Question: I need all answers plz. What is the difference between cumulative and non-cumulative preferred shares? They both receive dividends in arrears. Cumulative preferred shares' undeclared

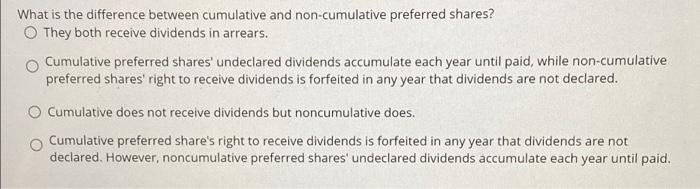

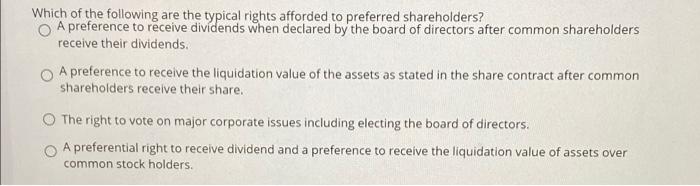

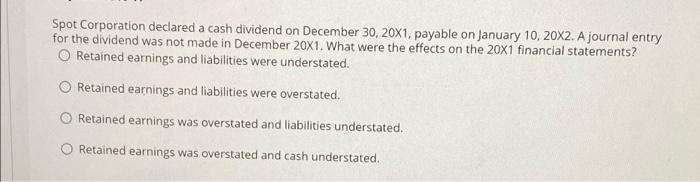

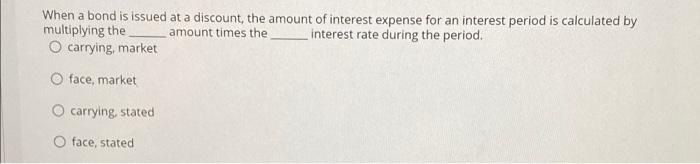

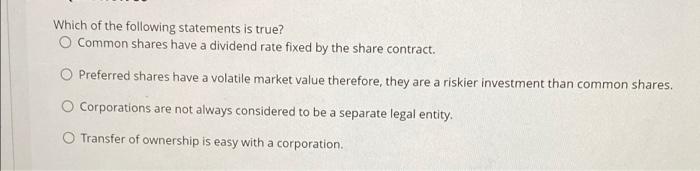

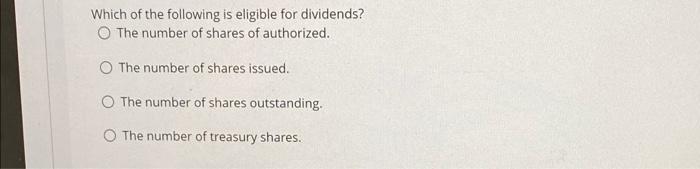

What is the difference between cumulative and non-cumulative preferred shares? They both receive dividends in arrears. Cumulative preferred shares' undeclared dividends accumulate each year until paid, while non-cumulative preferred shares' right to receive dividends is forfeited in any year that dividends are not declared. Cumulative does not receive dividends but noncumulative does. Cumulative preferred share's right to receive dividends is forfeited in any year that dividends are not declared. However, noncumulative preferred shares' undeclared dividends accumulate each year until paid. Which of the following are the typical rights afforded to preferred shareholders? A preference to receive dividends when declared by the board of directors after common shareholders receive their dividends. A preference to receive the liquidation value of the assets as stated in the share contract after common shareholders receive their share. The right to vote on major corporate issues including electing the board of directors. A preferential right to receive dividend and a preference to receive the liquidation value of assets over common stock holders. Spot Corporation declared a cash dividend on December 30, 20X1. payable on January 10, 20X2. A journal entry for the dividend was not made in December 20X1. What were the effects on the 20x1 financial statements? Retained earnings and liabilities were understated. O Retained earnings and liabilities were overstated. O Retained earnings was overstated and liabilities understated. O Retained earnings was overstated and cash understated. When a bond is issued at a discount, the amount of interest expense for an interest period is calculated by multiplying the amount times the interest rate during the period. O carrying, market O face, market O carrying, stated O face, stated Which of the following statements is true? O Common shares have a dividend rate fixed by the share contract. O Preferred shares have a volatile market value therefore, they are a riskier investment than common shares. O Corporations are not always considered to be a separate legal entity. Transfer of ownership is easy with a corporation. Which of the following is eligible for dividends? The number of shares of authorized. The number of shares issued. The number of shares outstanding. The number of treasury shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts