Question: I NEED A WRITTEN OUT STEP BY STEP GUIDE FOR EXACTLY WHAT I NEED TO DO TO FILL OUT THIS EXCEL SHEET INCLUDING WHAT AND

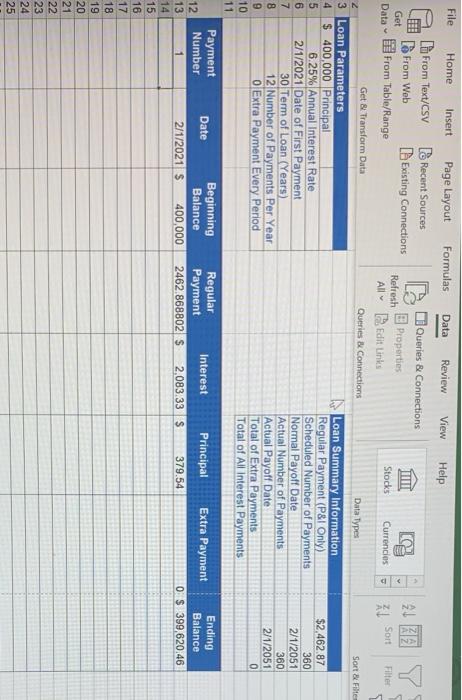

7.(15 points) This exercise let you practice your accounting and Excel knowledge/skill You have recently taken a position in a bank. Your first client would like assistance planning for a loan. You want to set up a detailed loan amortization table. Open the attached Excelle LoonAmortization Spring2021.x/sx. This file contains a worksheet with a loan parameters area de input section, a summary section, and an amortization table with column labels. You must use this template to complete a detailed loan amortization table and the summary section. Any other format of your amortization schedule will not be acceptable. You amortization table should be able to display the data for a loan up to 30 years. The data in the Summary section should be automatically changed when a user changes any value in the input section. You should hide zeros from displaying if your client takes out a shorter-term loan or pay it off early. The Ending Balance cannot be negative values. In addition, you will notice overpayments on the last payment if you pay extra toward the principal each month. Add a header in the worksheet and place your name in the header Data Types File Home Insert Page Layout Formulas Data Review View Help Lh From Text/csv Recent Sources Queries & Connections From Web [Existing Connections Get 21 A Properties Refresh Data from Table/Range Stocks Currencies Sort Filter All Edit Links Get & Transform Data Queries & Connections 2 Sort & Filter 3 Loan Parameters Loan Summary Information 4 $ 400,000 Principal Regular Payment (P&I Only) $2,462.87 5 6.25% Annual Interest Rate Scheduled Number of Payments 360 6 2/1/2021 Date of First Payment Normal Payoff Date 2/1/2051 7 30 Term of Loan (Years) Actual Number of Payments 360 8 12 Number of Payments Per Year Actual Payoff Date 2/1/2051 9 O Extra Payment Every Period Total of Extra Payments 10 Total of All Interest Payments 11 Payment Beginning Regular Date Principal Interest Ending Extra Payment Number 12 Balance Payment Balance 13 1 2/1/2021 $ 400,000 2462.868802 S 2,083.33 $ 379.54 0 $ 399,620.46 OOON 16 17 18 19 20 21 22 23 24 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts