Question: i need all just answers X Your answer is incorrect. The Charless bought a home in January and borrowed $424000 to finance it. The mortgage

i need all just answers

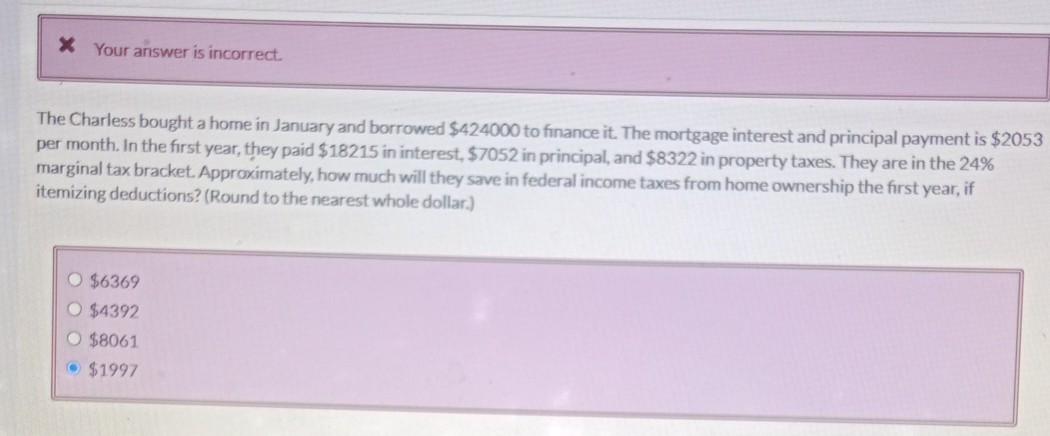

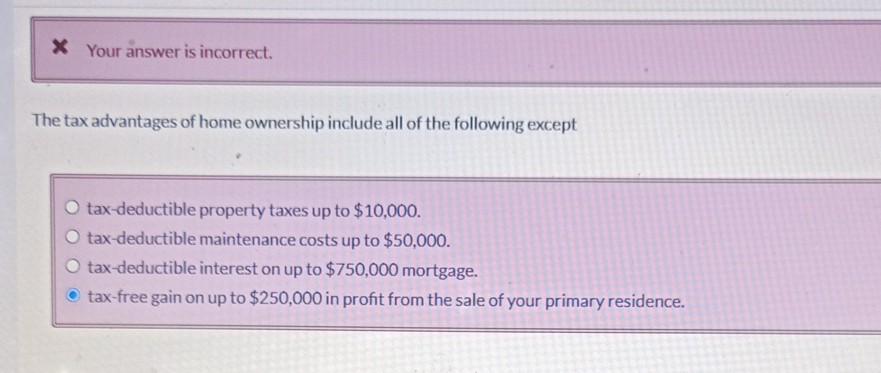

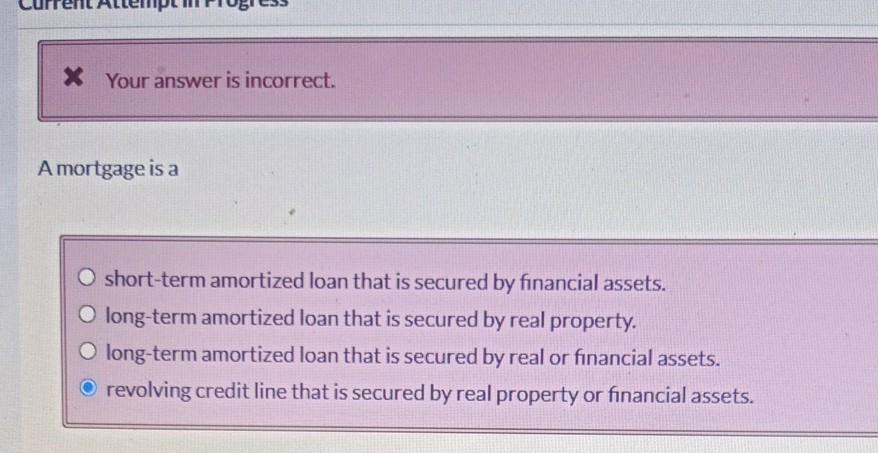

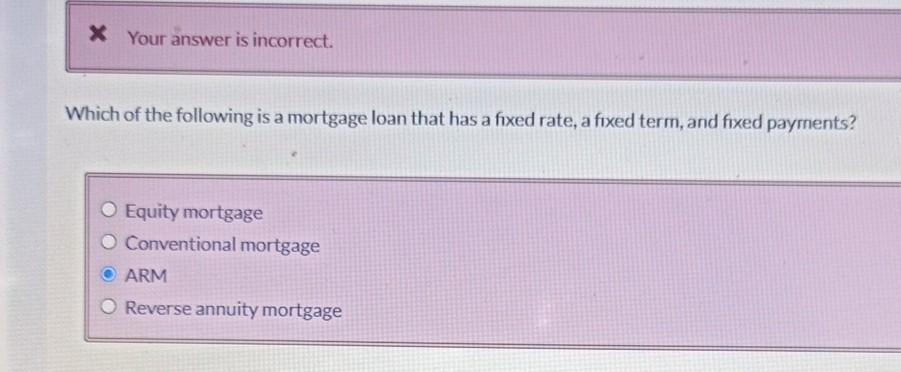

X Your answer is incorrect. The Charless bought a home in January and borrowed $424000 to finance it. The mortgage interest and principal payment is $2053 per month. In the first year, they paid $18215 in interest, $7052 in principal, and $8322 in property taxes. They are in the 24% marginal tax bracket. Approximately, how much will they save in federal income taxes from home ownership the first year, if itemizing deductions? (Round to the nearest whole dollar) O $6369 $4392 $8061 $1997 * Your answer is incorrect. The tax advantages of home ownership include all of the following except tax-deductible property taxes up to $10,000. tax-deductible maintenance costs up to $50,000. tax-deductible interest on up to $750,000 mortgage. tax-free gain on up to $250,000 in profit from the sale of your primary residence. X Your answer is incorrect. A mortgage is a short-term amortized loan that is secured by financial assets. O long-term amortized loan that is secured by real property. long-term amortized loan that is secured by real or financial assets. O revolving credit line that is secured by real property or financial assets. X Your answer is incorrect. Which of the following is a mortgage loan that has a fixed rate, a fixed term, and fixed payments? O Equity mortgage O Conventional mortgage ARM O Reverse annuity mortgage X Your answer is incorrect. The Charless bought a home in January and borrowed $424000 to finance it. The mortgage interest and principal payment is $2053 per month. In the first year, they paid $18215 in interest, $7052 in principal, and $8322 in property taxes. They are in the 24% marginal tax bracket. Approximately, how much will they save in federal income taxes from home ownership the first year, if itemizing deductions? (Round to the nearest whole dollar) O $6369 $4392 $8061 $1997 * Your answer is incorrect. The tax advantages of home ownership include all of the following except tax-deductible property taxes up to $10,000. tax-deductible maintenance costs up to $50,000. tax-deductible interest on up to $750,000 mortgage. tax-free gain on up to $250,000 in profit from the sale of your primary residence. X Your answer is incorrect. A mortgage is a short-term amortized loan that is secured by financial assets. O long-term amortized loan that is secured by real property. long-term amortized loan that is secured by real or financial assets. O revolving credit line that is secured by real property or financial assets. X Your answer is incorrect. Which of the following is a mortgage loan that has a fixed rate, a fixed term, and fixed payments? O Equity mortgage O Conventional mortgage ARM O Reverse annuity mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts