Question: i need a walkthrough on how to solve this please. Short Sales: Example You sell short 100 shares of stock priced at $60 per share.

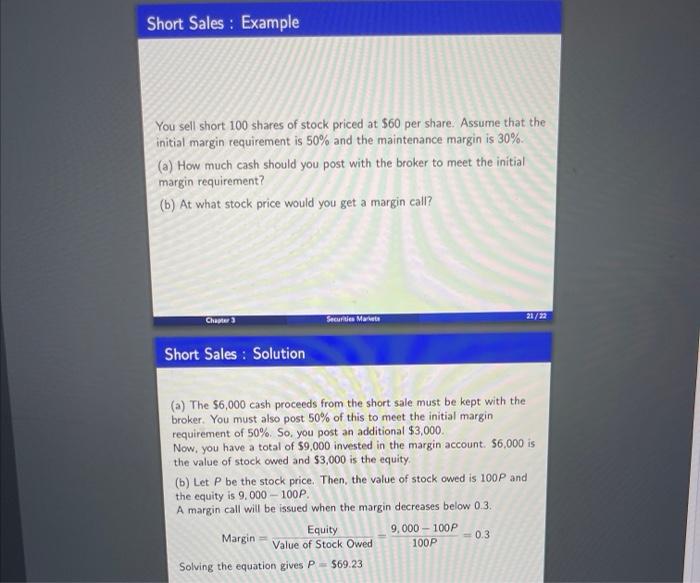

Short Sales: Example You sell short 100 shares of stock priced at $60 per share. Assume that the initial margin requirement is 50% and the maintenance margin is 30%. (a) How much cash should you post with the broker to meet the initial margin requirement? (b) At what stock price would you get a margin call? Chapter 3 Securities Market 21/22 Short Sales : Solution (a) The $6,000 cash proceeds from the short sale must be kept with the broker. You must also post 50% of this to meet the initial margin requirement of 50%. So, you post an additional $3,000. Now, you have a total of $9,000 invested in the margin account. $6,000 is the value of stock owed and $3,000 is the equity (b) Let P be the stock price. Then, the value of stock owed is 100P and the equity is 9.000 - 100P. A margin call will be issued when the margin decreases below 0.3. Equity Margin 9.000 - 100P 0.3 Value of Stock Owed 100P Solving the equation gives P - $69.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts