurchased Common stock cash dividends paid Other, net EH aaaaaaaaa be ae 2919 99299, 1 1,992 I 4952 . (292) (94931 (2312} 597, m,?191 (L994; 292, 4992, 2929, t419. 591, 52995, (4.999}. 9142, i1943i i1311l {9751 $ ra'E-t eeeeeeeeeeeeeeeeee be 636969 2919 91521, 19291, 9949, 91212) (594311 (3&521 H95} (9521 (2951 1949, 5922, 19999, 795. Gm} 4a994, (19241 2999, (199991 L052. (19221} 92.999). (971}. $ 201? 29499 9329 9299 (2929) {329} (L215) 59 3929 (91?) ,91 9929 9292 3.59 n19) 9959? (4,963} 49344 (E922) iTE ltLTBE) (19345) (193) 2019 \f\f\f