Question: I need a very short answer for each question Direction: Read and analyze the following cases in paragraph form A public company is currently trading

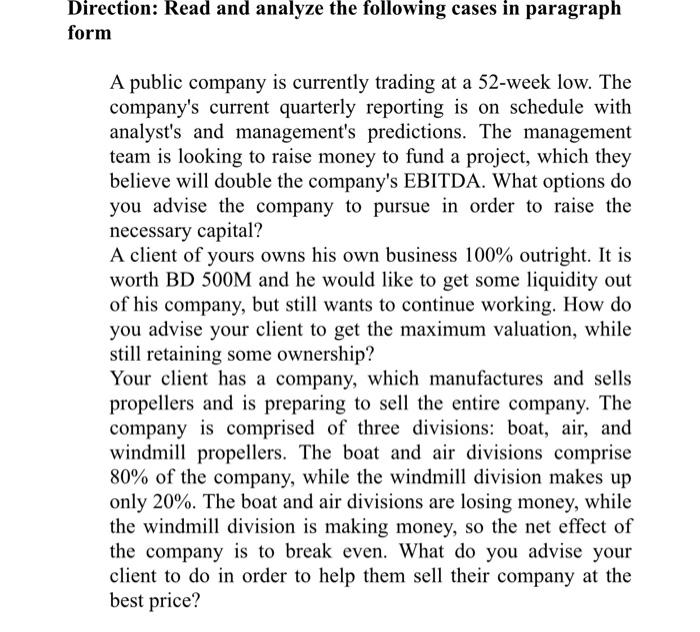

Direction: Read and analyze the following cases in paragraph form A public company is currently trading at a 52-week low. The company's current quarterly reporting is on schedule with analyst's and management's predictions. The management team is looking to raise money to fund a project, which they believe will double the company's EBITDA. What options do you advise the company to pursue in order to raise the necessary capital? A client of yours owns his own business 100% outright. It is worth BD 500M and he would like to get some liquidity out of his company, but still wants to continue working. How do you advise your client to get the maximum valuation, while still retaining some ownership? Your client has a company, which manufactures and sells propellers and is preparing to sell the entire company. The company is comprised of three divisions: boat, air, and windmill propellers. The boat and air divisions comprise 80% of the company, while the windmill division makes up only 20%. The boat and air divisions are losing money, while the windmill division is making money, so the net effect of the company is to break even. What do you advise your client to do in order to help them sell their company at the best price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts